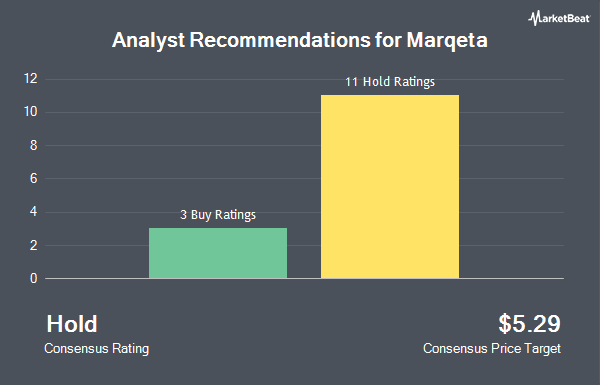

Shares of Marqeta, Inc. (NASDAQ:MQ - Get Free Report) have been given an average recommendation of "Hold" by the fourteen brokerages that are currently covering the stock, Marketbeat.com reports. Eleven research analysts have rated the stock with a hold recommendation and three have given a buy recommendation to the company. The average twelve-month price target among analysts that have covered the stock in the last year is $5.33.

Several equities analysts have recently issued reports on MQ shares. Wells Fargo & Company lowered their price target on Marqeta from $5.00 to $4.00 and set an "equal weight" rating on the stock in a research report on Thursday, January 16th. Barclays reiterated an "equal weight" rating and issued a $4.00 price target (down from $5.00) on shares of Marqeta in a research report on Tuesday, December 17th. Keefe, Bruyette & Woods lowered their price objective on shares of Marqeta from $5.00 to $4.00 and set a "market perform" rating on the stock in a research note on Monday, January 6th. Finally, The Goldman Sachs Group increased their target price on shares of Marqeta from $4.00 to $4.50 and gave the company a "neutral" rating in a research note on Thursday, February 27th.

Check Out Our Latest Stock Analysis on Marqeta

Marqeta Price Performance

NASDAQ:MQ traded up $0.11 during midday trading on Monday, reaching $4.43. 8,706,836 shares of the company traded hands, compared to its average volume of 5,300,595. Marqeta has a twelve month low of $3.37 and a twelve month high of $6.44. The company has a fifty day moving average price of $3.85 and a 200 day moving average price of $4.28. The firm has a market capitalization of $2.23 billion, a price-to-earnings ratio of 221.25 and a beta of 1.49.

Marqeta (NASDAQ:MQ - Get Free Report) last released its quarterly earnings results on Wednesday, February 26th. The company reported ($0.05) EPS for the quarter, topping the consensus estimate of ($0.10) by $0.05. Marqeta had a net margin of 2.86% and a return on equity of 1.20%. The business had revenue of $135.79 million during the quarter, compared to analyst estimates of $132.71 million. On average, equities research analysts forecast that Marqeta will post 0.06 earnings per share for the current fiscal year.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently bought and sold shares of MQ. T. Rowe Price Investment Management Inc. acquired a new position in Marqeta in the fourth quarter worth about $72,879,000. Price T Rowe Associates Inc. MD raised its holdings in shares of Marqeta by 5,396.3% in the 4th quarter. Price T Rowe Associates Inc. MD now owns 18,169,103 shares of the company's stock worth $68,862,000 after buying an additional 17,838,535 shares in the last quarter. RPD Fund Management LLC acquired a new stake in Marqeta in the 4th quarter valued at $37,289,000. Wellington Management Group LLP acquired a new stake in Marqeta in the 4th quarter valued at $19,717,000. Finally, North Reef Capital Management LP grew its position in Marqeta by 99.7% in the fourth quarter. North Reef Capital Management LP now owns 7,786,999 shares of the company's stock valued at $29,513,000 after acquiring an additional 3,886,999 shares during the period. 78.64% of the stock is currently owned by institutional investors and hedge funds.

Marqeta Company Profile

(

Get Free ReportMarqeta, Inc operates a cloud-based open application programming interface platform that delivers card issuing and transaction processing services. It offers its solutions in various verticals, including financial services, on-demand services, expense management, and e-commerce enablement, as well as buy now, pay later.

Further Reading

Before you consider Marqeta, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marqeta wasn't on the list.

While Marqeta currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.