MAI Capital Management decreased its holdings in shares of The Progressive Co. (NYSE:PGR - Free Report) by 5.7% in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 58,821 shares of the insurance provider's stock after selling 3,582 shares during the period. MAI Capital Management's holdings in Progressive were worth $14,926,000 as of its most recent filing with the Securities and Exchange Commission.

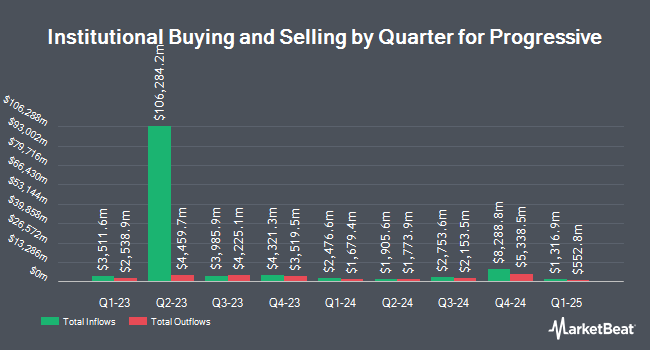

Other institutional investors and hedge funds have also added to or reduced their stakes in the company. AMG National Trust Bank acquired a new stake in Progressive during the 3rd quarter worth about $203,000. Swiss National Bank increased its stake in Progressive by 0.3% in the 3rd quarter. Swiss National Bank now owns 1,738,400 shares of the insurance provider's stock valued at $441,136,000 after buying an additional 4,400 shares during the period. Thrivent Financial for Lutherans boosted its stake in shares of Progressive by 26.2% during the 3rd quarter. Thrivent Financial for Lutherans now owns 139,782 shares of the insurance provider's stock valued at $35,471,000 after buying an additional 29,050 shares during the period. Claro Advisors LLC grew its holdings in shares of Progressive by 117.2% during the 3rd quarter. Claro Advisors LLC now owns 2,952 shares of the insurance provider's stock valued at $749,000 after acquiring an additional 1,593 shares in the last quarter. Finally, Obsidian Personal Planning Solutions LLC acquired a new position in shares of Progressive in the third quarter worth $214,000. 85.34% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several research analysts have recently commented on the stock. HSBC upgraded shares of Progressive from a "hold" rating to a "buy" rating and set a $253.00 price target on the stock in a research note on Monday, August 12th. Morgan Stanley raised their target price on Progressive from $300.00 to $310.00 and gave the stock an "overweight" rating in a research report on Friday, October 18th. Jefferies Financial Group lifted their target price on shares of Progressive from $257.00 to $295.00 and gave the company a "buy" rating in a research report on Wednesday, October 9th. Hsbc Global Res upgraded shares of Progressive from a "hold" rating to a "strong-buy" rating in a research note on Monday, August 12th. Finally, Wells Fargo & Company lifted their price target on shares of Progressive from $281.00 to $282.00 and gave the company an "overweight" rating in a report on Tuesday, September 10th. Five research analysts have rated the stock with a hold rating, thirteen have given a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat.com, Progressive currently has a consensus rating of "Moderate Buy" and a consensus target price of $269.81.

View Our Latest Stock Analysis on Progressive

Progressive Stock Down 0.8 %

NYSE:PGR traded down $2.01 during mid-day trading on Tuesday, hitting $254.51. 1,657,290 shares of the company's stock were exchanged, compared to its average volume of 2,453,554. The Progressive Co. has a one year low of $149.14 and a one year high of $263.85. The business has a fifty day moving average price of $252.32 and a 200 day moving average price of $230.44. The company has a market cap of $149.09 billion, a PE ratio of 18.49, a P/E/G ratio of 0.71 and a beta of 0.36. The company has a debt-to-equity ratio of 0.25, a current ratio of 0.30 and a quick ratio of 0.30.

Progressive (NYSE:PGR - Get Free Report) last announced its quarterly earnings data on Tuesday, October 15th. The insurance provider reported $3.58 earnings per share for the quarter, topping analysts' consensus estimates of $3.40 by $0.18. Progressive had a net margin of 11.27% and a return on equity of 33.10%. The company had revenue of $19.43 billion during the quarter, compared to analyst estimates of $18.95 billion. Equities analysts predict that The Progressive Co. will post 13.09 EPS for the current year.

Insider Buying and Selling

In other news, Director Dyke Kahina Van sold 2,180 shares of the firm's stock in a transaction on Friday, September 27th. The stock was sold at an average price of $252.28, for a total transaction of $549,970.40. Following the transaction, the director now owns 13,723 shares in the company, valued at approximately $3,462,038.44. This trade represents a 13.71 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is accessible through this link. Also, CEO Susan Patricia Griffith sold 43,370 shares of the business's stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $252.20, for a total transaction of $10,937,914.00. Following the completion of the transaction, the chief executive officer now owns 473,735 shares of the company's stock, valued at $119,475,967. This represents a 8.39 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 59,209 shares of company stock worth $14,975,979. Insiders own 0.34% of the company's stock.

Progressive Profile

(

Free Report)

The Progressive Corporation, an insurance holding company, provides personal and commercial auto, personal residential and commercial property, business related general liability, and other specialty property-casualty insurance products and related services in the United States. It operates in three segments: Personal Lines, Commercial Lines, and Property.

Read More

Before you consider Progressive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Progressive wasn't on the list.

While Progressive currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.