LyondellBasell Industries (NYSE:LYB - Get Free Report) was upgraded by analysts at StockNews.com from a "hold" rating to a "buy" rating in a report released on Thursday.

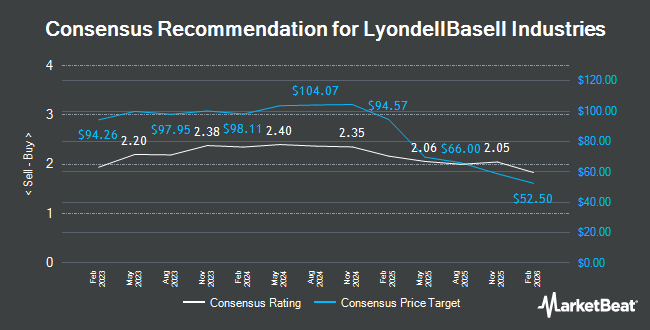

Other analysts also recently issued research reports about the company. Piper Sandler dropped their target price on LyondellBasell Industries from $117.00 to $112.00 and set an "overweight" rating for the company in a research report on Friday, November 8th. Royal Bank of Canada decreased their price target on LyondellBasell Industries from $110.00 to $104.00 and set an "outperform" rating on the stock in a research note on Monday, November 4th. Mizuho decreased their price target on LyondellBasell Industries from $101.00 to $97.00 and set a "neutral" rating on the stock in a research note on Monday, November 4th. JPMorgan Chase & Co. decreased their price target on LyondellBasell Industries from $110.00 to $100.00 and set an "overweight" rating on the stock in a research note on Monday, November 4th. Finally, Deutsche Bank Aktiengesellschaft decreased their price target on LyondellBasell Industries from $100.00 to $94.00 and set a "hold" rating on the stock in a research note on Monday, November 4th. One analyst has rated the stock with a sell rating, seven have assigned a hold rating and six have given a buy rating to the stock. According to data from MarketBeat, the stock presently has a consensus rating of "Hold" and an average price target of $101.70.

View Our Latest Research Report on LyondellBasell Industries

LyondellBasell Industries Price Performance

Shares of LYB traded down $0.88 during trading hours on Thursday, reaching $82.56. 1,938,165 shares of the company's stock traded hands, compared to its average volume of 1,868,874. The firm's 50 day simple moving average is $91.58 and its 200-day simple moving average is $95.15. The stock has a market cap of $26.81 billion, a PE ratio of 12.70, a price-to-earnings-growth ratio of 2.33 and a beta of 1.08. LyondellBasell Industries has a 12 month low of $82.20 and a 12 month high of $107.02. The company has a current ratio of 2.13, a quick ratio of 1.25 and a debt-to-equity ratio of 0.81.

LyondellBasell Industries (NYSE:LYB - Get Free Report) last released its earnings results on Friday, November 1st. The specialty chemicals company reported $1.88 earnings per share for the quarter, missing analysts' consensus estimates of $1.98 by ($0.10). The firm had revenue of $10.33 billion during the quarter, compared to the consensus estimate of $10.60 billion. LyondellBasell Industries had a return on equity of 17.05% and a net margin of 5.29%. The business's quarterly revenue was down 2.8% compared to the same quarter last year. During the same quarter in the previous year, the firm earned $2.46 EPS. Equities analysts expect that LyondellBasell Industries will post 7.09 EPS for the current year.

Institutional Investors Weigh In On LyondellBasell Industries

Hedge funds have recently added to or reduced their stakes in the stock. State Board of Administration of Florida Retirement System boosted its holdings in LyondellBasell Industries by 8.4% in the first quarter. State Board of Administration of Florida Retirement System now owns 282,374 shares of the specialty chemicals company's stock worth $26,512,000 after acquiring an additional 21,809 shares in the last quarter. Banco Santander S.A. bought a new stake in LyondellBasell Industries in the first quarter worth $3,607,000. Foresight Capital Management Advisors Inc. bought a new stake in LyondellBasell Industries in the second quarter worth $1,416,000. PGGM Investments lifted its holdings in shares of LyondellBasell Industries by 47.9% during the second quarter. PGGM Investments now owns 22,148 shares of the specialty chemicals company's stock valued at $2,119,000 after purchasing an additional 7,168 shares in the last quarter. Finally, Capital World Investors lifted its holdings in shares of LyondellBasell Industries by 28.9% during the first quarter. Capital World Investors now owns 2,675,701 shares of the specialty chemicals company's stock valued at $273,671,000 after purchasing an additional 600,554 shares in the last quarter. 71.20% of the stock is owned by institutional investors.

LyondellBasell Industries Company Profile

(

Get Free Report)

LyondellBasell Industries N.V. operates as a chemical company in the United States, Germany, Mexico, Italy, Poland, France, Japan, China, the Netherlands, and internationally. The company operates in six segments: Olefins and PolyolefinsAmericas; Olefins and PolyolefinsEurope, Asia, International; Intermediates and Derivatives; Advanced Polymer Solutions; Refining; and Technology.

Featured Stories

Before you consider LyondellBasell Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LyondellBasell Industries wasn't on the list.

While LyondellBasell Industries currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.