Kentucky Retirement Systems trimmed its holdings in shares of Marathon Petroleum Co. (NYSE:MPC - Free Report) by 12.2% in the third quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 23,316 shares of the oil and gas company's stock after selling 3,234 shares during the quarter. Kentucky Retirement Systems' holdings in Marathon Petroleum were worth $3,798,000 as of its most recent filing with the SEC.

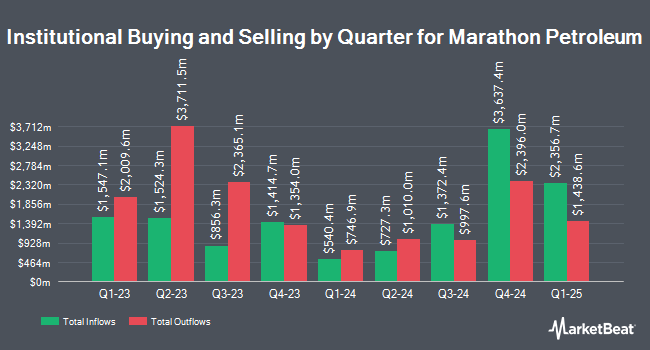

Other institutional investors have also added to or reduced their stakes in the company. Raymond James & Associates boosted its holdings in shares of Marathon Petroleum by 2.6% during the second quarter. Raymond James & Associates now owns 4,286,892 shares of the oil and gas company's stock worth $743,690,000 after acquiring an additional 107,915 shares during the period. Price T Rowe Associates Inc. MD raised its holdings in Marathon Petroleum by 1.0% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 3,080,958 shares of the oil and gas company's stock worth $620,815,000 after purchasing an additional 31,100 shares during the last quarter. Boston Partners lifted its position in shares of Marathon Petroleum by 0.3% during the 1st quarter. Boston Partners now owns 2,773,050 shares of the oil and gas company's stock valued at $558,390,000 after acquiring an additional 8,476 shares during the period. Pacer Advisors Inc. increased its stake in Marathon Petroleum by 8.5% during the 2nd quarter. Pacer Advisors Inc. now owns 2,669,815 shares of the oil and gas company's stock valued at $463,160,000 after purchasing an additional 209,270 shares in the last quarter. Finally, International Assets Investment Management LLC grew its holdings in Marathon Petroleum by 19,153.8% during the third quarter. International Assets Investment Management LLC now owns 1,311,182 shares of the oil and gas company's stock worth $213,605,000 after buying an additional 1,304,372 shares in the last quarter. 76.77% of the stock is owned by institutional investors.

Marathon Petroleum Stock Performance

Marathon Petroleum stock traded down $0.62 during mid-day trading on Friday, reaching $157.52. 2,258,883 shares of the company traded hands, compared to its average volume of 2,355,848. The company has a market capitalization of $50.63 billion, a price-to-earnings ratio of 12.48, a price-to-earnings-growth ratio of 2.74 and a beta of 1.38. Marathon Petroleum Co. has a fifty-two week low of $140.98 and a fifty-two week high of $221.11. The firm's fifty day moving average is $159.06 and its two-hundred day moving average is $168.33. The company has a debt-to-equity ratio of 0.94, a current ratio of 1.23 and a quick ratio of 0.76.

Marathon Petroleum (NYSE:MPC - Get Free Report) last issued its quarterly earnings data on Tuesday, November 5th. The oil and gas company reported $1.87 earnings per share for the quarter, topping analysts' consensus estimates of $0.97 by $0.90. Marathon Petroleum had a net margin of 3.15% and a return on equity of 16.19%. The business had revenue of $35.37 billion during the quarter, compared to the consensus estimate of $34.34 billion. During the same quarter in the prior year, the firm posted $8.14 earnings per share. The company's revenue was down 14.9% compared to the same quarter last year. On average, equities research analysts expect that Marathon Petroleum Co. will post 9.59 earnings per share for the current fiscal year.

Marathon Petroleum declared that its board has approved a share repurchase program on Tuesday, November 5th that permits the company to buyback $5.00 billion in outstanding shares. This buyback authorization permits the oil and gas company to purchase up to 10% of its stock through open market purchases. Stock buyback programs are usually a sign that the company's leadership believes its shares are undervalued.

Marathon Petroleum Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Tuesday, December 10th. Shareholders of record on Wednesday, November 20th will be paid a dividend of $0.91 per share. The ex-dividend date of this dividend is Wednesday, November 20th. This is an increase from Marathon Petroleum's previous quarterly dividend of $0.83. This represents a $3.64 dividend on an annualized basis and a yield of 2.31%. Marathon Petroleum's payout ratio is 26.15%.

Analysts Set New Price Targets

A number of research analysts have recently commented on MPC shares. Mizuho dropped their price target on Marathon Petroleum from $198.00 to $193.00 and set a "neutral" rating on the stock in a research report on Monday, September 16th. Citigroup dropped their price target on Marathon Petroleum from $172.00 to $167.00 and set a "neutral" rating for the company in a research note on Thursday, October 10th. Bank of America began coverage on shares of Marathon Petroleum in a research report on Thursday, October 17th. They set a "neutral" rating and a $174.00 price target on the stock. Tudor, Pickering, Holt & Co. downgraded shares of Marathon Petroleum from a "buy" rating to a "sell" rating in a research note on Monday, September 9th. Finally, Barclays lowered their price target on Marathon Petroleum from $168.00 to $159.00 and set an "overweight" rating for the company in a research report on Monday, November 11th. Two investment analysts have rated the stock with a sell rating, six have given a hold rating, nine have assigned a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $185.07.

Get Our Latest Stock Analysis on Marathon Petroleum

Marathon Petroleum Company Profile

(

Free Report)

Marathon Petroleum Corporation, together with its subsidiaries, operates as an integrated downstream energy company primarily in the United States. The company operates through Refining & Marketing, and Midstream segments. The Refining & Marketing segment refines crude oil and other feedstocks at its refineries in the Gulf Coast, Mid-Continent, and West Coast regions of the United States; and purchases refined products and ethanol for resale and distributes refined products, including renewable diesel, through transportation, storage, distribution, and marketing services.

Further Reading

Before you consider Marathon Petroleum, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marathon Petroleum wasn't on the list.

While Marathon Petroleum currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.