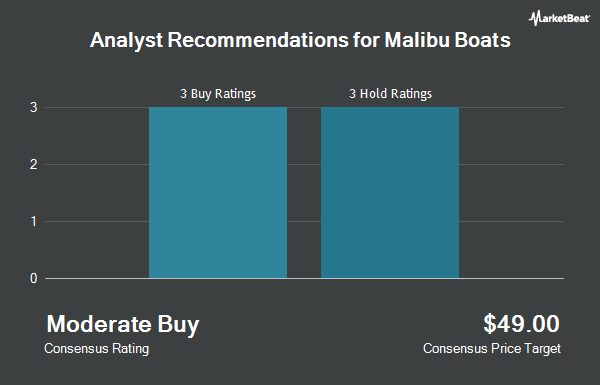

Malibu Boats (NASDAQ:MBUU - Get Free Report) was upgraded by stock analysts at DA Davidson to a "hold" rating in a note issued to investors on Monday,Zacks.com reports.

Other research analysts also recently issued reports about the stock. Robert W. Baird reissued a "neutral" rating and set a $32.00 target price (down from $50.00) on shares of Malibu Boats in a research report on Friday, April 4th. B. Riley upgraded Malibu Boats to a "hold" rating in a research note on Wednesday, February 12th. Baird R W lowered Malibu Boats from a "strong-buy" rating to a "hold" rating in a report on Friday, April 4th. StockNews.com upgraded Malibu Boats from a "sell" rating to a "hold" rating in a research note on Tuesday, April 15th. Finally, Truist Financial cut their price target on Malibu Boats from $38.00 to $28.00 and set a "hold" rating for the company in a research note on Monday, April 14th. Seven analysts have rated the stock with a hold rating and one has issued a buy rating to the company's stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Hold" and an average target price of $38.17.

Read Our Latest Analysis on MBUU

Malibu Boats Stock Performance

Shares of MBUU traded up $0.90 on Monday, reaching $27.01. 245,703 shares of the company's stock traded hands, compared to its average volume of 224,501. The stock's 50 day simple moving average is $31.00 and its two-hundred day simple moving average is $36.87. The company has a current ratio of 1.52, a quick ratio of 0.45 and a debt-to-equity ratio of 0.04. Malibu Boats has a 52-week low of $24.43 and a 52-week high of $47.82. The stock has a market cap of $530.34 million, a PE ratio of -6.21 and a beta of 1.27.

Malibu Boats (NASDAQ:MBUU - Get Free Report) last released its earnings results on Thursday, January 30th. The company reported $0.20 EPS for the quarter, missing analysts' consensus estimates of $0.21 by ($0.01). Malibu Boats had a positive return on equity of 1.04% and a negative net margin of 12.09%. On average, analysts forecast that Malibu Boats will post 1.69 earnings per share for the current fiscal year.

Institutional Investors Weigh In On Malibu Boats

Large investors have recently added to or reduced their stakes in the company. Twin Lions Management LLC purchased a new position in shares of Malibu Boats during the 4th quarter valued at about $19,807,000. Bank of New York Mellon Corp raised its stake in shares of Malibu Boats by 370.5% during the fourth quarter. Bank of New York Mellon Corp now owns 440,829 shares of the company's stock worth $16,571,000 after acquiring an additional 347,144 shares in the last quarter. Lodge Hill Capital LLC lifted its holdings in shares of Malibu Boats by 74.6% in the 4th quarter. Lodge Hill Capital LLC now owns 530,514 shares of the company's stock worth $19,942,000 after acquiring an additional 226,650 shares during the last quarter. Raymond James Financial Inc. purchased a new stake in shares of Malibu Boats in the 4th quarter valued at $8,221,000. Finally, Schroder Investment Management Group bought a new position in shares of Malibu Boats during the 4th quarter valued at $6,888,000. Hedge funds and other institutional investors own 91.35% of the company's stock.

About Malibu Boats

(

Get Free Report)

Malibu Boats, Inc designs, engineers, manufactures, markets, and sells a range of recreational powerboats. It operates through three segments: Malibu, Saltwater Fishing, and Cobalt. The company provides performance sport boats, and sterndrive and outboard boats under the Malibu, Axis, Pursuit, Maverick, Cobia, Pathfinder, Hewes, and Cobalt brands.

Featured Articles

Before you consider Malibu Boats, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Malibu Boats wasn't on the list.

While Malibu Boats currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.