Marks Group Wealth Management Inc raised its position in Paycom Software, Inc. (NYSE:PAYC - Free Report) by 168.3% during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 35,124 shares of the software maker's stock after buying an additional 22,035 shares during the quarter. Marks Group Wealth Management Inc owned 0.06% of Paycom Software worth $5,851,000 at the end of the most recent reporting period.

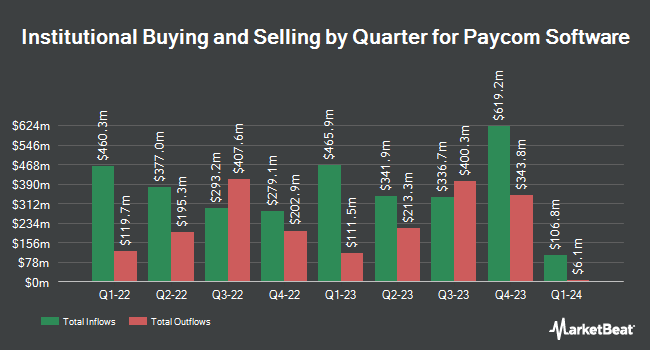

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Sylebra Capital LLC acquired a new stake in shares of Paycom Software during the 1st quarter worth $253,196,000. Federated Hermes Inc. grew its holdings in shares of Paycom Software by 1,011.2% during the 2nd quarter. Federated Hermes Inc. now owns 581,964 shares of the software maker's stock worth $83,244,000 after purchasing an additional 529,591 shares in the last quarter. International Assets Investment Management LLC grew its holdings in shares of Paycom Software by 9,997.5% during the 3rd quarter. International Assets Investment Management LLC now owns 281,315 shares of the software maker's stock worth $46,859,000 after purchasing an additional 278,529 shares in the last quarter. Raymond James & Associates grew its holdings in shares of Paycom Software by 769.2% during the 2nd quarter. Raymond James & Associates now owns 201,366 shares of the software maker's stock worth $28,803,000 after purchasing an additional 178,198 shares in the last quarter. Finally, Strategic Financial Concepts LLC grew its holdings in shares of Paycom Software by 12,268.6% during the 2nd quarter. Strategic Financial Concepts LLC now owns 169,202 shares of the software maker's stock worth $242,000 after purchasing an additional 167,834 shares in the last quarter. 87.77% of the stock is owned by institutional investors and hedge funds.

Paycom Software Stock Performance

Shares of PAYC traded up $12.55 during mid-day trading on Wednesday, reaching $231.09. 1,299,580 shares of the company were exchanged, compared to its average volume of 822,076. Paycom Software, Inc. has a 52 week low of $139.50 and a 52 week high of $233.69. The stock has a market capitalization of $13.32 billion, a PE ratio of 27.81, a PEG ratio of 2.92 and a beta of 1.14. The business has a 50 day simple moving average of $170.97 and a two-hundred day simple moving average of $163.91.

Paycom Software Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Monday, December 9th. Investors of record on Monday, November 25th will be paid a dividend of $0.375 per share. The ex-dividend date of this dividend is Monday, November 25th. This represents a $1.50 annualized dividend and a yield of 0.65%. Paycom Software's dividend payout ratio is currently 18.05%.

Insider Buying and Selling

In related news, CEO Chad R. Richison sold 1,950 shares of the firm's stock in a transaction that occurred on Wednesday, November 6th. The stock was sold at an average price of $216.60, for a total transaction of $422,370.00. Following the completion of the sale, the chief executive officer now owns 2,743,110 shares of the company's stock, valued at $594,157,626. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. In other Paycom Software news, CEO Chad R. Richison sold 1,950 shares of the firm's stock in a transaction that occurred on Wednesday, November 6th. The stock was sold at an average price of $216.60, for a total value of $422,370.00. Following the completion of the sale, the chief executive officer now owns 2,743,110 shares of the company's stock, valued at approximately $594,157,626. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Also, CFO Craig E. Boelte sold 11,882 shares of the firm's stock in a transaction that occurred on Monday, August 12th. The shares were sold at an average price of $155.98, for a total value of $1,853,354.36. Following the completion of the sale, the chief financial officer now directly owns 294,849 shares of the company's stock, valued at $45,990,547.02. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 73,856 shares of company stock valued at $12,354,038 over the last 90 days. Company insiders own 12.60% of the company's stock.

Analysts Set New Price Targets

Several research firms have recently issued reports on PAYC. Citigroup increased their target price on Paycom Software from $172.00 to $196.00 and gave the stock a "neutral" rating in a report on Thursday, October 31st. Jefferies Financial Group upped their price objective on Paycom Software from $170.00 to $175.00 and gave the stock a "hold" rating in a research report on Thursday, October 31st. TD Cowen upped their price objective on Paycom Software from $171.00 to $188.00 and gave the stock a "hold" rating in a research report on Monday, September 23rd. StockNews.com downgraded Paycom Software from a "buy" rating to a "hold" rating in a research report on Monday, July 15th. Finally, Needham & Company LLC restated a "hold" rating on shares of Paycom Software in a research report on Thursday, August 1st. Twelve analysts have rated the stock with a hold rating and one has given a buy rating to the stock. Based on data from MarketBeat.com, the company currently has an average rating of "Hold" and a consensus target price of $193.67.

Check Out Our Latest Stock Analysis on PAYC

Paycom Software Profile

(

Free Report)

Paycom Software, Inc provides cloud-based human capital management (HCM) solution delivered as software-as-a-service for small to mid-sized companies in the United States. It offers functionality and data analytics that businesses need to manage the employment life cycle from recruitment to retirement.

See Also

Before you consider Paycom Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Paycom Software wasn't on the list.

While Paycom Software currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.