Markel Group Inc. boosted its holdings in shares of W. R. Berkley Co. (NYSE:WRB - Free Report) by 50.0% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 60,750 shares of the insurance provider's stock after buying an additional 20,250 shares during the period. Markel Group Inc.'s holdings in W. R. Berkley were worth $3,446,000 as of its most recent SEC filing.

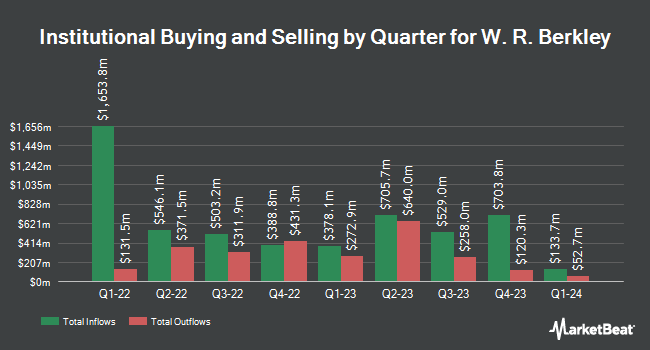

A number of other institutional investors have also recently bought and sold shares of the business. Vanguard Group Inc. raised its holdings in W. R. Berkley by 0.8% during the 1st quarter. Vanguard Group Inc. now owns 24,439,361 shares of the insurance provider's stock worth $2,161,417,000 after purchasing an additional 195,763 shares during the last quarter. Kayne Anderson Rudnick Investment Management LLC increased its stake in shares of W. R. Berkley by 0.7% in the 2nd quarter. Kayne Anderson Rudnick Investment Management LLC now owns 7,553,875 shares of the insurance provider's stock valued at $593,584,000 after acquiring an additional 54,530 shares during the last quarter. Principal Financial Group Inc. grew its position in shares of W. R. Berkley by 211.3% in the 3rd quarter. Principal Financial Group Inc. now owns 3,674,171 shares of the insurance provider's stock valued at $208,436,000 after purchasing an additional 2,493,758 shares during the period. APG Asset Management N.V. grew its position in shares of W. R. Berkley by 3.5% in the 2nd quarter. APG Asset Management N.V. now owns 2,698,311 shares of the insurance provider's stock valued at $197,838,000 after purchasing an additional 92,242 shares during the period. Finally, Dimensional Fund Advisors LP boosted its position in W. R. Berkley by 7.4% during the 2nd quarter. Dimensional Fund Advisors LP now owns 2,037,599 shares of the insurance provider's stock worth $160,128,000 after acquiring an additional 139,588 shares during the last quarter. Institutional investors and hedge funds own 68.82% of the company's stock.

Wall Street Analysts Forecast Growth

A number of equities analysts have weighed in on the company. Royal Bank of Canada upped their price target on W. R. Berkley from $57.00 to $63.00 and gave the stock a "sector perform" rating in a research report on Tuesday, October 22nd. Jefferies Financial Group upped their price target on W. R. Berkley from $53.00 to $57.00 and gave the stock a "hold" rating in a research report on Wednesday, October 9th. Wells Fargo & Company upped their price target on W. R. Berkley from $63.00 to $68.00 and gave the stock an "overweight" rating in a research report on Tuesday, October 22nd. StockNews.com downgraded W. R. Berkley from a "buy" rating to a "hold" rating in a research report on Thursday, October 3rd. Finally, Bank of America upped their price objective on W. R. Berkley from $73.00 to $76.00 and gave the stock a "buy" rating in a research note on Tuesday, October 22nd. One equities research analyst has rated the stock with a sell rating, seven have assigned a hold rating and five have issued a buy rating to the company. According to data from MarketBeat, the company presently has an average rating of "Hold" and a consensus target price of $63.08.

Get Our Latest Analysis on W. R. Berkley

W. R. Berkley Stock Performance

WRB stock traded up $0.93 during trading hours on Friday, hitting $60.55. 940,238 shares of the stock were exchanged, compared to its average volume of 2,126,320. The company has a current ratio of 0.36, a quick ratio of 0.38 and a debt-to-equity ratio of 0.34. The firm has a market capitalization of $23.07 billion, a P/E ratio of 15.51, a P/E/G ratio of 1.20 and a beta of 0.62. The company has a 50-day simple moving average of $58.40 and a two-hundred day simple moving average of $55.88. W. R. Berkley Co. has a 12 month low of $44.88 and a 12 month high of $61.96.

W. R. Berkley (NYSE:WRB - Get Free Report) last posted its quarterly earnings data on Monday, October 21st. The insurance provider reported $0.93 earnings per share for the quarter, topping the consensus estimate of $0.92 by $0.01. The firm had revenue of $2.93 billion for the quarter, compared to analysts' expectations of $2.93 billion. W. R. Berkley had a return on equity of 20.41% and a net margin of 11.96%. The company's quarterly revenue was up 10.8% compared to the same quarter last year. During the same quarter last year, the business earned $0.90 EPS. On average, analysts forecast that W. R. Berkley Co. will post 3.96 earnings per share for the current fiscal year.

W. R. Berkley Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Monday, September 30th. Stockholders of record on Monday, September 23rd were issued a dividend of $0.08 per share. This represents a $0.32 annualized dividend and a dividend yield of 0.53%. The ex-dividend date of this dividend was Monday, September 23rd. W. R. Berkley's dividend payout ratio (DPR) is currently 8.20%.

W. R. Berkley Company Profile

(

Free Report)

W. R. Berkley Corporation, an insurance holding company, operates as a commercial lines writers worldwide. It operates in two segments, Insurance and Reinsurance & Monoline Excess. The Insurance segment underwrites commercial insurance business, including excess and surplus lines, admitted lines, and specialty personal lines.

Recommended Stories

Before you consider W. R. Berkley, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and W. R. Berkley wasn't on the list.

While W. R. Berkley currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.