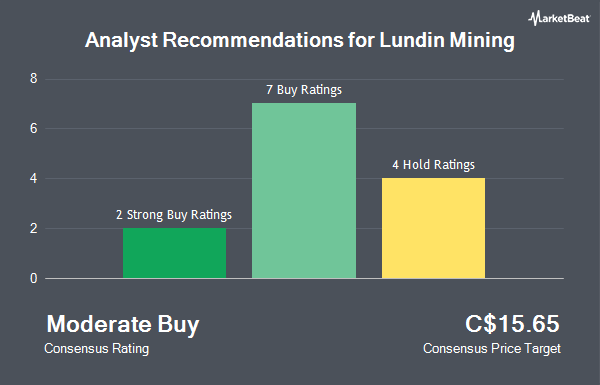

Shares of Lundin Mining Co. (TSE:LUN - Get Free Report) have been assigned an average rating of "Moderate Buy" from the sixteen research firms that are currently covering the company, MarketBeat.com reports. One research analyst has rated the stock with a sell rating, six have assigned a hold rating and nine have assigned a buy rating to the company. The average 1-year price objective among brokerages that have updated their coverage on the stock in the last year is C$17.98.

Several analysts recently weighed in on the stock. Ventum Financial lifted their target price on shares of Lundin Mining from C$18.50 to C$19.00 in a report on Friday, October 18th. Royal Bank of Canada cut their price objective on Lundin Mining from C$20.00 to C$16.00 and set a "sector perform" rating on the stock in a report on Tuesday, September 10th. JPMorgan Chase & Co. raised Lundin Mining from a "neutral" rating to an "overweight" rating and decreased their target price for the stock from C$18.20 to C$17.30 in a research note on Tuesday, August 20th. Scotiabank upgraded shares of Lundin Mining from a "sector perform" rating to an "outperform" rating and cut their price target for the stock from C$18.00 to C$16.00 in a research note on Monday, August 19th. Finally, Haywood Securities raised shares of Lundin Mining from a "hold" rating to a "buy" rating and set a C$17.00 price objective for the company in a research note on Tuesday, August 6th.

View Our Latest Analysis on LUN

Insider Activity

In related news, Director Jack Oliver Lundin purchased 65,000 shares of the firm's stock in a transaction that occurred on Tuesday, September 3rd. The stock was purchased at an average cost of C$12.55 per share, with a total value of C$815,854.00. Corporate insiders own 15.70% of the company's stock.

Lundin Mining Trading Up 0.1 %

Shares of LUN stock traded up C$0.02 on Friday, hitting C$13.74. 1,273,537 shares of the stock traded hands, compared to its average volume of 2,355,997. The company has a debt-to-equity ratio of 24.64, a quick ratio of 0.90 and a current ratio of 1.49. Lundin Mining has a twelve month low of C$9.23 and a twelve month high of C$17.97. The firm's 50-day moving average price is C$14.02 and its two-hundred day moving average price is C$14.30. The stock has a market capitalization of C$10.67 billion, a PE ratio of 49.07, a PEG ratio of -0.26 and a beta of 1.66.

Lundin Mining (TSE:LUN - Get Free Report) last announced its quarterly earnings results on Wednesday, November 6th. The mining company reported C$0.12 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of C$0.24 by C($0.12). The firm had revenue of C$1.46 billion for the quarter, compared to analyst estimates of C$1.49 billion. Lundin Mining had a return on equity of 5.04% and a net margin of 4.21%.

Lundin Mining Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, December 11th. Investors of record on Friday, November 29th will be paid a dividend of $0.09 per share. This represents a $0.36 dividend on an annualized basis and a yield of 2.62%. The ex-dividend date is Friday, November 29th. Lundin Mining's dividend payout ratio is currently 128.57%.

About Lundin Mining

(

Get Free ReportLundin Mining Corporation, a diversified base metals mining company, engages in the exploration, development, and mining of mineral properties in Chile, Brazil, the United States, Portugal, Sweden, and Argentina. It primarily produces copper, zinc, gold, nickel, and molybdenum, as well as lead, silver, and other metals.

Recommended Stories

Before you consider Lundin Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lundin Mining wasn't on the list.

While Lundin Mining currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.