Nisa Investment Advisors LLC reduced its stake in Madison Square Garden Entertainment Corp. (NYSE:MSGE - Free Report) by 99.0% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 1,859 shares of the company's stock after selling 179,211 shares during the quarter. Nisa Investment Advisors LLC's holdings in Madison Square Garden Entertainment were worth $79,000 at the end of the most recent reporting period.

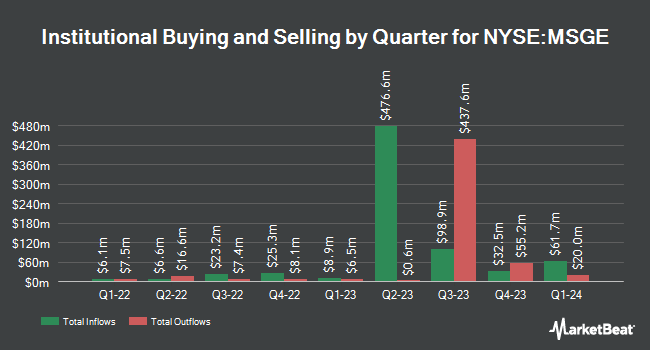

A number of other institutional investors and hedge funds have also added to or reduced their stakes in the company. Assenagon Asset Management S.A. increased its stake in shares of Madison Square Garden Entertainment by 1,425.2% in the 3rd quarter. Assenagon Asset Management S.A. now owns 899,614 shares of the company's stock valued at $38,261,000 after acquiring an additional 840,631 shares in the last quarter. Oliver Luxxe Assets LLC acquired a new position in shares of Madison Square Garden Entertainment during the third quarter valued at about $1,853,000. Handelsbanken Fonder AB bought a new stake in Madison Square Garden Entertainment during the 3rd quarter worth approximately $323,000. Quent Capital LLC raised its stake in shares of Madison Square Garden Entertainment by 913.8% in the third quarter. Quent Capital LLC now owns 659 shares of the company's stock worth $28,000 after purchasing an additional 594 shares during the last quarter. Finally, SG Americas Securities LLC lifted its holdings in shares of Madison Square Garden Entertainment by 77.4% in the third quarter. SG Americas Securities LLC now owns 18,325 shares of the company's stock valued at $779,000 after purchasing an additional 7,996 shares in the last quarter. Institutional investors and hedge funds own 96.86% of the company's stock.

Wall Street Analysts Forecast Growth

MSGE has been the subject of a number of analyst reports. Bank of America increased their price target on Madison Square Garden Entertainment from $43.00 to $48.00 and gave the company a "buy" rating in a research report on Monday, August 19th. Macquarie raised their price target on shares of Madison Square Garden Entertainment from $46.00 to $47.00 and gave the company an "outperform" rating in a research report on Thursday, August 22nd. The Goldman Sachs Group raised shares of Madison Square Garden Entertainment from a "neutral" rating to a "buy" rating and upped their price objective for the stock from $41.00 to $45.00 in a research report on Wednesday, July 24th. Finally, Morgan Stanley boosted their target price on Madison Square Garden Entertainment from $42.00 to $45.00 and gave the stock an "equal weight" rating in a research note on Monday, August 19th. Two research analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $44.20.

Read Our Latest Analysis on Madison Square Garden Entertainment

Insider Transactions at Madison Square Garden Entertainment

In other news, EVP Philip Gerard D'ambrosio sold 6,000 shares of the business's stock in a transaction that occurred on Monday, September 30th. The shares were sold at an average price of $42.43, for a total value of $254,580.00. Following the sale, the executive vice president now owns 12,192 shares of the company's stock, valued at $517,306.56. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. 18.72% of the stock is owned by corporate insiders.

Madison Square Garden Entertainment Stock Down 9.3 %

NYSE MSGE traded down $4.02 during trading hours on Friday, reaching $39.06. 731,912 shares of the company were exchanged, compared to its average volume of 270,464. The stock has a market capitalization of $1.63 billion, a P/E ratio of 12.76, a P/E/G ratio of 3.75 and a beta of 0.17. Madison Square Garden Entertainment Corp. has a 1 year low of $28.29 and a 1 year high of $44.14. The business's 50 day simple moving average is $41.72 and its 200-day simple moving average is $38.68.

Madison Square Garden Entertainment (NYSE:MSGE - Get Free Report) last posted its quarterly earnings data on Friday, August 16th. The company reported $1.41 EPS for the quarter, beating the consensus estimate of ($0.56) by $1.97. Madison Square Garden Entertainment had a negative return on equity of 138.81% and a net margin of 15.04%. The business had revenue of $186.10 million for the quarter, compared to the consensus estimate of $173.26 million. During the same quarter in the prior year, the business earned ($0.47) earnings per share. Madison Square Garden Entertainment's revenue for the quarter was up 25.8% on a year-over-year basis. As a group, sell-side analysts anticipate that Madison Square Garden Entertainment Corp. will post 1.66 earnings per share for the current year.

About Madison Square Garden Entertainment

(

Free Report)

Madison Square Garden Entertainment Corp. engages in live entertainment business. The company produces, presents, and hosts live entertainment events, including concerts, sports events, and other live events, such as family shows, performing arts events, and special events. Its operations include a collection of venues, the entertainment and sports bookings business, and the Christmas Spectacular Starring the Radio City Rockettes production.

Read More

Before you consider Madison Square Garden Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Madison Square Garden Entertainment wasn't on the list.

While Madison Square Garden Entertainment currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.