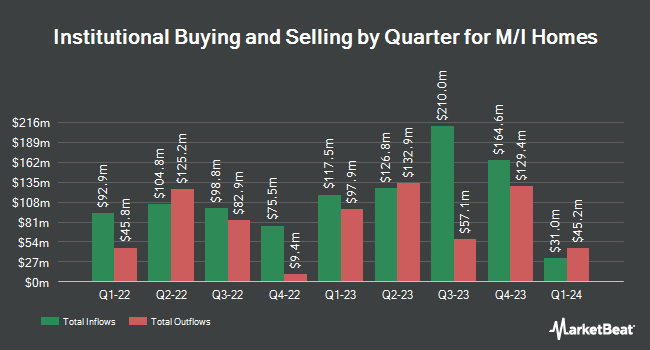

Magnetar Financial LLC bought a new stake in M/I Homes, Inc. (NYSE:MHO - Free Report) in the fourth quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor bought 2,565 shares of the construction company's stock, valued at approximately $341,000.

Several other hedge funds have also made changes to their positions in MHO. Connor Clark & Lunn Investment Management Ltd. purchased a new stake in M/I Homes during the 3rd quarter valued at approximately $1,365,000. Intech Investment Management LLC increased its holdings in shares of M/I Homes by 100.5% in the third quarter. Intech Investment Management LLC now owns 9,245 shares of the construction company's stock valued at $1,584,000 after purchasing an additional 4,635 shares during the period. Foundry Partners LLC purchased a new stake in shares of M/I Homes during the third quarter worth approximately $393,000. Charles Schwab Investment Management Inc. lifted its holdings in shares of M/I Homes by 4.5% during the third quarter. Charles Schwab Investment Management Inc. now owns 462,081 shares of the construction company's stock worth $79,182,000 after purchasing an additional 19,754 shares during the period. Finally, Citigroup Inc. grew its position in M/I Homes by 48.4% in the 3rd quarter. Citigroup Inc. now owns 55,705 shares of the construction company's stock valued at $9,546,000 after buying an additional 18,173 shares during the last quarter. Institutional investors and hedge funds own 95.14% of the company's stock.

Wall Street Analysts Forecast Growth

A number of brokerages have commented on MHO. Raymond James restated a "strong-buy" rating and set a $168.00 price objective (down previously from $210.00) on shares of M/I Homes in a research report on Thursday, January 30th. StockNews.com raised shares of M/I Homes from a "hold" rating to a "buy" rating in a report on Tuesday, February 25th. Finally, Seaport Res Ptn raised M/I Homes from a "hold" rating to a "strong-buy" rating in a report on Thursday, March 6th.

View Our Latest Research Report on M/I Homes

M/I Homes Price Performance

M/I Homes stock traded down $1.24 during midday trading on Thursday, reaching $116.69. The company's stock had a trading volume of 159,991 shares, compared to its average volume of 274,940. The firm has a market capitalization of $3.16 billion, a PE ratio of 5.92 and a beta of 2.31. M/I Homes, Inc. has a fifty-two week low of $109.92 and a fifty-two week high of $176.18. The stock's 50 day simple moving average is $122.19 and its 200 day simple moving average is $143.71. The company has a debt-to-equity ratio of 0.33, a quick ratio of 1.93 and a current ratio of 7.65.

M/I Homes (NYSE:MHO - Get Free Report) last announced its quarterly earnings results on Wednesday, January 29th. The construction company reported $4.71 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $4.96 by ($0.25). M/I Homes had a net margin of 12.51% and a return on equity of 20.20%. On average, equities research analysts forecast that M/I Homes, Inc. will post 18.44 earnings per share for the current year.

M/I Homes Profile

(

Free Report)

M/I Homes, Inc, together with its subsidiaries, engages in the construction and sale of single-family residential homes in Ohio, Indiana, Illinois, Minnesota, Michigan, Florida, Texas, North Carolina, and Tennessee. The company operates through Northern Homebuilding, Southern Homebuilding, and Financial Services segments.

Recommended Stories

Before you consider M/I Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and M/I Homes wasn't on the list.

While M/I Homes currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.