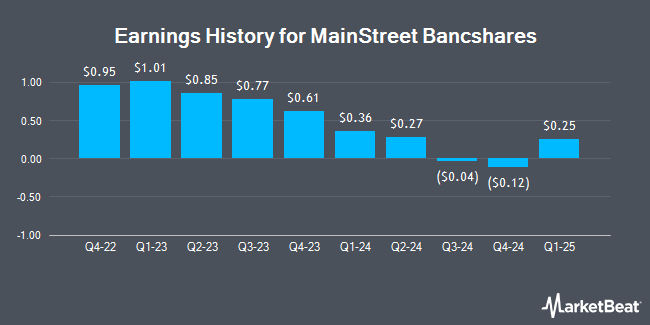

MainStreet Bancshares (NASDAQ:MNSB - Get Free Report) will likely be releasing its Q1 2025 earnings data before the market opens on Monday, April 21st. Analysts expect the company to announce earnings of $0.21 per share and revenue of $18.00 million for the quarter.

MainStreet Bancshares (NASDAQ:MNSB - Get Free Report) last issued its quarterly earnings data on Monday, April 21st. The company reported $0.25 EPS for the quarter, beating the consensus estimate of $0.21 by $0.04. MainStreet Bancshares had a negative net margin of 7.24% and a positive return on equity of 2.96%. The company had revenue of $17.45 million during the quarter, compared to analysts' expectations of $18.00 million. On average, analysts expect MainStreet Bancshares to post $1 EPS for the current fiscal year and $1 EPS for the next fiscal year.

MainStreet Bancshares Price Performance

NASDAQ MNSB traded up $0.62 on Wednesday, hitting $18.41. The stock had a trading volume of 30,674 shares, compared to its average volume of 18,513. The firm has a 50-day moving average of $16.48 and a 200-day moving average of $17.38. The company has a debt-to-equity ratio of 0.37, a quick ratio of 1.08 and a current ratio of 1.08. MainStreet Bancshares has a 52-week low of $14.97 and a 52-week high of $20.88. The company has a market capitalization of $142.23 million, a price-to-earnings ratio of -11.43 and a beta of 0.43.

MainStreet Bancshares Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Monday, February 17th. Investors of record on Monday, February 10th were given a $0.10 dividend. The ex-dividend date of this dividend was Monday, February 10th. This represents a $0.40 dividend on an annualized basis and a dividend yield of 2.17%. MainStreet Bancshares's dividend payout ratio (DPR) is presently -24.84%.

About MainStreet Bancshares

(

Get Free Report)

MainStreet Bancshares, Inc operates as the bank holding company for MainStreet Bank that provides various banking products and services for individuals, small to medium-sized businesses, and professional service organizations. The company offers demand, NOW, money market, savings, and sweep accounts, as well as certificates of deposit; business and consumer checking, interest-bearing checking, business account analysis, and other depository services; and cash management, wire transfer, check imaging, bill pay, remote deposit capture, and courier services.

Read More

Before you consider MainStreet Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MainStreet Bancshares wasn't on the list.

While MainStreet Bancshares currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.