Manchester Financial Inc. boosted its position in Microsoft Co. (NASDAQ:MSFT - Free Report) by 26.2% during the fourth quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 15,694 shares of the software giant's stock after acquiring an additional 3,263 shares during the quarter. Microsoft accounts for approximately 1.4% of Manchester Financial Inc.'s portfolio, making the stock its 13th largest holding. Manchester Financial Inc.'s holdings in Microsoft were worth $6,615,000 at the end of the most recent reporting period.

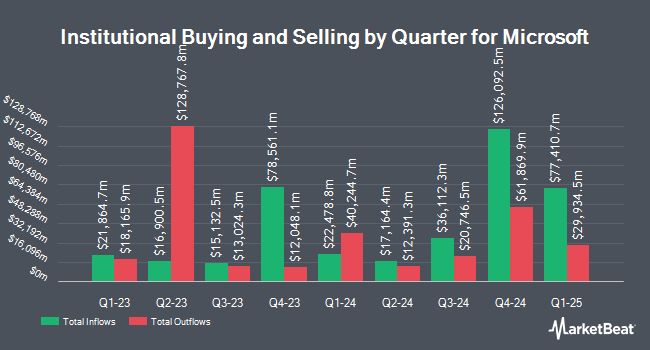

A number of other large investors have also added to or reduced their stakes in MSFT. Geode Capital Management LLC lifted its position in Microsoft by 2.0% in the 3rd quarter. Geode Capital Management LLC now owns 165,024,812 shares of the software giant's stock worth $70,790,682,000 after buying an additional 3,264,648 shares during the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lifted its holdings in shares of Microsoft by 4.1% in the 3rd quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 54,590,791 shares of the software giant's stock worth $23,490,417,000 after acquiring an additional 2,125,030 shares during the last quarter. Charles Schwab Investment Management Inc. boosted its stake in shares of Microsoft by 1.4% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 47,229,125 shares of the software giant's stock valued at $20,322,513,000 after purchasing an additional 652,493 shares in the last quarter. International Assets Investment Management LLC grew its holdings in shares of Microsoft by 48,526.1% during the 3rd quarter. International Assets Investment Management LLC now owns 38,501,645 shares of the software giant's stock valued at $16,567,258,000 after purchasing an additional 38,422,466 shares during the last quarter. Finally, Franklin Resources Inc. raised its position in Microsoft by 1.1% in the 3rd quarter. Franklin Resources Inc. now owns 38,420,657 shares of the software giant's stock worth $16,104,959,000 after purchasing an additional 406,940 shares during the period. Hedge funds and other institutional investors own 71.13% of the company's stock.

Analyst Ratings Changes

MSFT has been the subject of several analyst reports. Royal Bank of Canada restated an "outperform" rating and set a $500.00 price target on shares of Microsoft in a research report on Thursday, January 30th. Bank of America reduced their price target on Microsoft from $510.00 to $480.00 and set a "buy" rating on the stock in a research report on Tuesday. BMO Capital Markets lowered their price objective on Microsoft from $490.00 to $470.00 and set an "outperform" rating for the company in a research report on Wednesday. Piper Sandler restated an "overweight" rating and issued a $520.00 target price on shares of Microsoft in a report on Monday, January 27th. Finally, Jefferies Financial Group reiterated a "buy" rating and set a $475.00 price target (down from $500.00) on shares of Microsoft in a report on Monday, April 7th. Four analysts have rated the stock with a hold rating and twenty-eight have assigned a buy rating to the stock. According to data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $499.97.

Read Our Latest Stock Analysis on MSFT

Microsoft Stock Down 3.7 %

Shares of MSFT traded down $14.12 during mid-day trading on Wednesday, reaching $371.61. The company had a trading volume of 21,938,586 shares, compared to its average volume of 21,233,013. The company has a debt-to-equity ratio of 0.13, a quick ratio of 1.34 and a current ratio of 1.35. The company has a market capitalization of $2.76 trillion, a price-to-earnings ratio of 29.92, a price-to-earnings-growth ratio of 2.21 and a beta of 1.00. The firm has a 50-day moving average price of $390.78 and a 200 day moving average price of $413.81. Microsoft Co. has a 52 week low of $344.79 and a 52 week high of $468.35.

Microsoft (NASDAQ:MSFT - Get Free Report) last released its earnings results on Wednesday, January 29th. The software giant reported $3.23 EPS for the quarter, topping the consensus estimate of $3.15 by $0.08. Microsoft had a return on equity of 33.36% and a net margin of 35.43%. During the same period in the prior year, the business earned $2.93 EPS. On average, sell-side analysts forecast that Microsoft Co. will post 13.08 EPS for the current year.

Microsoft Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Thursday, June 12th. Stockholders of record on Thursday, May 15th will be issued a dividend of $0.83 per share. This represents a $3.32 dividend on an annualized basis and a dividend yield of 0.89%. The ex-dividend date is Thursday, May 15th. Microsoft's payout ratio is 26.73%.

About Microsoft

(

Free Report)

Microsoft Corporation develops and supports software, services, devices and solutions worldwide. The Productivity and Business Processes segment offers office, exchange, SharePoint, Microsoft Teams, office 365 Security and Compliance, Microsoft viva, and Microsoft 365 copilot; and office consumer services, such as Microsoft 365 consumer subscriptions, Office licensed on-premises, and other office services.

Featured Articles

Before you consider Microsoft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Microsoft wasn't on the list.

While Microsoft currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.