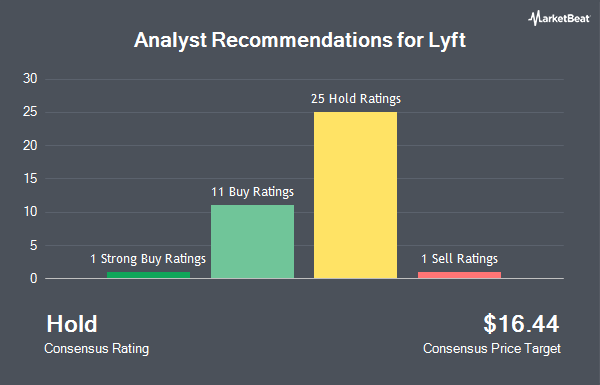

Lyft, Inc. (NASDAQ:LYFT - Get Free Report) has been given an average rating of "Hold" by the thirty-eight ratings firms that are currently covering the company, Marketbeat Ratings reports. One equities research analyst has rated the stock with a sell recommendation, twenty-seven have given a hold recommendation, nine have given a buy recommendation and one has assigned a strong buy recommendation to the company. The average 12-month price objective among brokerages that have covered the stock in the last year is $16.60.

A number of research analysts recently weighed in on LYFT shares. Wells Fargo & Company dropped their price objective on Lyft from $14.00 to $13.00 and set an "equal weight" rating on the stock in a report on Thursday, April 3rd. Evercore ISI decreased their price objective on shares of Lyft from $19.00 to $15.00 and set an "in-line" rating on the stock in a report on Wednesday, February 12th. DA Davidson dropped their target price on shares of Lyft from $16.00 to $15.00 and set a "neutral" rating for the company in a report on Wednesday, February 12th. Needham & Company LLC restated a "hold" rating on shares of Lyft in a report on Monday, March 24th. Finally, Cantor Fitzgerald decreased their target price on Lyft from $15.00 to $14.00 and set a "neutral" rating on the stock in a research report on Wednesday, February 12th.

Check Out Our Latest Analysis on LYFT

Insider Activity at Lyft

In related news, Director Logan Green sold 11,411 shares of the company's stock in a transaction on Thursday, February 27th. The shares were sold at an average price of $13.34, for a total transaction of $152,222.74. Following the completion of the sale, the director now directly owns 297,640 shares of the company's stock, valued at approximately $3,970,517.60. This represents a 3.69 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director John Patrick Zimmer sold 2,424 shares of the business's stock in a transaction dated Tuesday, February 25th. The stock was sold at an average price of $12.52, for a total value of $30,348.48. Following the transaction, the director now owns 911,922 shares in the company, valued at approximately $11,417,263.44. This represents a 0.27 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 15,407 shares of company stock worth $203,778. Company insiders own 3.07% of the company's stock.

Institutional Inflows and Outflows

Institutional investors have recently made changes to their positions in the company. Renaissance Technologies LLC lifted its holdings in Lyft by 282.0% in the 4th quarter. Renaissance Technologies LLC now owns 8,623,227 shares of the ride-sharing company's stock worth $111,240,000 after buying an additional 6,365,727 shares in the last quarter. Two Sigma Advisers LP grew its stake in Lyft by 828.5% during the 4th quarter. Two Sigma Advisers LP now owns 6,662,535 shares of the ride-sharing company's stock valued at $85,947,000 after purchasing an additional 5,945,000 shares in the last quarter. Two Sigma Investments LP raised its position in shares of Lyft by 156.9% in the 4th quarter. Two Sigma Investments LP now owns 8,025,099 shares of the ride-sharing company's stock valued at $103,524,000 after purchasing an additional 4,901,358 shares in the last quarter. Norges Bank purchased a new position in shares of Lyft during the 4th quarter valued at approximately $49,599,000. Finally, Pacer Advisors Inc. increased its stake in shares of Lyft by 32.4% in the fourth quarter. Pacer Advisors Inc. now owns 9,408,466 shares of the ride-sharing company's stock worth $121,369,000 after buying an additional 2,302,248 shares during the last quarter. 83.07% of the stock is owned by institutional investors and hedge funds.

Lyft Stock Performance

NASDAQ:LYFT traded up $0.01 during midday trading on Thursday, reaching $10.89. The stock had a trading volume of 9,792,405 shares, compared to its average volume of 15,567,952. The stock has a market cap of $4.55 billion, a P/E ratio of 181.50, a P/E/G ratio of 1.90 and a beta of 2.13. The company has a quick ratio of 0.75, a current ratio of 0.76 and a debt-to-equity ratio of 0.74. Lyft has a 12-month low of $8.93 and a 12-month high of $19.07. The firm has a fifty day simple moving average of $12.23 and a two-hundred day simple moving average of $13.69.

Lyft (NASDAQ:LYFT - Get Free Report) last issued its quarterly earnings results on Tuesday, February 11th. The ride-sharing company reported $0.10 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.20 by ($0.10). Lyft had a return on equity of 8.03% and a net margin of 0.39%. On average, equities analysts expect that Lyft will post 0.22 EPS for the current year.

Lyft announced that its board has initiated a share buyback program on Tuesday, February 11th that allows the company to buyback $500.00 million in shares. This buyback authorization allows the ride-sharing company to buy up to 8.4% of its shares through open market purchases. Shares buyback programs are often an indication that the company's board believes its shares are undervalued.

Lyft Company Profile

(

Get Free ReportLyft, Inc operates a peer-to-peer marketplace for on-demand ridesharing in the United States and Canada. It operates multimodal transportation networks that offer access to various transportation options through the Lyft platform and mobile-based applications. The company's platform provides a ridesharing marketplace, which connects drivers with riders; Express Drive, a car rental program for drivers; and a network of shared bikes and scooters in various cities to address the needs of riders for short trips.

See Also

Before you consider Lyft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lyft wasn't on the list.

While Lyft currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.