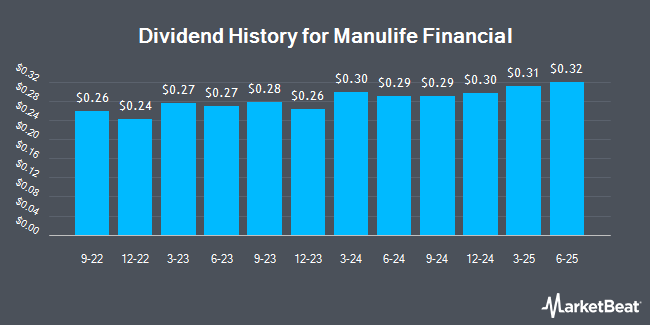

Manulife Financial Co. (NYSE:MFC - Get Free Report) TSE: MFC declared a quarterly dividend on Wednesday, November 6th,Zacks Dividends reports. Investors of record on Wednesday, November 20th will be paid a dividend of 0.296 per share by the financial services provider on Thursday, December 19th. This represents a $1.18 annualized dividend and a yield of 3.72%. The ex-dividend date is Wednesday, November 20th. This is a boost from Manulife Financial's previous quarterly dividend of $0.29.

Manulife Financial has raised its dividend by an average of 9.2% per year over the last three years and has raised its dividend annually for the last 11 consecutive years. Manulife Financial has a payout ratio of 40.5% indicating that its dividend is sufficiently covered by earnings. Research analysts expect Manulife Financial to earn $2.96 per share next year, which means the company should continue to be able to cover its $1.18 annual dividend with an expected future payout ratio of 39.9%.

Manulife Financial Stock Performance

MFC stock traded down $0.49 on Friday, hitting $31.80. 1,458,018 shares of the company's stock were exchanged, compared to its average volume of 2,536,172. Manulife Financial has a 12-month low of $18.42 and a 12-month high of $32.94. The firm has a 50 day moving average price of $29.21 and a two-hundred day moving average price of $26.96. The stock has a market cap of $55.93 billion, a P/E ratio of 18.42, a price-to-earnings-growth ratio of 1.08 and a beta of 1.08.

Manulife Financial (NYSE:MFC - Get Free Report) TSE: MFC last issued its quarterly earnings results on Wednesday, August 7th. The financial services provider reported $0.91 EPS for the quarter, topping analysts' consensus estimates of $0.64 by $0.27. Manulife Financial had a return on equity of 16.16% and a net margin of 9.18%. The company had revenue of $9.41 billion during the quarter, compared to analysts' expectations of $8.95 billion. During the same quarter in the previous year, the firm posted $0.62 EPS. Sell-side analysts expect that Manulife Financial will post 2.74 earnings per share for the current fiscal year.

Analyst Ratings Changes

A number of brokerages have commented on MFC. Dbs Bank raised Manulife Financial to a "strong-buy" rating in a research report on Thursday, August 8th. Barclays began coverage on Manulife Financial in a research report on Thursday, September 5th. They set an "equal weight" rating for the company. One analyst has rated the stock with a hold rating, six have assigned a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat.com, Manulife Financial currently has an average rating of "Buy" and an average price target of $35.67.

Check Out Our Latest Report on MFC

About Manulife Financial

(

Get Free Report)

Manulife Financial Corporation, together with its subsidiaries, provides financial products and services in the United States, Canada, Asia, and internationally. The company operates through Wealth and Asset Management Businesses; Insurance and Annuity Products; and Corporate and Other segments. The Wealth and Asset Management Businesses segment offers investment advice and solutions to retirement, retail, and institutional clients through multiple distribution channels, including agents and brokers affiliated with the company, independent securities brokerage firms and financial advisors pension plan consultants, and banks.

See Also

Before you consider Manulife Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Manulife Financial wasn't on the list.

While Manulife Financial currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.