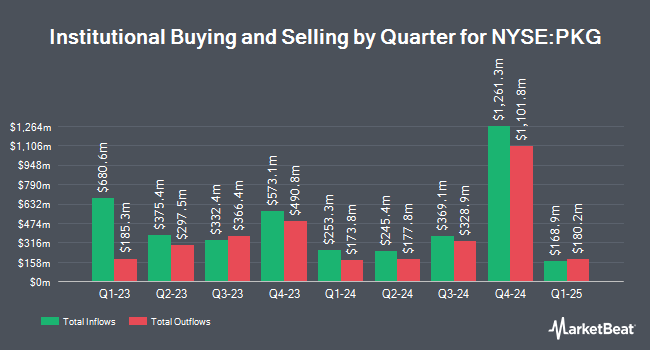

Machina Capital S.A.S. bought a new position in shares of Packaging Co. of America (NYSE:PKG - Free Report) in the 4th quarter, according to its most recent disclosure with the SEC. The institutional investor bought 10,686 shares of the industrial products company's stock, valued at approximately $2,406,000. Packaging Co. of America accounts for approximately 1.0% of Machina Capital S.A.S.'s holdings, making the stock its 11th biggest position.

Several other large investors have also made changes to their positions in PKG. Larson Financial Group LLC raised its stake in Packaging Co. of America by 234.7% in the 3rd quarter. Larson Financial Group LLC now owns 164 shares of the industrial products company's stock valued at $35,000 after purchasing an additional 115 shares during the last quarter. Fortitude Family Office LLC raised its stake in Packaging Co. of America by 150.8% in the 4th quarter. Fortitude Family Office LLC now owns 163 shares of the industrial products company's stock valued at $37,000 after purchasing an additional 98 shares during the last quarter. Centricity Wealth Management LLC acquired a new position in Packaging Co. of America in the 4th quarter valued at $44,000. Golden State Wealth Management LLC acquired a new position in Packaging Co. of America in the 4th quarter valued at $48,000. Finally, Assetmark Inc. raised its stake in Packaging Co. of America by 44.6% in the 3rd quarter. Assetmark Inc. now owns 269 shares of the industrial products company's stock valued at $58,000 after purchasing an additional 83 shares during the last quarter. 89.78% of the stock is owned by institutional investors and hedge funds.

Packaging Co. of America Trading Down 0.0 %

Packaging Co. of America stock traded down $0.10 during midday trading on Wednesday, reaching $197.35. 686,702 shares of the stock traded hands, compared to its average volume of 615,261. The company has a 50-day simple moving average of $218.85 and a two-hundred day simple moving average of $223.03. Packaging Co. of America has a 12-month low of $169.00 and a 12-month high of $250.82. The firm has a market cap of $17.72 billion, a PE ratio of 22.10, a price-to-earnings-growth ratio of 2.41 and a beta of 0.77. The company has a current ratio of 2.95, a quick ratio of 1.98 and a debt-to-equity ratio of 0.58.

Packaging Co. of America (NYSE:PKG - Get Free Report) last announced its earnings results on Tuesday, January 28th. The industrial products company reported $2.47 EPS for the quarter, missing analysts' consensus estimates of $2.51 by ($0.04). Packaging Co. of America had a net margin of 9.60% and a return on equity of 19.67%. Research analysts expect that Packaging Co. of America will post 10.44 earnings per share for the current fiscal year.

Packaging Co. of America Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, April 15th. Stockholders of record on Friday, March 14th will be paid a $1.25 dividend. This represents a $5.00 annualized dividend and a dividend yield of 2.53%. The ex-dividend date is Friday, March 14th. Packaging Co. of America's payout ratio is presently 55.99%.

Wall Street Analysts Forecast Growth

A number of analysts have issued reports on PKG shares. Seaport Res Ptn raised Packaging Co. of America from a "hold" rating to a "strong-buy" rating in a research note on Thursday, February 13th. Jefferies Financial Group raised Packaging Co. of America from a "hold" rating to a "buy" rating and raised their target price for the stock from $215.00 to $280.00 in a research note on Wednesday, December 18th. Truist Financial reaffirmed a "buy" rating and issued a $265.00 target price (down from $282.00) on shares of Packaging Co. of America in a research note on Thursday, January 30th. StockNews.com raised Packaging Co. of America from a "hold" rating to a "buy" rating in a research note on Wednesday, February 26th. Finally, Wells Fargo & Company cut their target price on Packaging Co. of America from $253.00 to $236.00 and set an "overweight" rating for the company in a research note on Thursday, January 30th. Two investment analysts have rated the stock with a hold rating, five have issued a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $233.00.

Check Out Our Latest Research Report on Packaging Co. of America

About Packaging Co. of America

(

Free Report)

Packaging Corporation of America engages in the production of container products. It operates through the following segments: Packaging, Paper, and Corporate and Other. The Packaging segment offers a variety of corrugated packaging products, such as conventional shipping containers. The Paper segment manufactures and sells a range of papers, including communication-based papers, and pressure sensitive papers.

Read More

Before you consider Packaging Co. of America, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Packaging Co. of America wasn't on the list.

While Packaging Co. of America currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Get this report to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.