Wolfe Research began coverage on shares of Maravai LifeSciences (NASDAQ:MRVI - Get Free Report) in a note issued to investors on Thursday, MarketBeat.com reports. The brokerage set a "peer perform" rating on the stock.

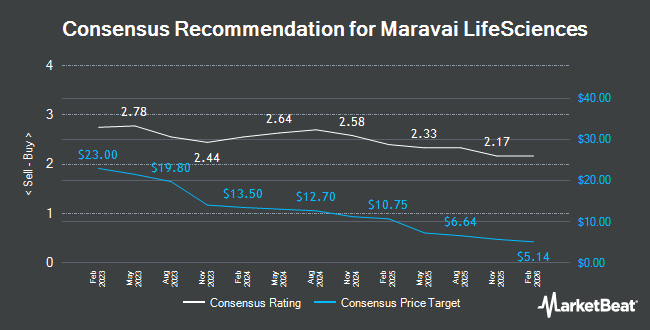

A number of other equities analysts have also recently issued reports on MRVI. William Blair reaffirmed a "market perform" rating on shares of Maravai LifeSciences in a report on Friday, November 8th. Morgan Stanley cut shares of Maravai LifeSciences from an "overweight" rating to an "equal weight" rating and reduced their price objective for the company from $11.00 to $10.00 in a research note on Tuesday, August 13th. Wells Fargo & Company assumed coverage on shares of Maravai LifeSciences in a report on Tuesday, August 27th. They issued an "overweight" rating and a $10.00 price objective for the company. Royal Bank of Canada decreased their price objective on shares of Maravai LifeSciences from $17.00 to $13.00 and set an "outperform" rating for the company in a report on Friday, November 8th. Finally, The Goldman Sachs Group decreased their price target on Maravai LifeSciences from $8.00 to $7.00 and set a "neutral" rating on the stock in a report on Tuesday, October 8th. Five investment analysts have rated the stock with a hold rating and six have assigned a buy rating to the company. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and an average price target of $10.33.

Read Our Latest Report on MRVI

Maravai LifeSciences Trading Down 6.6 %

NASDAQ:MRVI traded down $0.37 on Thursday, hitting $5.26. 1,157,414 shares of the stock were exchanged, compared to its average volume of 2,259,787. The company has a debt-to-equity ratio of 0.71, a quick ratio of 9.28 and a current ratio of 10.00. The stock has a market capitalization of $1.33 billion, a price-to-earnings ratio of -3.18 and a beta of 0.02. The company's 50-day moving average price is $7.92 and its 200 day moving average price is $8.46. Maravai LifeSciences has a 52 week low of $4.68 and a 52 week high of $11.56.

Insider Transactions at Maravai LifeSciences

In other Maravai LifeSciences news, insider Carl Hull acquired 175,000 shares of the business's stock in a transaction dated Monday, November 11th. The stock was bought at an average cost of $5.64 per share, with a total value of $987,000.00. Following the completion of the transaction, the insider now directly owns 175,000 shares in the company, valued at approximately $987,000. The transaction was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. 0.63% of the stock is currently owned by corporate insiders.

Hedge Funds Weigh In On Maravai LifeSciences

A number of institutional investors and hedge funds have recently added to or reduced their stakes in MRVI. Vanguard Group Inc. grew its position in shares of Maravai LifeSciences by 0.3% during the 1st quarter. Vanguard Group Inc. now owns 10,038,126 shares of the company's stock valued at $87,031,000 after acquiring an additional 34,232 shares during the period. Millennium Management LLC grew its position in Maravai LifeSciences by 12.3% in the second quarter. Millennium Management LLC now owns 5,968,592 shares of the company's stock worth $42,735,000 after acquiring an additional 653,639 shares in the last quarter. Mackenzie Financial Corp boosted its position in shares of Maravai LifeSciences by 16.8% during the second quarter. Mackenzie Financial Corp now owns 5,860,641 shares of the company's stock valued at $41,962,000 after buying an additional 844,325 shares during the period. Massachusetts Financial Services Co. MA boosted its position in shares of Maravai LifeSciences by 15.1% during the second quarter. Massachusetts Financial Services Co. MA now owns 4,550,503 shares of the company's stock valued at $32,582,000 after buying an additional 598,530 shares during the period. Finally, Renaissance Technologies LLC boosted its holdings in shares of Maravai LifeSciences by 20.8% in the second quarter. Renaissance Technologies LLC now owns 3,881,441 shares of the company's stock valued at $27,791,000 after purchasing an additional 668,552 shares during the period. Institutional investors own 50.25% of the company's stock.

About Maravai LifeSciences

(

Get Free Report)

Maravai LifeSciences Holdings, Inc, a life sciences company, provides products to enable the development of drug therapies, diagnostics, novel vaccines, and support research on human diseases worldwide. The company's products address the key phases of biopharmaceutical development and include nucleic acids for diagnostic and therapeutic applications, antibody-based products to detect impurities during the production of biopharmaceutical products, and products to detect the expression of proteins in tissues of various species.

See Also

Before you consider Maravai LifeSciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Maravai LifeSciences wasn't on the list.

While Maravai LifeSciences currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.