MAI Capital Management lessened its stake in shares of Diageo plc (NYSE:DEO - Free Report) by 33.8% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 29,326 shares of the company's stock after selling 14,979 shares during the quarter. MAI Capital Management's holdings in Diageo were worth $4,116,000 as of its most recent filing with the Securities and Exchange Commission.

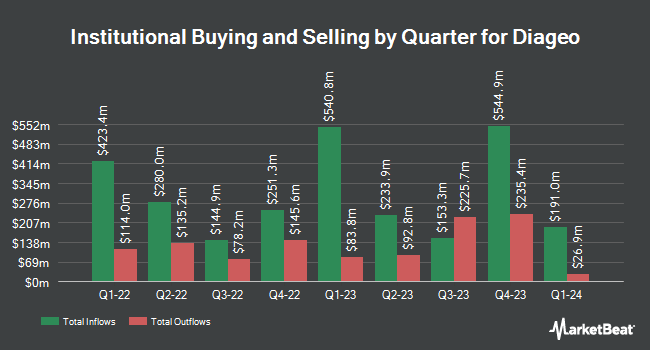

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in DEO. Financial Counselors Inc. boosted its stake in Diageo by 3.3% in the 2nd quarter. Financial Counselors Inc. now owns 2,587 shares of the company's stock worth $326,000 after buying an additional 83 shares during the last quarter. PFG Investments LLC lifted its stake in shares of Diageo by 3.4% in the 2nd quarter. PFG Investments LLC now owns 2,516 shares of the company's stock valued at $317,000 after purchasing an additional 83 shares in the last quarter. Global Retirement Partners LLC lifted its stake in shares of Diageo by 1.1% in the 3rd quarter. Global Retirement Partners LLC now owns 8,146 shares of the company's stock valued at $1,143,000 after purchasing an additional 85 shares in the last quarter. Gradient Investments LLC lifted its stake in shares of Diageo by 2.8% in the 2nd quarter. Gradient Investments LLC now owns 3,181 shares of the company's stock valued at $401,000 after purchasing an additional 86 shares in the last quarter. Finally, Toronto Dominion Bank lifted its stake in shares of Diageo by 0.9% in the 1st quarter. Toronto Dominion Bank now owns 9,949 shares of the company's stock valued at $1,480,000 after purchasing an additional 90 shares in the last quarter. Hedge funds and other institutional investors own 8.97% of the company's stock.

Diageo Price Performance

DEO stock traded up $0.25 during midday trading on Wednesday, hitting $119.45. 820,720 shares of the company's stock were exchanged, compared to its average volume of 759,412. The company has a debt-to-equity ratio of 1.62, a current ratio of 1.53 and a quick ratio of 0.55. Diageo plc has a 12-month low of $117.84 and a 12-month high of $154.71. The firm has a 50 day moving average price of $131.21 and a 200-day moving average price of $131.47.

Analysts Set New Price Targets

Several research firms have recently weighed in on DEO. Bank of America raised Diageo from a "neutral" rating to a "buy" rating in a research note on Thursday, September 12th. Royal Bank of Canada raised Diageo from an "underperform" rating to a "sector perform" rating in a research report on Monday, August 12th. Three equities research analysts have rated the stock with a sell rating, three have given a hold rating and two have given a buy rating to the stock. According to MarketBeat.com, Diageo presently has a consensus rating of "Hold".

View Our Latest Research Report on Diageo

About Diageo

(

Free Report)

Diageo plc, together with its subsidiaries, engages in the production, marketing, and sale of alcoholic beverages. The company offers scotch, gin, vodka, rum, raki, liqueur, wine, tequila, Chinese white spirits, cachaça, and brandy, as well as beer, including cider and flavored malt beverages. It also provides Chinese, Canadian, Irish, American, and Indian-Made Foreign Liquor whiskies, as well as flavored malt beverages, ready to drink, and non-alcoholic products.

Recommended Stories

Before you consider Diageo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Diageo wasn't on the list.

While Diageo currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.