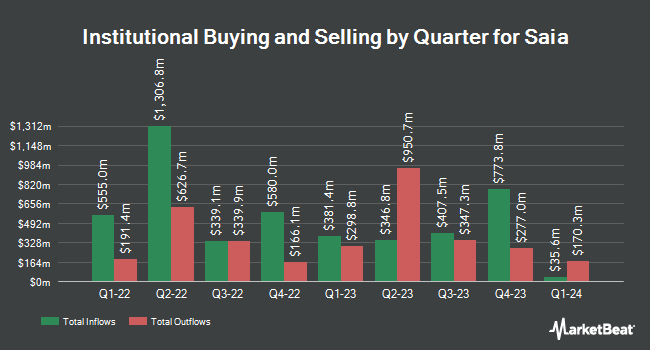

Marks Group Wealth Management Inc acquired a new stake in Saia, Inc. (NASDAQ:SAIA - Free Report) during the third quarter, according to its most recent Form 13F filing with the SEC. The institutional investor acquired 20,313 shares of the transportation company's stock, valued at approximately $8,882,000. Marks Group Wealth Management Inc owned about 0.08% of Saia at the end of the most recent quarter.

A number of other large investors also recently modified their holdings of SAIA. Sequoia Financial Advisors LLC increased its position in shares of Saia by 8.5% in the 1st quarter. Sequoia Financial Advisors LLC now owns 546 shares of the transportation company's stock valued at $319,000 after purchasing an additional 43 shares during the last quarter. Mirae Asset Global Investments Co. Ltd. purchased a new position in shares of Saia in the 1st quarter valued at $6,943,000. BNP Paribas Financial Markets grew its position in shares of Saia by 1,012.6% in the 1st quarter. BNP Paribas Financial Markets now owns 17,646 shares of the transportation company's stock valued at $10,323,000 after buying an additional 16,060 shares during the last quarter. Janney Montgomery Scott LLC grew its position in shares of Saia by 5.2% in the 1st quarter. Janney Montgomery Scott LLC now owns 15,521 shares of the transportation company's stock valued at $9,080,000 after buying an additional 762 shares during the last quarter. Finally, Essex LLC purchased a new position in shares of Saia in the 1st quarter valued at $205,000.

Saia Price Performance

Shares of SAIA traded up $67.19 during trading hours on Wednesday, reaching $568.02. The company had a trading volume of 748,237 shares, compared to its average volume of 389,192. The firm has a 50 day simple moving average of $439.73 and a 200-day simple moving average of $432.84. The company has a current ratio of 1.26, a quick ratio of 1.26 and a debt-to-equity ratio of 0.08. The company has a market capitalization of $15.10 billion, a price-to-earnings ratio of 40.57, a PEG ratio of 2.80 and a beta of 1.73. Saia, Inc. has a 12-month low of $358.90 and a 12-month high of $628.34.

Saia (NASDAQ:SAIA - Get Free Report) last announced its quarterly earnings results on Friday, October 25th. The transportation company reported $3.46 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $3.53 by ($0.07). The company had revenue of $842.10 million during the quarter, compared to analysts' expectations of $839.82 million. Saia had a net margin of 11.83% and a return on equity of 18.00%. The business's revenue for the quarter was up 8.6% compared to the same quarter last year. During the same quarter in the prior year, the business earned $3.67 EPS. Research analysts expect that Saia, Inc. will post 13.54 earnings per share for the current year.

Analyst Ratings Changes

A number of research analysts recently commented on SAIA shares. The Goldman Sachs Group dropped their target price on shares of Saia from $510.00 to $490.00 and set a "neutral" rating on the stock in a research report on Wednesday, October 9th. Barclays dropped their target price on shares of Saia from $575.00 to $515.00 and set an "overweight" rating on the stock in a research report on Monday, July 29th. Wolfe Research upgraded shares of Saia from a "peer perform" rating to an "outperform" rating and set a $511.00 price target for the company in a research note on Wednesday, October 9th. Susquehanna increased their price target on shares of Saia from $550.00 to $585.00 and gave the stock a "positive" rating in a research note on Wednesday, September 18th. Finally, Jefferies Financial Group increased their price target on shares of Saia from $480.00 to $500.00 and gave the stock a "buy" rating in a research note on Thursday, October 10th. One analyst has rated the stock with a sell rating, five have assigned a hold rating and twelve have assigned a buy rating to the company. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average target price of $492.00.

Check Out Our Latest Analysis on SAIA

Saia Profile

(

Free Report)

Saia, Inc, together with its subsidiaries, operates as a transportation company in North America. The company provides less-than-truckload services for shipments between 100 and 10,000 pounds; and other value-added services, including non-asset truckload, expedited, and logistics services. It also offers other value-added services, including non-asset truckload, expedited, and logistics services.

See Also

Before you consider Saia, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Saia wasn't on the list.

While Saia currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.