Mainstream Capital Management LLC acquired a new position in shares of The Honest Company, Inc. (NASDAQ:HNST - Free Report) in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm acquired 236,061 shares of the company's stock, valued at approximately $843,000. Mainstream Capital Management LLC owned 0.24% of Honest as of its most recent SEC filing.

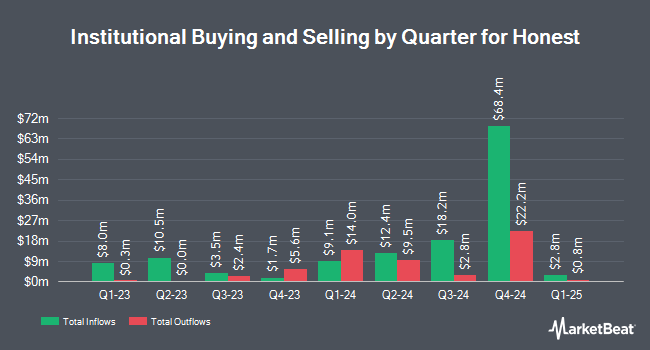

Other large investors also recently modified their holdings of the company. EntryPoint Capital LLC bought a new position in shares of Honest in the 1st quarter worth $27,000. XTX Topco Ltd lifted its holdings in shares of Honest by 6.4% in the 2nd quarter. XTX Topco Ltd now owns 137,797 shares of the company's stock worth $402,000 after purchasing an additional 8,282 shares in the last quarter. Creative Planning bought a new position in shares of Honest in the 3rd quarter worth $39,000. Wealth Enhancement Advisory Services LLC bought a new position in shares of Honest in the 3rd quarter worth $40,000. Finally, Algert Global LLC lifted its holdings in shares of Honest by 24.4% in the 2nd quarter. Algert Global LLC now owns 63,472 shares of the company's stock worth $185,000 after purchasing an additional 12,437 shares in the last quarter. Institutional investors and hedge funds own 45.54% of the company's stock.

Honest Price Performance

Shares of Honest stock traded up $0.17 during trading hours on Friday, hitting $4.39. 2,243,110 shares of the company's stock traded hands, compared to its average volume of 1,229,997. The Honest Company, Inc. has a 12-month low of $1.21 and a 12-month high of $4.89. The stock has a market capitalization of $439.36 million, a price-to-earnings ratio of -32.46 and a beta of 1.85. The company has a fifty day simple moving average of $3.81 and a 200-day simple moving average of $3.42.

Honest (NASDAQ:HNST - Get Free Report) last announced its earnings results on Thursday, August 8th. The company reported ($0.04) earnings per share (EPS) for the quarter, meeting the consensus estimate of ($0.04). Honest had a negative return on equity of 10.00% and a negative net margin of 3.50%. The firm had revenue of $93.05 million during the quarter, compared to analyst estimates of $87.63 million. During the same period last year, the firm posted ($0.14) EPS. On average, analysts forecast that The Honest Company, Inc. will post -0.1 EPS for the current fiscal year.

Analyst Ratings Changes

HNST has been the topic of a number of recent research reports. B. Riley started coverage on Honest in a report on Tuesday, September 10th. They issued a "buy" rating and a $6.50 target price on the stock. Northland Securities started coverage on Honest in a research note on Tuesday, August 6th. They set an "outperform" rating and a $6.00 price objective on the stock. Finally, Northland Capmk upgraded Honest to a "strong-buy" rating in a research note on Tuesday, August 6th. Two research analysts have rated the stock with a hold rating, five have assigned a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $5.04.

View Our Latest Analysis on HNST

Insider Buying and Selling

In related news, EVP Stephen Winchell sold 6,938 shares of Honest stock in a transaction dated Wednesday, August 21st. The stock was sold at an average price of $4.28, for a total value of $29,694.64. Following the completion of the sale, the executive vice president now owns 414,736 shares of the company's stock, valued at approximately $1,775,070.08. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. In other Honest news, EVP Stephen Winchell sold 6,938 shares of Honest stock in a transaction dated Wednesday, August 21st. The stock was sold at an average price of $4.28, for a total transaction of $29,694.64. Following the completion of the transaction, the executive vice president now owns 414,736 shares of the company's stock, valued at $1,775,070.08. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Also, CEO Carla Vernon sold 52,751 shares of Honest stock in a transaction dated Wednesday, August 21st. The shares were sold at an average price of $4.28, for a total value of $225,774.28. Following the transaction, the chief executive officer now directly owns 2,828,319 shares of the company's stock, valued at $12,105,205.32. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 2,531,187 shares of company stock valued at $9,018,480. 8.60% of the stock is owned by insiders.

Honest Profile

(

Free Report)

The Honest Company, Inc manufactures and sells diapers and wipes, skin and personal care, and household and wellness products. The company also offers baby clothing and nursery bedding products. It sells its products through digital and retail sales channels, such as its website and third-party ecommerce sites, as well as brick and mortar retailers.

Read More

Before you consider Honest, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Honest wasn't on the list.

While Honest currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.