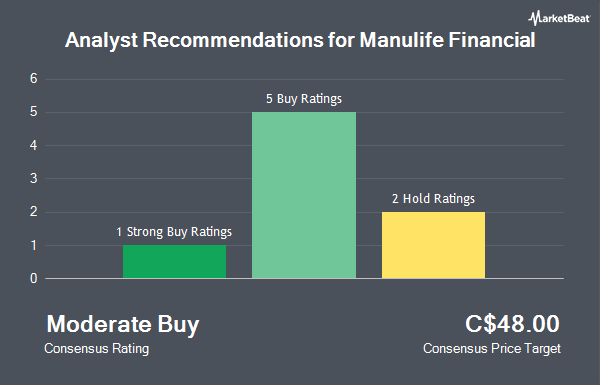

Manulife Financial Co. (TSE:MFC - Get Free Report) NYSE: MFC has received an average rating of "Moderate Buy" from the thirteen brokerages that are covering the company, Marketbeat.com reports. One analyst has rated the stock with a sell rating, three have given a hold rating, eight have issued a buy rating and one has issued a strong buy rating on the company. The average 12 month price objective among brokerages that have updated their coverage on the stock in the last year is C$43.45.

A number of research firms have recently weighed in on MFC. National Bankshares upped their price target on shares of Manulife Financial from C$45.00 to C$47.00 in a research note on Thursday, November 7th. CIBC raised their price target on Manulife Financial from C$42.00 to C$46.00 in a research note on Friday, November 8th. Dbs Bank raised Manulife Financial to a "strong-buy" rating in a research note on Thursday, August 8th. Royal Bank of Canada increased their price objective on Manulife Financial from C$38.00 to C$39.00 in a report on Friday, August 9th. Finally, Scotiabank lifted their target price on shares of Manulife Financial from C$48.00 to C$49.00 in a research note on Friday, November 8th.

Get Our Latest Stock Report on Manulife Financial

Manulife Financial Stock Up 0.2 %

MFC traded up C$0.11 on Tuesday, reaching C$44.81. 5,030,652 shares of the company traded hands, compared to its average volume of 6,528,629. The company has a market cap of C$79.31 billion, a price-to-earnings ratio of 19.07, a PEG ratio of 1.01 and a beta of 1.06. The company has a debt-to-equity ratio of 49.60, a current ratio of 36.68 and a quick ratio of 2.58. The stock's 50 day moving average price is C$41.91 and its 200-day moving average price is C$38.04. Manulife Financial has a 52-week low of C$26.11 and a 52-week high of C$46.42.

Manulife Financial Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Thursday, December 19th. Shareholders of record on Wednesday, November 20th will be issued a dividend of $0.40 per share. This represents a $1.60 dividend on an annualized basis and a yield of 3.57%. The ex-dividend date of this dividend is Wednesday, November 20th. Manulife Financial's dividend payout ratio (DPR) is 68.09%.

Insider Activity

In related news, Director Brooks Tingle sold 3,866 shares of the company's stock in a transaction on Thursday, November 14th. The shares were sold at an average price of C$46.07, for a total transaction of C$178,102.75. Also, Senior Officer Steve Finch sold 11,598 shares of the firm's stock in a transaction on Thursday, November 14th. The stock was sold at an average price of C$46.07, for a total transaction of C$534,308.26. Over the last ninety days, insiders have sold 17,630 shares of company stock valued at $793,528. 0.03% of the stock is owned by insiders.

Manulife Financial Company Profile

(

Get Free ReportManulife Financial Corporation, together with its subsidiaries, provides financial products and services in the United States, Canada, Asia, and internationally. The company operates through Wealth and Asset Management Businesses; Insurance and Annuity Products; and Corporate and Other segments. The Wealth and Asset Management Businesses segment offers investment advice and solutions to retirement, retail, and institutional clients through multiple distribution channels, including agents and brokers affiliated with the company, independent securities brokerage firms and financial advisors pension plan consultants, and banks.

Read More

Before you consider Manulife Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Manulife Financial wasn't on the list.

While Manulife Financial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.