Y Intercept Hong Kong Ltd lessened its holdings in LXP Industrial Trust (NYSE:LXP - Free Report) by 76.4% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 29,755 shares of the real estate investment trust's stock after selling 96,272 shares during the quarter. Y Intercept Hong Kong Ltd's holdings in LXP Industrial Trust were worth $299,000 as of its most recent SEC filing.

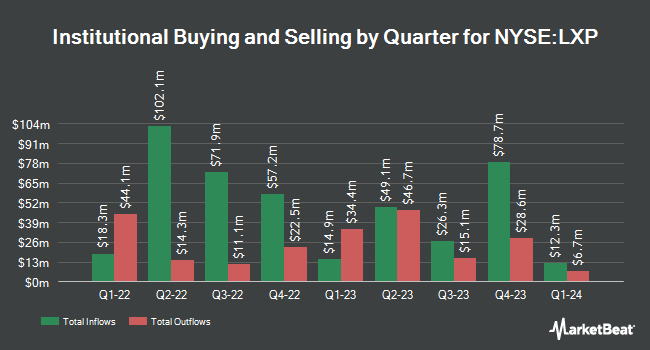

Several other institutional investors and hedge funds have also recently bought and sold shares of LXP. Charles Schwab Investment Management Inc. boosted its stake in shares of LXP Industrial Trust by 4.1% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 5,285,807 shares of the real estate investment trust's stock valued at $53,122,000 after purchasing an additional 209,718 shares in the last quarter. Dimensional Fund Advisors LP raised its holdings in LXP Industrial Trust by 7.2% during the 2nd quarter. Dimensional Fund Advisors LP now owns 4,383,993 shares of the real estate investment trust's stock worth $39,982,000 after purchasing an additional 293,078 shares during the last quarter. William Blair Investment Management LLC bought a new stake in LXP Industrial Trust during the 2nd quarter worth about $36,683,000. Bank of New York Mellon Corp increased its stake in shares of LXP Industrial Trust by 2.1% in the 2nd quarter. Bank of New York Mellon Corp now owns 3,102,610 shares of the real estate investment trust's stock valued at $28,296,000 after acquiring an additional 65,202 shares during the last quarter. Finally, Victory Capital Management Inc. increased its stake in shares of LXP Industrial Trust by 5.8% in the 2nd quarter. Victory Capital Management Inc. now owns 2,941,937 shares of the real estate investment trust's stock valued at $26,830,000 after acquiring an additional 160,651 shares during the last quarter. Institutional investors own 93.52% of the company's stock.

Analyst Ratings Changes

Separately, Evercore ISI increased their target price on LXP Industrial Trust from $10.00 to $11.00 and gave the stock an "in-line" rating in a research note on Monday, September 16th.

Get Our Latest Research Report on LXP Industrial Trust

LXP Industrial Trust Price Performance

LXP Industrial Trust stock traded down $0.39 during midday trading on Wednesday, reaching $8.39. The company's stock had a trading volume of 2,703,624 shares, compared to its average volume of 2,174,143. The business has a 50-day moving average price of $9.39 and a 200-day moving average price of $9.60. LXP Industrial Trust has a 52 week low of $8.23 and a 52 week high of $10.56. The stock has a market cap of $2.47 billion, a PE ratio of 139.86 and a beta of 0.86. The company has a current ratio of 0.12, a quick ratio of 0.12 and a debt-to-equity ratio of 0.21.

LXP Industrial Trust Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, January 15th. Shareholders of record on Tuesday, December 31st will be issued a $0.135 dividend. This is an increase from LXP Industrial Trust's previous quarterly dividend of $0.13. This represents a $0.54 dividend on an annualized basis and a yield of 6.44%. The ex-dividend date is Tuesday, December 31st. LXP Industrial Trust's payout ratio is presently 900.00%.

About LXP Industrial Trust

(

Free Report)

LXP Industrial Trust NYSE: LXP is a publicly traded real estate investment trust (REIT) focused on single-tenant industrial real estate investments across the United States. LXP seeks to expand its industrial portfolio through acquisitions, build-to-suit transactions, sale-leaseback transactions, development projects and other transactions.

Read More

Before you consider LXP Industrial Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LXP Industrial Trust wasn't on the list.

While LXP Industrial Trust currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.