Barclays PLC lowered its stake in shares of Manhattan Associates, Inc. (NASDAQ:MANH - Free Report) by 30.6% in the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 70,557 shares of the software maker's stock after selling 31,077 shares during the quarter. Barclays PLC owned about 0.12% of Manhattan Associates worth $19,853,000 at the end of the most recent quarter.

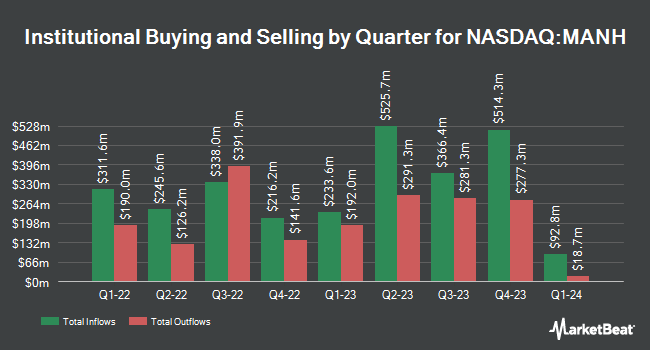

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in the stock. Innealta Capital LLC acquired a new position in Manhattan Associates in the 2nd quarter valued at $26,000. International Assets Investment Management LLC bought a new position in shares of Manhattan Associates in the second quarter worth about $27,000. DT Investment Partners LLC acquired a new position in shares of Manhattan Associates during the 2nd quarter worth about $31,000. Ashton Thomas Private Wealth LLC acquired a new position in shares of Manhattan Associates during the 2nd quarter worth about $31,000. Finally, Capital Performance Advisors LLP bought a new stake in Manhattan Associates during the 3rd quarter valued at approximately $34,000. Institutional investors and hedge funds own 98.45% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research analysts have recently commented on MANH shares. Robert W. Baird upped their price target on Manhattan Associates from $263.00 to $304.00 and gave the stock an "outperform" rating in a report on Tuesday, October 22nd. Citigroup upped their target price on shares of Manhattan Associates from $257.00 to $287.00 and gave the company a "neutral" rating in a research note on Wednesday, September 25th. Piper Sandler began coverage on shares of Manhattan Associates in a report on Monday, November 25th. They issued an "overweight" rating and a $326.00 price target for the company. Raymond James boosted their price objective on shares of Manhattan Associates from $255.00 to $305.00 and gave the stock an "outperform" rating in a report on Wednesday, October 23rd. Finally, Truist Financial upped their price objective on shares of Manhattan Associates from $275.00 to $310.00 and gave the company a "buy" rating in a research report on Friday, October 11th. Four equities research analysts have rated the stock with a hold rating and seven have given a buy rating to the company's stock. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average target price of $290.78.

Read Our Latest Report on Manhattan Associates

Insiders Place Their Bets

In other news, EVP James Stewart Gantt sold 3,475 shares of Manhattan Associates stock in a transaction on Tuesday, November 26th. The stock was sold at an average price of $288.10, for a total value of $1,001,147.50. Following the completion of the sale, the executive vice president now directly owns 42,812 shares of the company's stock, valued at approximately $12,334,137.20. This trade represents a 7.51 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, SVP Bruce Richards sold 4,150 shares of the business's stock in a transaction dated Friday, November 29th. The stock was sold at an average price of $289.73, for a total value of $1,202,379.50. Following the sale, the senior vice president now directly owns 22,086 shares of the company's stock, valued at $6,398,976.78. This represents a 15.82 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Corporate insiders own 0.72% of the company's stock.

Manhattan Associates Trading Down 3.7 %

NASDAQ MANH traded down $11.61 on Friday, reaching $298.17. The company's stock had a trading volume of 305,803 shares, compared to its average volume of 413,238. Manhattan Associates, Inc. has a 52 week low of $199.23 and a 52 week high of $312.60. The firm has a market cap of $18.21 billion, a PE ratio of 84.71 and a beta of 1.50. The business has a 50-day moving average price of $286.25 and a 200 day moving average price of $262.54.

Manhattan Associates (NASDAQ:MANH - Get Free Report) last released its quarterly earnings data on Tuesday, October 22nd. The software maker reported $1.35 earnings per share for the quarter, beating the consensus estimate of $1.06 by $0.29. The company had revenue of $266.70 million for the quarter, compared to analyst estimates of $262.90 million. Manhattan Associates had a return on equity of 84.55% and a net margin of 21.38%. The company's revenue was up 11.9% compared to the same quarter last year. During the same period in the prior year, the company posted $0.79 EPS. Analysts anticipate that Manhattan Associates, Inc. will post 3.39 earnings per share for the current fiscal year.

Manhattan Associates Company Profile

(

Free Report)

Manhattan Associates, Inc develops, sells, deploys, services, and maintains software solutions to manage supply chains, inventory, and omni-channel operations. It offers Warehouse Management Solution for managing goods and information across the distribution centers; Manhattan Active Warehouse Management, a cloud native and version less application for the associate; and Transportation Management Solution for helping shippers navigate their way through the demands and meet customer service expectations at the lowest possible freight costs; Manhattan SCALE, a portfolio of logistics execution solution; and Manhattan Active Omni, which offers order management, store inventory and fulfillment, POS, and customer engagement tools for enterprises and stores.

See Also

Before you consider Manhattan Associates, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Manhattan Associates wasn't on the list.

While Manhattan Associates currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.