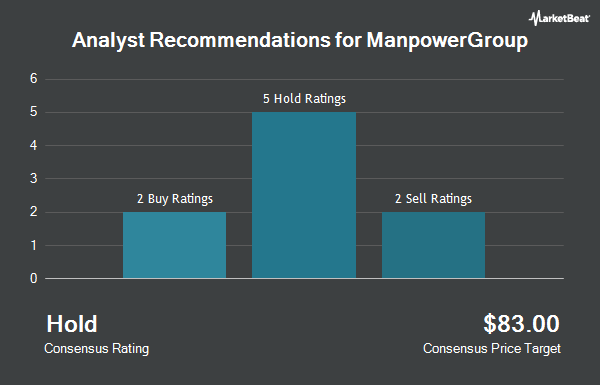

Shares of ManpowerGroup Inc. (NYSE:MAN - Get Free Report) have received a consensus rating of "Hold" from the six analysts that are currently covering the company, MarketBeat Ratings reports. Five investment analysts have rated the stock with a hold recommendation and one has given a buy recommendation to the company. The average 12 month price objective among brokerages that have covered the stock in the last year is $76.60.

Several research firms have recently issued reports on MAN. BMO Capital Markets cut their price target on ManpowerGroup from $87.00 to $71.00 and set a "market perform" rating for the company in a research note on Friday, October 18th. UBS Group cut their target price on shares of ManpowerGroup from $78.00 to $71.00 and set a "neutral" rating for the company in a research report on Friday, October 18th. Finally, Truist Financial lowered their price target on shares of ManpowerGroup from $78.00 to $74.00 and set a "hold" rating on the stock in a research report on Friday, October 18th.

View Our Latest Stock Analysis on MAN

Insider Buying and Selling

In other ManpowerGroup news, CFO John T. Mcginnis bought 8,000 shares of ManpowerGroup stock in a transaction that occurred on Wednesday, October 23rd. The shares were acquired at an average price of $62.28 per share, for a total transaction of $498,240.00. Following the acquisition, the chief financial officer now owns 70,639 shares of the company's stock, valued at $4,399,396.92. The trade was a 12.77 % increase in their position. The acquisition was disclosed in a filing with the SEC, which can be accessed through this link. 2.40% of the stock is owned by company insiders.

Institutional Investors Weigh In On ManpowerGroup

Several hedge funds and other institutional investors have recently bought and sold shares of the business. Commerce Bank increased its stake in ManpowerGroup by 4.1% during the 3rd quarter. Commerce Bank now owns 4,272 shares of the business services provider's stock valued at $314,000 after buying an additional 167 shares during the period. Abich Financial Wealth Management LLC lifted its stake in ManpowerGroup by 34.8% during the second quarter. Abich Financial Wealth Management LLC now owns 786 shares of the business services provider's stock valued at $55,000 after purchasing an additional 203 shares during the last quarter. State of Alaska Department of Revenue increased its holdings in shares of ManpowerGroup by 4.5% in the third quarter. State of Alaska Department of Revenue now owns 5,510 shares of the business services provider's stock valued at $405,000 after buying an additional 235 shares in the last quarter. Impact Partnership Wealth LLC raised its position in shares of ManpowerGroup by 9.8% during the third quarter. Impact Partnership Wealth LLC now owns 3,693 shares of the business services provider's stock worth $271,000 after purchasing an additional 329 shares during the period. Finally, Captrust Financial Advisors grew its position in ManpowerGroup by 11.8% during the 3rd quarter. Captrust Financial Advisors now owns 3,260 shares of the business services provider's stock worth $240,000 after purchasing an additional 344 shares in the last quarter. 98.03% of the stock is currently owned by hedge funds and other institutional investors.

ManpowerGroup Stock Performance

Shares of MAN traded up $0.04 during trading hours on Friday, hitting $56.94. The stock had a trading volume of 3,400,285 shares, compared to its average volume of 462,899. The firm has a market capitalization of $2.67 billion, a price-to-earnings ratio of 72.08 and a beta of 1.45. The firm has a 50-day moving average price of $63.16 and a 200 day moving average price of $68.75. The company has a debt-to-equity ratio of 0.46, a quick ratio of 1.15 and a current ratio of 1.15. ManpowerGroup has a fifty-two week low of $55.87 and a fifty-two week high of $80.25.

ManpowerGroup (NYSE:MAN - Get Free Report) last posted its quarterly earnings results on Thursday, October 17th. The business services provider reported $1.29 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.28 by $0.01. The firm had revenue of $4.53 billion during the quarter, compared to analysts' expectations of $4.48 billion. ManpowerGroup had a net margin of 0.21% and a return on equity of 11.05%. As a group, research analysts anticipate that ManpowerGroup will post 4.55 EPS for the current year.

ManpowerGroup Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Monday, December 16th. Stockholders of record on Monday, December 2nd were given a $1.545 dividend. This represents a $6.18 dividend on an annualized basis and a dividend yield of 10.85%. The ex-dividend date of this dividend was Monday, December 2nd. This is a positive change from ManpowerGroup's previous quarterly dividend of $1.01. ManpowerGroup's payout ratio is currently 389.87%.

ManpowerGroup Company Profile

(

Get Free ReportManpowerGroup Inc provides workforce solutions and services worldwide. The company offers recruitment services, including permanent, temporary, and contract recruitment of professionals, as well as administrative and industrial positions under the Manpower and Experis brands. It also offers various assessment services; training and development services; career and talent management; and outsourcing services related to human resources functions primarily in the areas of large-scale recruiting and workforce-intensive initiatives.

Featured Articles

Before you consider ManpowerGroup, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ManpowerGroup wasn't on the list.

While ManpowerGroup currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.