Main Management ETF Advisors LLC acquired a new stake in Qualys, Inc. (NASDAQ:QLYS - Free Report) in the 3rd quarter, according to its most recent filing with the SEC. The fund acquired 6,208 shares of the software maker's stock, valued at approximately $797,000.

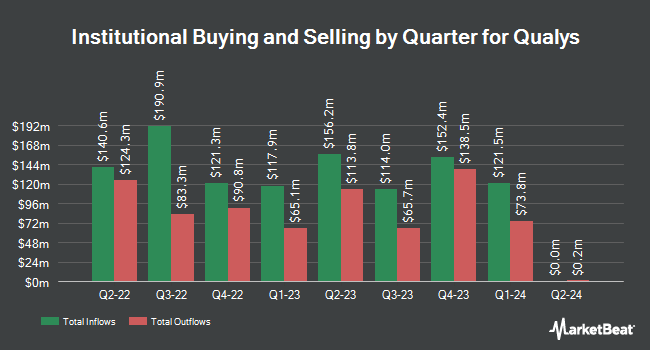

Several other institutional investors and hedge funds have also modified their holdings of QLYS. Financial Enhancement Group LLC grew its stake in shares of Qualys by 1.5% during the 3rd quarter. Financial Enhancement Group LLC now owns 6,100 shares of the software maker's stock worth $784,000 after acquiring an additional 91 shares in the last quarter. Bank of Montreal Can boosted its holdings in shares of Qualys by 2.2% in the 2nd quarter. Bank of Montreal Can now owns 4,896 shares of the software maker's stock valued at $699,000 after buying an additional 107 shares during the last quarter. Legacy Advisors LLC boosted its holdings in shares of Qualys by 1.4% in the 2nd quarter. Legacy Advisors LLC now owns 8,272 shares of the software maker's stock valued at $1,180,000 after buying an additional 113 shares during the last quarter. The Manufacturers Life Insurance Company boosted its holdings in shares of Qualys by 0.3% in the 2nd quarter. The Manufacturers Life Insurance Company now owns 46,436 shares of the software maker's stock valued at $6,622,000 after buying an additional 127 shares during the last quarter. Finally, West Coast Financial LLC boosted its holdings in shares of Qualys by 0.6% in the 3rd quarter. West Coast Financial LLC now owns 23,177 shares of the software maker's stock valued at $2,977,000 after buying an additional 127 shares during the last quarter. 99.31% of the stock is currently owned by institutional investors and hedge funds.

Qualys Stock Performance

Shares of NASDAQ QLYS traded down $1.41 during mid-day trading on Friday, reaching $155.38. The company had a trading volume of 326,079 shares, compared to its average volume of 398,156. Qualys, Inc. has a one year low of $119.17 and a one year high of $206.35. The firm has a market cap of $5.69 billion, a price-to-earnings ratio of 34.22 and a beta of 0.54. The business's 50-day simple moving average is $137.39 and its 200 day simple moving average is $135.25.

Qualys (NASDAQ:QLYS - Get Free Report) last issued its quarterly earnings results on Tuesday, November 5th. The software maker reported $1.56 EPS for the quarter, topping analysts' consensus estimates of $1.33 by $0.23. Qualys had a return on equity of 40.24% and a net margin of 28.72%. The company had revenue of $153.87 million for the quarter, compared to analysts' expectations of $150.74 million. During the same quarter last year, the business earned $1.24 earnings per share. Qualys's revenue was up 8.4% on a year-over-year basis. On average, sell-side analysts anticipate that Qualys, Inc. will post 4.34 EPS for the current year.

Analyst Ratings Changes

Several research firms have recently commented on QLYS. Morgan Stanley increased their price objective on Qualys from $123.00 to $126.00 and gave the company an "underweight" rating in a report on Wednesday, November 6th. Canaccord Genuity Group raised their price target on Qualys from $160.00 to $170.00 and gave the company a "buy" rating in a report on Wednesday, November 6th. TD Cowen raised their price target on Qualys from $130.00 to $150.00 and gave the company a "hold" rating in a report on Wednesday, November 6th. Westpark Capital reaffirmed a "hold" rating on shares of Qualys in a report on Wednesday, November 6th. Finally, UBS Group raised their price target on Qualys from $140.00 to $160.00 and gave the company a "neutral" rating in a report on Wednesday, November 6th. Three research analysts have rated the stock with a sell rating, fourteen have given a hold rating and two have given a buy rating to the stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus price target of $152.80.

Get Our Latest Stock Analysis on QLYS

Insider Buying and Selling at Qualys

In other news, insider Bruce K. Posey sold 8,555 shares of the business's stock in a transaction dated Monday, December 2nd. The stock was sold at an average price of $154.62, for a total transaction of $1,322,774.10. Following the sale, the insider now directly owns 64,032 shares in the company, valued at approximately $9,900,627.84. The trade was a 11.79 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, CFO Joo Mi Kim sold 1,332 shares of the business's stock in a transaction dated Thursday, December 5th. The stock was sold at an average price of $157.37, for a total value of $209,616.84. Following the sale, the chief financial officer now owns 113,652 shares in the company, valued at approximately $17,885,415.24. This trade represents a 1.16 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 31,190 shares of company stock worth $4,449,290 over the last 90 days. Insiders own 1.00% of the company's stock.

Qualys Profile

(

Free Report)

Qualys, Inc, together with its subsidiaries, provides cloud-based platform delivering information technology (IT), security, and compliance solutions in the United States and internationally. It offers Qualys Cloud Apps, which include Cybersecurity Asset Management and External Attack Surface Management; Vulnerability Management, Detection and Response; Web Application Scanning; Patch Management; Custom Assessment and Remediation; Multi-Vector Endpoint Detection and Response; Context Extended Detection and Response; Policy Compliance; File Integrity Monitoring; and Qualys TotalCloud, as well as Cloud Workload Protection, Cloud Detection and Response, Cloud Security Posture Management, Infrastructure as Code, and Container Security.

Featured Articles

Before you consider Qualys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Qualys wasn't on the list.

While Qualys currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.