Manning & Napier Advisors LLC lowered its holdings in shares of Truist Financial Co. (NYSE:TFC - Free Report) by 6.8% in the 4th quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund owned 390,972 shares of the insurance provider's stock after selling 28,695 shares during the quarter. Manning & Napier Advisors LLC's holdings in Truist Financial were worth $16,960,000 as of its most recent filing with the Securities & Exchange Commission.

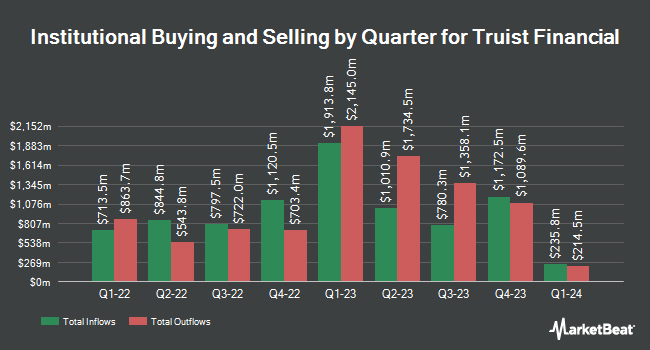

Several other institutional investors have also recently made changes to their positions in TFC. Tradewinds LLC. increased its position in shares of Truist Financial by 0.5% during the 3rd quarter. Tradewinds LLC. now owns 44,513 shares of the insurance provider's stock valued at $1,904,000 after purchasing an additional 222 shares during the last quarter. Koshinski Asset Management Inc. increased its position in Truist Financial by 2.1% during the fourth quarter. Koshinski Asset Management Inc. now owns 10,825 shares of the insurance provider's stock valued at $470,000 after acquiring an additional 225 shares during the last quarter. Aaron Wealth Advisors LLC raised its stake in shares of Truist Financial by 3.0% in the fourth quarter. Aaron Wealth Advisors LLC now owns 7,712 shares of the insurance provider's stock valued at $335,000 after acquiring an additional 227 shares during the period. Ignite Planners LLC lifted its holdings in shares of Truist Financial by 1.4% in the 4th quarter. Ignite Planners LLC now owns 17,499 shares of the insurance provider's stock worth $772,000 after acquiring an additional 246 shares during the last quarter. Finally, Burkett Financial Services LLC grew its holdings in Truist Financial by 26.8% during the 3rd quarter. Burkett Financial Services LLC now owns 1,198 shares of the insurance provider's stock valued at $51,000 after purchasing an additional 253 shares during the last quarter. Institutional investors own 71.28% of the company's stock.

Insider Activity

In other news, Director K. David Jr. Boyer sold 4,966 shares of the stock in a transaction that occurred on Wednesday, December 4th. The stock was sold at an average price of $46.20, for a total transaction of $229,429.20. Following the transaction, the director now owns 11,246 shares in the company, valued at $519,565.20. This trade represents a 30.63 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Also, CEO William H. Rogers, Jr. purchased 34,180 shares of the business's stock in a transaction that occurred on Monday, November 25th. The stock was bought at an average cost of $48.56 per share, with a total value of $1,659,780.80. Following the acquisition, the chief executive officer now owns 691,451 shares in the company, valued at $33,576,860.56. This represents a 5.20 % increase in their position. The disclosure for this purchase can be found here. Insiders own 0.17% of the company's stock.

Truist Financial Stock Performance

Shares of TFC traded up $0.80 during mid-day trading on Wednesday, reaching $48.07. The company had a trading volume of 1,029,158 shares, compared to its average volume of 7,384,504. The stock has a market capitalization of $63.81 billion, a P/E ratio of 14.46, a PEG ratio of 1.67 and a beta of 1.08. Truist Financial Co. has a 52-week low of $34.23 and a 52-week high of $49.06. The stock has a 50 day moving average of $45.51 and a two-hundred day moving average of $44.00. The company has a quick ratio of 0.83, a current ratio of 0.83 and a debt-to-equity ratio of 0.61.

Truist Financial (NYSE:TFC - Get Free Report) last released its quarterly earnings data on Friday, January 17th. The insurance provider reported $0.91 EPS for the quarter, topping the consensus estimate of $0.88 by $0.03. Truist Financial had a return on equity of 9.32% and a net margin of 15.59%. The business had revenue of $5.11 billion for the quarter, compared to analyst estimates of $5.05 billion. During the same quarter in the prior year, the firm posted $0.81 EPS. The business's quarterly revenue was up 3.4% compared to the same quarter last year. On average, analysts expect that Truist Financial Co. will post 3.95 earnings per share for the current year.

Truist Financial Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Monday, March 3rd. Shareholders of record on Friday, February 14th will be given a $0.52 dividend. This represents a $2.08 dividend on an annualized basis and a dividend yield of 4.33%. Truist Financial's dividend payout ratio (DPR) is currently 62.46%.

Analysts Set New Price Targets

Several equities analysts have commented on the company. JPMorgan Chase & Co. upped their price objective on Truist Financial from $43.50 to $47.00 and gave the company a "neutral" rating in a research report on Wednesday, October 16th. Morgan Stanley raised their price target on shares of Truist Financial from $55.00 to $56.00 and gave the stock an "equal weight" rating in a research note on Tuesday, January 21st. Raymond James boosted their price objective on shares of Truist Financial from $47.00 to $51.00 and gave the company an "overweight" rating in a research report on Thursday, January 16th. Barclays raised their target price on shares of Truist Financial from $47.00 to $51.00 and gave the stock an "equal weight" rating in a research report on Monday, January 6th. Finally, UBS Group increased their price objective on Truist Financial from $47.00 to $49.00 and gave the stock a "buy" rating in a research note on Friday, October 18th. Eleven analysts have rated the stock with a hold rating, eleven have issued a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, the company has an average rating of "Moderate Buy" and an average target price of $50.79.

Read Our Latest Stock Analysis on TFC

About Truist Financial

(

Free Report)

Truist Financial Corporation, a financial services company, provides banking and trust services in the Southeastern and Mid-Atlantic United States. The company operates through three segments: Consumer Banking and Wealth, Corporate and Commercial Banking, and Insurance Holdings.Its deposit products include noninterest-bearing checking, interest-bearing checking, savings, and money market deposit accounts, as well as certificates of deposit and individual retirement accounts.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Truist Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Truist Financial wasn't on the list.

While Truist Financial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.