Marks Group Wealth Management Inc lifted its stake in TransDigm Group Incorporated (NYSE:TDG - Free Report) by 317.4% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 2,450 shares of the aerospace company's stock after acquiring an additional 1,863 shares during the period. Marks Group Wealth Management Inc's holdings in TransDigm Group were worth $3,496,000 as of its most recent filing with the Securities and Exchange Commission.

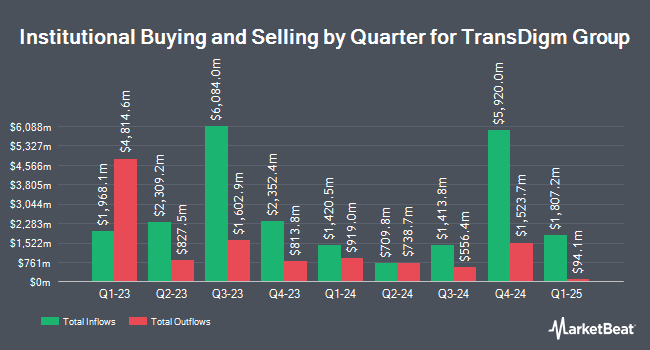

A number of other institutional investors also recently made changes to their positions in TDG. Vanguard Group Inc. raised its holdings in shares of TransDigm Group by 1.0% in the 1st quarter. Vanguard Group Inc. now owns 6,047,083 shares of the aerospace company's stock worth $7,447,587,000 after purchasing an additional 58,243 shares in the last quarter. Capital World Investors raised its holdings in shares of TransDigm Group by 14.3% in the 1st quarter. Capital World Investors now owns 3,535,539 shares of the aerospace company's stock worth $4,354,369,000 after purchasing an additional 442,182 shares in the last quarter. Capital Research Global Investors raised its holdings in shares of TransDigm Group by 1.6% in the 1st quarter. Capital Research Global Investors now owns 1,965,640 shares of the aerospace company's stock worth $2,420,882,000 after purchasing an additional 30,393 shares in the last quarter. JPMorgan Chase & Co. raised its holdings in shares of TransDigm Group by 13.1% in the 1st quarter. JPMorgan Chase & Co. now owns 1,669,460 shares of the aerospace company's stock worth $2,056,109,000 after purchasing an additional 192,962 shares in the last quarter. Finally, Legal & General Group Plc raised its holdings in shares of TransDigm Group by 2.6% in the 2nd quarter. Legal & General Group Plc now owns 365,745 shares of the aerospace company's stock worth $467,282,000 after purchasing an additional 9,180 shares in the last quarter. 95.78% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

A number of analysts recently commented on TDG shares. Morgan Stanley boosted their target price on shares of TransDigm Group from $1,550.00 to $1,575.00 and gave the stock an "overweight" rating in a report on Wednesday, August 7th. Truist Financial boosted their price target on shares of TransDigm Group from $1,425.00 to $1,483.00 and gave the company a "buy" rating in a report on Wednesday, July 17th. KeyCorp boosted their price target on shares of TransDigm Group from $1,440.00 to $1,500.00 and gave the company an "overweight" rating in a report on Thursday, October 24th. Royal Bank of Canada restated an "outperform" rating and set a $1,500.00 price target on shares of TransDigm Group in a report on Wednesday, August 7th. Finally, StockNews.com lowered shares of TransDigm Group from a "buy" rating to a "hold" rating in a report on Monday, August 5th. Eight equities research analysts have rated the stock with a hold rating and thirteen have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $1,461.82.

Check Out Our Latest Stock Analysis on TDG

TransDigm Group Stock Performance

Shares of TDG stock traded up $43.12 during mid-day trading on Wednesday, reaching $1,380.72. The company's stock had a trading volume of 396,874 shares, compared to its average volume of 215,237. TransDigm Group Incorporated has a 1-year low of $879.35 and a 1-year high of $1,451.32. The company has a market cap of $77.47 billion, a P/E ratio of 51.08, a PEG ratio of 1.79 and a beta of 1.43. The firm's 50-day moving average is $1,369.27 and its two-hundred day moving average is $1,315.00.

TransDigm Group (NYSE:TDG - Get Free Report) last posted its earnings results on Tuesday, August 6th. The aerospace company reported $9.00 earnings per share for the quarter, topping the consensus estimate of $7.77 by $1.23. TransDigm Group had a net margin of 21.83% and a negative return on equity of 66.70%. The business had revenue of $2.05 billion for the quarter, compared to analyst estimates of $2.01 billion. During the same quarter in the prior year, the firm earned $6.55 EPS. The firm's quarterly revenue was up 17.3% compared to the same quarter last year. Sell-side analysts anticipate that TransDigm Group Incorporated will post 30.71 EPS for the current year.

TransDigm Group Increases Dividend

The business also recently disclosed a special dividend, which was paid on Friday, October 18th. Shareholders of record on Friday, October 4th were issued a dividend of $75.00 per share. The ex-dividend date was Friday, October 4th. This is a positive change from TransDigm Group's previous special dividend of $32.50.

Insiders Place Their Bets

In other TransDigm Group news, COO Joel Reiss sold 3,000 shares of the stock in a transaction dated Monday, September 16th. The shares were sold at an average price of $1,375.89, for a total transaction of $4,127,670.00. Following the sale, the chief operating officer now owns 3,600 shares of the company's stock, valued at $4,953,204. This represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. In other news, COO Joel Reiss sold 3,000 shares of the firm's stock in a transaction dated Monday, September 16th. The shares were sold at an average price of $1,375.89, for a total value of $4,127,670.00. Following the transaction, the chief operating officer now owns 3,600 shares of the company's stock, valued at approximately $4,953,204. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. Also, Director W Nicholas Howley sold 5,472 shares of the firm's stock in a transaction dated Tuesday, October 15th. The shares were sold at an average price of $1,402.85, for a total transaction of $7,676,395.20. Following the completion of the transaction, the director now directly owns 21,548 shares in the company, valued at $30,228,611.80. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 26,944 shares of company stock valued at $35,823,485 in the last 90 days. 4.96% of the stock is currently owned by insiders.

TransDigm Group Company Profile

(

Free Report)

TransDigm Group Incorporated designs, produces, and supplies aircraft components in the United States and internationally. The Power & Control segment offers mechanical/electro-mechanical actuators and controls, ignition systems and engine technology, specialized pumps and valves, power conditioning devices, specialized AC/DC electric motors and generators, batteries and chargers, databus and power controls, sensor products, switches and relay panels, hoists, winches and lifting devices, and cargo loading and handling systems.

Further Reading

Before you consider TransDigm Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TransDigm Group wasn't on the list.

While TransDigm Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report