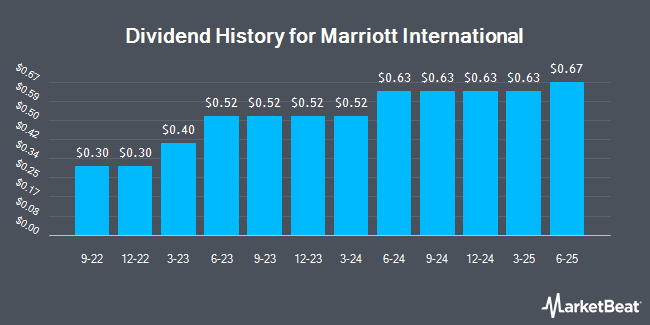

Marriott International, Inc. (NASDAQ:MAR - Get Free Report) declared a quarterly dividend on Thursday, February 13th,RTT News reports. Stockholders of record on Thursday, February 27th will be given a dividend of 0.63 per share on Monday, March 31st. This represents a $2.52 annualized dividend and a dividend yield of 0.89%. The ex-dividend date of this dividend is Thursday, February 27th.

Marriott International has a dividend payout ratio of 21.7% indicating that its dividend is sufficiently covered by earnings. Analysts expect Marriott International to earn $10.65 per share next year, which means the company should continue to be able to cover its $2.52 annual dividend with an expected future payout ratio of 23.7%.

Marriott International Stock Down 1.6 %

Shares of MAR stock traded down $4.72 during trading hours on Monday, hitting $283.52. 1,659,747 shares of the company's stock traded hands, compared to its average volume of 1,393,102. Marriott International has a 12 month low of $204.55 and a 12 month high of $307.52. The stock's 50 day simple moving average is $284.12 and its 200 day simple moving average is $262.98. The stock has a market cap of $78.79 billion, a PE ratio of 29.66, a price-to-earnings-growth ratio of 4.88 and a beta of 1.57.

Marriott International (NASDAQ:MAR - Get Free Report) last announced its earnings results on Tuesday, February 11th. The company reported $2.45 earnings per share for the quarter, topping analysts' consensus estimates of $2.37 by $0.08. Marriott International had a net margin of 11.18% and a negative return on equity of 177.91%. As a group, equities research analysts expect that Marriott International will post 9.26 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

Several equities research analysts have weighed in on the stock. Stifel Nicolaus lifted their price target on shares of Marriott International from $252.00 to $283.00 and gave the company a "hold" rating in a research note on Tuesday, November 26th. Truist Financial lifted their price target on shares of Marriott International from $277.00 to $308.00 and gave the company a "hold" rating in a research note on Wednesday, February 12th. Macquarie reiterated a "neutral" rating and set a $245.00 price objective on shares of Marriott International in a report on Tuesday, November 5th. Sanford C. Bernstein lifted their price objective on shares of Marriott International from $262.00 to $290.00 and gave the company an "outperform" rating in a report on Tuesday, November 5th. Finally, Argus lifted their price objective on shares of Marriott International from $300.00 to $330.00 and gave the company a "buy" rating in a report on Thursday, January 16th. Thirteen research analysts have rated the stock with a hold rating and seven have assigned a buy rating to the company's stock. According to MarketBeat, the company currently has an average rating of "Hold" and a consensus price target of $284.45.

Read Our Latest Stock Analysis on Marriott International

Insiders Place Their Bets

In other news, insider William P. Brown sold 1,707 shares of the business's stock in a transaction that occurred on Friday, November 22nd. The shares were sold at an average price of $284.30, for a total value of $485,300.10. Following the sale, the insider now owns 23,077 shares of the company's stock, valued at $6,560,791.10. The trade was a 6.89 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. Insiders own 12.32% of the company's stock.

Marriott International Company Profile

(

Get Free Report)

Marriott International, Inc engages in operating, franchising, and licensing hotel, residential, timeshare, and other lodging properties worldwide. It operates its properties under the JW Marriott, The Ritz-Carlton, The Luxury Collection, W Hotels, St. Regis, EDITION, Bvlgari, Marriott Hotels, Sheraton, Westin, Autograph Collection, Renaissance Hotels, Le Méridien, Delta Hotels by Marriott, Tribute Portfolio, Gaylord Hotels, Design Hotels, Marriott Executive Apartments, Apartments by Marriott Bonvoy, Courtyard by Marriott, Fairfield by Marriott, Residence Inn by Marriott, SpringHill Suites by Marriott, Four Points by Sheraton, TownePlace Suites by Marriott, Aloft Hotels, AC Hotels by Marriott, Moxy Hotels, Element Hotels, Protea Hotels by Marriott, City Express by Marriott, and St.

See Also

Before you consider Marriott International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marriott International wasn't on the list.

While Marriott International currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.