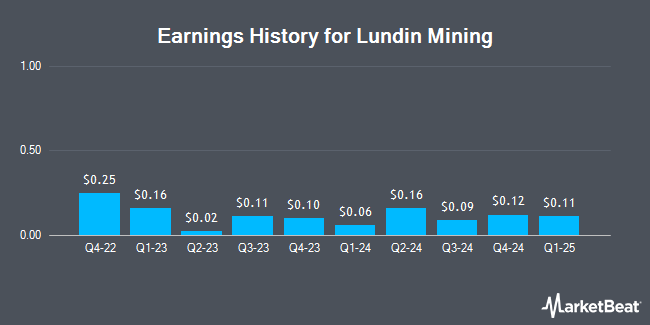

Lundin Mining (OTCMKTS:LUNMF - Get Free Report) is anticipated to issue its quarterly earnings data after the market closes on Wednesday, February 19th. Analysts expect the company to announce earnings of $0.22 per share and revenue of $1.06 billion for the quarter.

Lundin Mining Price Performance

LUNMF stock traded down $0.01 during midday trading on Friday, hitting $8.70. 208,347 shares of the stock were exchanged, compared to its average volume of 297,242. The stock's 50-day moving average price is $8.59 and its 200-day moving average price is $9.42. The stock has a market cap of $7.55 billion, a price-to-earnings ratio of 24.17, a PEG ratio of 0.36 and a beta of 1.46. Lundin Mining has a fifty-two week low of $7.51 and a fifty-two week high of $13.26. The company has a debt-to-equity ratio of 0.28, a quick ratio of 0.96 and a current ratio of 1.40.

Lundin Mining Cuts Dividend

The company also recently disclosed a dividend, which was paid on Wednesday, December 11th. Investors of record on Monday, December 2nd were issued a dividend of $0.0647 per share. The ex-dividend date of this dividend was Friday, November 29th. This represents a yield of 2.56%. Lundin Mining's dividend payout ratio is presently 75.00%.

Lundin Mining Company Profile

(

Get Free Report)

Lundin Mining Corporation, a diversified base metals mining company, engages in the exploration, development, and mining of mineral properties in Chile, Brazil, the United States, Portugal, Sweden, and Argentina. It primarily produces copper, zinc, gold, nickel, and molybdenum, as well as lead, silver, and other metals.

See Also

Before you consider Lundin Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lundin Mining wasn't on the list.

While Lundin Mining currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.