Jennison Associates LLC reduced its stake in shares of Maravai LifeSciences Holdings, Inc. (NASDAQ:MRVI - Free Report) by 34.6% during the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 2,980,645 shares of the company's stock after selling 1,574,052 shares during the period. Jennison Associates LLC owned 1.18% of Maravai LifeSciences worth $24,769,000 as of its most recent SEC filing.

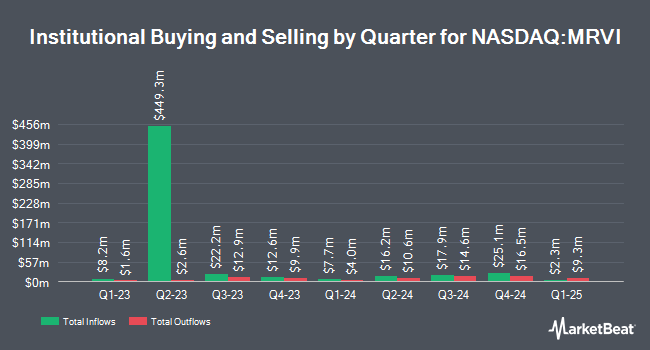

A number of other hedge funds have also modified their holdings of the stock. Point72 Asset Management L.P. raised its stake in shares of Maravai LifeSciences by 149.6% in the 2nd quarter. Point72 Asset Management L.P. now owns 3,519,561 shares of the company's stock valued at $25,200,000 after acquiring an additional 2,109,199 shares in the last quarter. Mackenzie Financial Corp boosted its holdings in shares of Maravai LifeSciences by 16.8% during the 2nd quarter. Mackenzie Financial Corp now owns 5,860,641 shares of the company's stock worth $41,962,000 after buying an additional 844,325 shares during the period. Dragoneer Investment Group LLC acquired a new position in Maravai LifeSciences in the 2nd quarter valued at $5,373,000. Renaissance Technologies LLC grew its stake in Maravai LifeSciences by 20.8% in the 2nd quarter. Renaissance Technologies LLC now owns 3,881,441 shares of the company's stock valued at $27,791,000 after buying an additional 668,552 shares during the last quarter. Finally, Millennium Management LLC raised its holdings in Maravai LifeSciences by 12.3% in the 2nd quarter. Millennium Management LLC now owns 5,968,592 shares of the company's stock worth $42,735,000 after acquiring an additional 653,639 shares during the period. 50.25% of the stock is owned by institutional investors and hedge funds.

Insider Buying and Selling

In other news, insider Carl Hull acquired 175,000 shares of the stock in a transaction that occurred on Monday, November 11th. The stock was acquired at an average price of $5.64 per share, for a total transaction of $987,000.00. Following the transaction, the insider now directly owns 175,000 shares in the company, valued at approximately $987,000. This represents a ∞ increase in their ownership of the stock. The purchase was disclosed in a document filed with the SEC, which is available at this link. 0.63% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

A number of research firms have recently commented on MRVI. Morgan Stanley lowered Maravai LifeSciences from an "overweight" rating to an "equal weight" rating and dropped their price objective for the stock from $11.00 to $10.00 in a research note on Tuesday, August 13th. The Goldman Sachs Group reduced their price objective on Maravai LifeSciences from $8.00 to $7.00 and set a "neutral" rating for the company in a research report on Tuesday, October 8th. Royal Bank of Canada dropped their target price on shares of Maravai LifeSciences from $17.00 to $13.00 and set an "outperform" rating on the stock in a research report on Friday, November 8th. UBS Group raised their price target on shares of Maravai LifeSciences from $8.50 to $11.00 and gave the stock a "neutral" rating in a research report on Thursday, August 8th. Finally, Wells Fargo & Company initiated coverage on shares of Maravai LifeSciences in a research report on Tuesday, August 27th. They set an "overweight" rating and a $10.00 price objective for the company. Five equities research analysts have rated the stock with a hold rating and six have issued a buy rating to the company's stock. Based on data from MarketBeat, Maravai LifeSciences currently has an average rating of "Moderate Buy" and an average price target of $10.33.

View Our Latest Report on MRVI

Maravai LifeSciences Trading Up 5.2 %

NASDAQ MRVI traded up $0.26 during trading hours on Friday, hitting $5.22. The company's stock had a trading volume of 1,302,664 shares, compared to its average volume of 2,576,875. Maravai LifeSciences Holdings, Inc. has a twelve month low of $4.28 and a twelve month high of $11.56. The firm has a market capitalization of $1.32 billion, a P/E ratio of -3.18 and a beta of 0.02. The company has a quick ratio of 9.94, a current ratio of 10.74 and a debt-to-equity ratio of 0.89. The stock has a fifty day moving average of $7.37 and a 200 day moving average of $8.28.

Maravai LifeSciences Profile

(

Free Report)

Maravai LifeSciences Holdings, Inc, a life sciences company, provides products to enable the development of drug therapies, diagnostics, novel vaccines, and support research on human diseases worldwide. The company's products address the key phases of biopharmaceutical development and include nucleic acids for diagnostic and therapeutic applications, antibody-based products to detect impurities during the production of biopharmaceutical products, and products to detect the expression of proteins in tissues of various species.

See Also

Before you consider Maravai LifeSciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Maravai LifeSciences wasn't on the list.

While Maravai LifeSciences currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.