Equities researchers at Macquarie assumed coverage on shares of MongoDB (NASDAQ:MDB - Get Free Report) in a research note issued on Thursday, MarketBeat reports. The brokerage set a "neutral" rating and a $300.00 price target on the stock. Macquarie's target price indicates a potential upside of 3.92% from the company's current price.

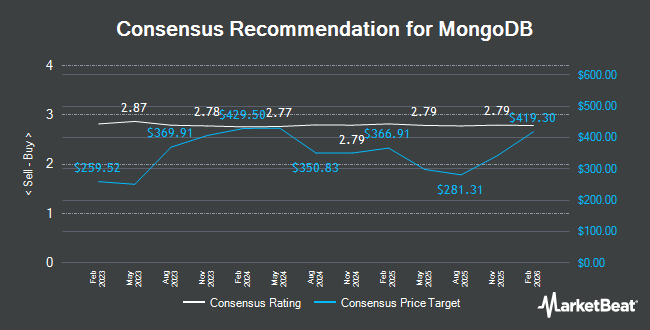

A number of other equities research analysts have also weighed in on MDB. Canaccord Genuity Group raised their price target on shares of MongoDB from $325.00 to $385.00 and gave the company a "buy" rating in a report on Wednesday. Oppenheimer raised their target price on MongoDB from $350.00 to $400.00 and gave the company an "outperform" rating in a research note on Tuesday. Wells Fargo & Company boosted their price target on MongoDB from $350.00 to $425.00 and gave the stock an "overweight" rating in a research note on Tuesday. Bank of America raised their price objective on MongoDB from $300.00 to $350.00 and gave the company a "buy" rating in a research note on Friday, August 30th. Finally, Citigroup upped their target price on MongoDB from $350.00 to $400.00 and gave the company a "buy" rating in a research report on Tuesday, September 3rd. One analyst has rated the stock with a sell rating, six have assigned a hold rating, twenty have given a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average price target of $370.08.

Check Out Our Latest Stock Report on MDB

MongoDB Stock Down 2.9 %

NASDAQ:MDB traded down $8.53 during mid-day trading on Thursday, hitting $288.67. The company had a trading volume of 2,066,740 shares, compared to its average volume of 1,516,573. MongoDB has a 1 year low of $212.74 and a 1 year high of $509.62. The business has a fifty day simple moving average of $292.42 and a 200-day simple moving average of $268.98. The company has a current ratio of 5.03, a quick ratio of 5.03 and a debt-to-equity ratio of 0.84. The firm has a market capitalization of $21.32 billion, a price-to-earnings ratio of -98.41 and a beta of 1.17.

MongoDB (NASDAQ:MDB - Get Free Report) last announced its earnings results on Monday, December 9th. The company reported $1.16 EPS for the quarter, beating the consensus estimate of $0.68 by $0.48. MongoDB had a negative return on equity of 15.06% and a negative net margin of 12.08%. The business had revenue of $529.40 million for the quarter, compared to the consensus estimate of $497.39 million. During the same period last year, the business posted $0.96 EPS. The company's revenue was up 22.3% on a year-over-year basis. Equities analysts forecast that MongoDB will post -2.37 earnings per share for the current fiscal year.

Insider Buying and Selling

In other MongoDB news, CRO Cedric Pech sold 302 shares of the company's stock in a transaction dated Wednesday, October 2nd. The shares were sold at an average price of $256.25, for a total value of $77,387.50. Following the completion of the transaction, the executive now owns 33,440 shares in the company, valued at approximately $8,569,000. This represents a 0.90 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, CEO Dev Ittycheria sold 3,556 shares of MongoDB stock in a transaction that occurred on Wednesday, October 2nd. The shares were sold at an average price of $256.25, for a total value of $911,225.00. Following the sale, the chief executive officer now directly owns 219,875 shares in the company, valued at approximately $56,342,968.75. This trade represents a 1.59 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 26,600 shares of company stock valued at $7,611,849. Insiders own 3.60% of the company's stock.

Institutional Investors Weigh In On MongoDB

Several hedge funds and other institutional investors have recently added to or reduced their stakes in MDB. Tidal Investments LLC grew its holdings in MongoDB by 76.8% during the third quarter. Tidal Investments LLC now owns 7,859 shares of the company's stock worth $2,125,000 after acquiring an additional 3,415 shares during the period. Wilmington Savings Fund Society FSB acquired a new stake in MongoDB in the 3rd quarter valued at about $44,000. Virtu Financial LLC boosted its position in shares of MongoDB by 351.2% during the 3rd quarter. Virtu Financial LLC now owns 10,016 shares of the company's stock valued at $2,708,000 after purchasing an additional 7,796 shares in the last quarter. Teachers Retirement System of The State of Kentucky acquired a new position in shares of MongoDB in the 3rd quarter worth approximately $5,840,000. Finally, Toronto Dominion Bank raised its holdings in shares of MongoDB by 21.9% in the 3rd quarter. Toronto Dominion Bank now owns 9,462 shares of the company's stock worth $2,558,000 after purchasing an additional 1,699 shares in the last quarter. Institutional investors own 89.29% of the company's stock.

About MongoDB

(

Get Free Report)

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

See Also

Before you consider MongoDB, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MongoDB wasn't on the list.

While MongoDB currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.