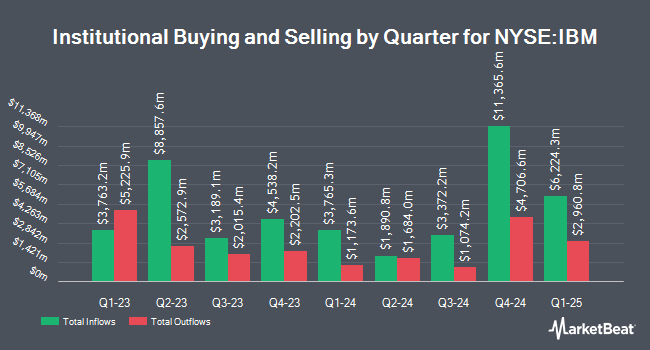

Mariner LLC grew its position in International Business Machines Co. (NYSE:IBM - Free Report) by 27.8% in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 359,504 shares of the technology company's stock after purchasing an additional 78,222 shares during the quarter. Mariner LLC's holdings in International Business Machines were worth $79,032,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other hedge funds and other institutional investors have also recently modified their holdings of IBM. Passumpsic Savings Bank lifted its position in shares of International Business Machines by 3.8% in the third quarter. Passumpsic Savings Bank now owns 2,045 shares of the technology company's stock worth $452,000 after buying an additional 74 shares in the last quarter. Virtu Financial LLC purchased a new stake in shares of International Business Machines during the 3rd quarter worth approximately $766,000. Westside Investment Management Inc. boosted its position in shares of International Business Machines by 12.2% during the 3rd quarter. Westside Investment Management Inc. now owns 919 shares of the technology company's stock valued at $188,000 after acquiring an additional 100 shares during the last quarter. SOA Wealth Advisors LLC. grew its holdings in shares of International Business Machines by 4.6% in the third quarter. SOA Wealth Advisors LLC. now owns 3,140 shares of the technology company's stock valued at $694,000 after purchasing an additional 139 shares in the last quarter. Finally, Diamant Asset Management Inc. increased its position in International Business Machines by 11.0% in the third quarter. Diamant Asset Management Inc. now owns 1,610 shares of the technology company's stock worth $356,000 after purchasing an additional 160 shares during the last quarter. 58.96% of the stock is owned by hedge funds and other institutional investors.

International Business Machines Price Performance

International Business Machines stock opened at $239.15 on Tuesday. International Business Machines Co. has a 12-month low of $162.62 and a 12-month high of $266.45. The company has a current ratio of 1.04, a quick ratio of 1.00 and a debt-to-equity ratio of 1.82. The stock has a market cap of $221.76 billion, a P/E ratio of 37.31, a price-to-earnings-growth ratio of 5.81 and a beta of 0.67. The company has a fifty day simple moving average of $248.67 and a 200-day simple moving average of $233.14.

International Business Machines (NYSE:IBM - Get Free Report) last released its quarterly earnings data on Wednesday, January 29th. The technology company reported $3.92 earnings per share for the quarter, topping analysts' consensus estimates of $3.77 by $0.15. International Business Machines had a net margin of 9.60% and a return on equity of 38.99%. Equities analysts expect that International Business Machines Co. will post 10.78 EPS for the current fiscal year.

International Business Machines Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Monday, March 10th. Stockholders of record on Monday, February 10th were issued a $1.67 dividend. This represents a $6.68 dividend on an annualized basis and a dividend yield of 2.79%. The ex-dividend date of this dividend was Monday, February 10th. International Business Machines's payout ratio is currently 104.21%.

Wall Street Analysts Forecast Growth

A number of brokerages have recently commented on IBM. Erste Group Bank upgraded International Business Machines from a "hold" rating to a "strong-buy" rating in a report on Monday, March 17th. Royal Bank of Canada reiterated an "outperform" rating and set a $276.00 price objective on shares of International Business Machines in a research report on Monday. JPMorgan Chase & Co. raised their target price on shares of International Business Machines from $233.00 to $244.00 and gave the stock a "neutral" rating in a report on Thursday, January 30th. Jefferies Financial Group cut their price target on shares of International Business Machines from $270.00 to $265.00 and set a "hold" rating on the stock in a report on Monday, March 31st. Finally, The Goldman Sachs Group reissued a "buy" rating on shares of International Business Machines in a research note on Wednesday, February 5th. Two equities research analysts have rated the stock with a sell rating, eight have given a hold rating, seven have issued a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat.com, International Business Machines presently has an average rating of "Hold" and a consensus price target of $232.75.

View Our Latest Stock Report on IBM

Insider Activity at International Business Machines

In related news, SVP Robert David Thomas sold 26,543 shares of the business's stock in a transaction dated Monday, March 3rd. The shares were sold at an average price of $253.01, for a total transaction of $6,715,644.43. Following the sale, the senior vice president now owns 45,007 shares of the company's stock, valued at approximately $11,387,221.07. The trade was a 37.10 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. 0.18% of the stock is currently owned by insiders.

International Business Machines Company Profile

(

Free Report)

International Business Machines Corporation, together with its subsidiaries, provides integrated solutions and services worldwide. The company operates through Software, Consulting, Infrastructure, and Financing segments. The Software segment offers a hybrid cloud and AI platforms that allows clients to realize their digital and AI transformations across the applications, data, and environments in which they operate.

See Also

Want to see what other hedge funds are holding IBM? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for International Business Machines Co. (NYSE:IBM - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider International Business Machines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and International Business Machines wasn't on the list.

While International Business Machines currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.