Marks Group Wealth Management Inc cut its holdings in shares of Manulife Financial Co. (NYSE:MFC - Free Report) TSE: MFC by 50.7% during the fourth quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 14,759 shares of the financial services provider's stock after selling 15,178 shares during the period. Marks Group Wealth Management Inc's holdings in Manulife Financial were worth $453,000 as of its most recent SEC filing.

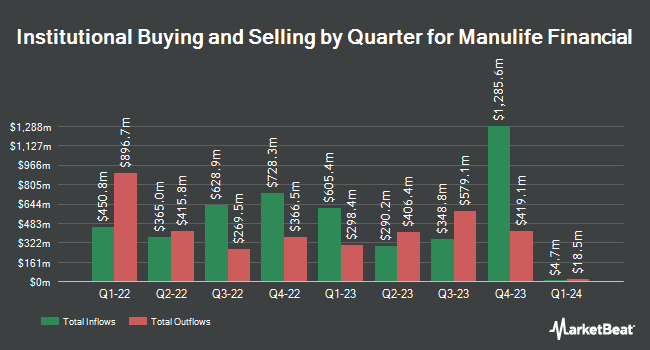

Several other institutional investors also recently bought and sold shares of MFC. Brooklyn Investment Group acquired a new stake in Manulife Financial in the 3rd quarter worth about $26,000. Crews Bank & Trust acquired a new stake in Manulife Financial in the 4th quarter worth about $26,000. Capital Performance Advisors LLP acquired a new stake in Manulife Financial in the 3rd quarter worth about $30,000. Fortitude Family Office LLC acquired a new stake in Manulife Financial in the 3rd quarter worth about $31,000. Finally, Stonebridge Financial Group LLC acquired a new stake in Manulife Financial in the 4th quarter worth about $34,000. 52.56% of the stock is currently owned by institutional investors and hedge funds.

Manulife Financial Price Performance

MFC stock traded up $0.03 during trading on Friday, hitting $29.67. The stock had a trading volume of 1,150,869 shares, compared to its average volume of 1,887,462. Manulife Financial Co. has a twelve month low of $22.61 and a twelve month high of $33.07. The stock has a market capitalization of $51.13 billion, a P/E ratio of 14.33, a PEG ratio of 1.04 and a beta of 1.09. The company's 50-day moving average price is $30.42 and its two-hundred day moving average price is $29.61.

Manulife Financial Profile

(

Free Report)

Manulife Financial Corporation, together with its subsidiaries, provides financial products and services in the United States, Canada, Asia, and internationally. The company operates through Wealth and Asset Management Businesses; Insurance and Annuity Products; and Corporate and Other segments. The Wealth and Asset Management Businesses segment offers investment advice and solutions to retirement, retail, and institutional clients through multiple distribution channels, including agents and brokers affiliated with the company, independent securities brokerage firms and financial advisors pension plan consultants, and banks.

See Also

Before you consider Manulife Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Manulife Financial wasn't on the list.

While Manulife Financial currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.