Manning & Napier Advisors LLC increased its position in Ferguson plc (NASDAQ:FERG - Free Report) by 69.9% during the 4th quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 24,951 shares of the company's stock after buying an additional 10,265 shares during the quarter. Manning & Napier Advisors LLC's holdings in Ferguson were worth $4,331,000 as of its most recent filing with the Securities and Exchange Commission.

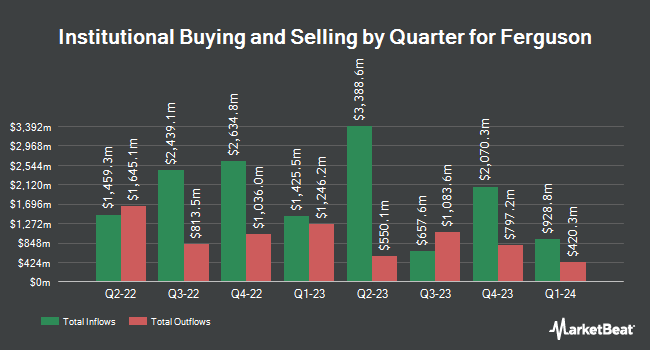

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. Asset Dedication LLC purchased a new position in shares of Ferguson in the 3rd quarter valued at $27,000. True Wealth Design LLC lifted its stake in shares of Ferguson by 1,350.0% during the third quarter. True Wealth Design LLC now owns 145 shares of the company's stock worth $29,000 after purchasing an additional 135 shares in the last quarter. Berbice Capital Management LLC purchased a new stake in shares of Ferguson in the fourth quarter worth about $35,000. Capital Performance Advisors LLP acquired a new stake in shares of Ferguson in the third quarter valued at about $37,000. Finally, Peterson Financial Group Inc. purchased a new stake in shares of Ferguson during the 3rd quarter valued at about $39,000. Institutional investors and hedge funds own 81.98% of the company's stock.

Ferguson Stock Performance

Shares of FERG stock traded up $3.46 on Thursday, hitting $182.24. 487,185 shares of the stock traded hands, compared to its average volume of 1,486,519. The company has a market capitalization of $36.44 billion, a PE ratio of 21.89, a PEG ratio of 1.75 and a beta of 1.24. The company's fifty day moving average is $188.08 and its 200 day moving average is $197.57. The company has a debt-to-equity ratio of 0.83, a current ratio of 1.68 and a quick ratio of 0.91. Ferguson plc has a 1-year low of $167.27 and a 1-year high of $225.63.

Ferguson Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Thursday, February 6th. Stockholders of record on Friday, December 20th will be issued a $0.83 dividend. The ex-dividend date is Friday, December 20th. This is a positive change from Ferguson's previous quarterly dividend of $0.79. This represents a $3.32 annualized dividend and a dividend yield of 1.82%. Ferguson's payout ratio is 39.86%.

Analyst Ratings Changes

Several analysts have issued reports on the stock. Barclays lowered their price objective on shares of Ferguson from $234.00 to $211.00 and set an "overweight" rating for the company in a research report on Thursday, January 16th. Citigroup lowered their price target on shares of Ferguson from $221.00 to $189.00 and set a "neutral" rating for the company in a report on Monday, January 6th. Bank of America upgraded shares of Ferguson from an "underperform" rating to a "buy" rating and boosted their price objective for the stock from $185.00 to $225.00 in a report on Wednesday, January 8th. Berenberg Bank raised their target price on Ferguson from $224.00 to $240.00 and gave the company a "buy" rating in a research note on Wednesday, December 11th. Finally, Wells Fargo & Company cut their price target on Ferguson from $220.00 to $215.00 and set an "overweight" rating on the stock in a research note on Tuesday, December 17th. Three research analysts have rated the stock with a hold rating and eight have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $220.10.

View Our Latest Report on FERG

Ferguson Company Profile

(

Free Report)

Ferguson plc distributes plumbing and heating products in the United States and Canada. It offers plumbing and heating solutions to customers in the residential, commercial, civil/infrastructure, and industrial end markets. The company also provides expertise, solutions, and products, including infrastructure, plumbing, appliances, fire, fabrication, and others, as well as heating, ventilation, and air conditioning products under the Ferguson brand name.

Read More

Before you consider Ferguson, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ferguson wasn't on the list.

While Ferguson currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.