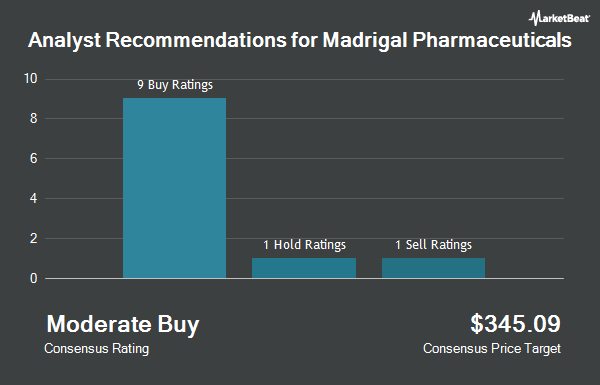

Shares of Madrigal Pharmaceuticals, Inc. (NASDAQ:MDGL - Get Free Report) have been assigned a consensus rating of "Moderate Buy" from the ten analysts that are currently covering the firm, MarketBeat.com reports. One research analyst has rated the stock with a sell recommendation, one has issued a hold recommendation, seven have issued a buy recommendation and one has assigned a strong buy recommendation to the company. The average twelve-month price target among brokers that have issued ratings on the stock in the last year is $378.44.

Several research analysts have recently weighed in on the stock. HC Wainwright boosted their price target on shares of Madrigal Pharmaceuticals from $400.00 to $405.00 and gave the company a "buy" rating in a research report on Thursday, February 27th. Citigroup boosted their target price on shares of Madrigal Pharmaceuticals from $378.00 to $469.00 and gave the company a "buy" rating in a report on Thursday, February 27th. JMP Securities restated a "market outperform" rating and set a $427.00 price target on shares of Madrigal Pharmaceuticals in a report on Friday, January 10th. Finally, B. Riley raised shares of Madrigal Pharmaceuticals from a "hold" rating to a "strong-buy" rating and lifted their price target for the company from $236.00 to $422.00 in a research report on Thursday, February 27th.

View Our Latest Report on MDGL

Madrigal Pharmaceuticals Price Performance

MDGL stock traded down $9.26 during mid-day trading on Friday, reaching $334.03. The company's stock had a trading volume of 125,133 shares, compared to its average volume of 410,879. The company has a current ratio of 5.98, a quick ratio of 5.93 and a debt-to-equity ratio of 0.15. The company's 50 day moving average is $329.76 and its two-hundred day moving average is $295.52. Madrigal Pharmaceuticals has a fifty-two week low of $189.00 and a fifty-two week high of $377.46. The stock has a market cap of $7.38 billion, a PE ratio of -13.32 and a beta of -0.41.

Madrigal Pharmaceuticals (NASDAQ:MDGL - Get Free Report) last announced its quarterly earnings data on Wednesday, February 26th. The biopharmaceutical company reported ($2.71) EPS for the quarter, topping analysts' consensus estimates of ($4.32) by $1.61. The company had revenue of $103.32 million for the quarter, compared to analysts' expectations of $97.81 million. Equities research analysts expect that Madrigal Pharmaceuticals will post -23.47 EPS for the current year.

Insider Activity at Madrigal Pharmaceuticals

In other news, CMO Rebecca Taub sold 1,689 shares of the firm's stock in a transaction that occurred on Friday, January 17th. The shares were sold at an average price of $273.41, for a total value of $461,789.49. Following the completion of the transaction, the chief marketing officer now owns 457,310 shares of the company's stock, valued at approximately $125,033,127.10. This trade represents a 0.37 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, Director James M. Daly sold 15,470 shares of the company's stock in a transaction that occurred on Thursday, February 27th. The stock was sold at an average price of $347.45, for a total transaction of $5,375,051.50. Following the sale, the director now directly owns 1,912 shares in the company, valued at approximately $664,324.40. The trade was a 89.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 35,900 shares of company stock worth $12,168,079 in the last three months. 22.80% of the stock is owned by company insiders.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently bought and sold shares of the stock. Kohmann Bosshard Financial Services LLC acquired a new position in shares of Madrigal Pharmaceuticals during the fourth quarter worth about $70,000. GF Fund Management CO. LTD. acquired a new position in Madrigal Pharmaceuticals during the 4th quarter worth approximately $141,000. BI Asset Management Fondsmaeglerselskab A S purchased a new stake in shares of Madrigal Pharmaceuticals in the 4th quarter valued at approximately $164,000. Quest Partners LLC raised its holdings in shares of Madrigal Pharmaceuticals by 172.8% in the 3rd quarter. Quest Partners LLC now owns 581 shares of the biopharmaceutical company's stock valued at $123,000 after purchasing an additional 368 shares in the last quarter. Finally, KBC Group NV lifted its position in shares of Madrigal Pharmaceuticals by 73.5% during the 4th quarter. KBC Group NV now owns 609 shares of the biopharmaceutical company's stock worth $188,000 after purchasing an additional 258 shares during the last quarter. 98.50% of the stock is currently owned by hedge funds and other institutional investors.

About Madrigal Pharmaceuticals

(

Get Free ReportMadrigal Pharmaceuticals, Inc, a clinical-stage biopharmaceutical company, focuses on the development of therapeutics for the treatment of non-alcoholic steatohepatitis (NASH) in the United States. Its lead product candidate is resmetirom, a liver-directed thyroid hormone receptor beta agonist, which is in Phase 3 clinical trials for treating NASH.

Further Reading

Before you consider Madrigal Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Madrigal Pharmaceuticals wasn't on the list.

While Madrigal Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.