Marshall Wace LLP increased its position in shares of Geron Co. (NASDAQ:GERN - Free Report) by 73.1% during the 4th quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 2,202,995 shares of the biopharmaceutical company's stock after purchasing an additional 930,412 shares during the quarter. Marshall Wace LLP owned approximately 0.36% of Geron worth $7,799,000 as of its most recent SEC filing.

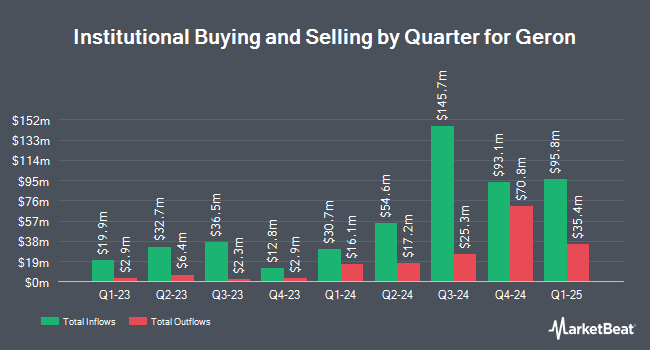

Other institutional investors have also added to or reduced their stakes in the company. Nvest Financial LLC bought a new stake in shares of Geron in the 4th quarter worth approximately $693,000. Charles Schwab Investment Management Inc. boosted its position in shares of Geron by 1.7% in the fourth quarter. Charles Schwab Investment Management Inc. now owns 4,523,864 shares of the biopharmaceutical company's stock valued at $16,014,000 after acquiring an additional 73,482 shares during the period. Barclays PLC grew its stake in Geron by 114.9% during the third quarter. Barclays PLC now owns 1,299,912 shares of the biopharmaceutical company's stock valued at $5,902,000 after acquiring an additional 694,931 shares in the last quarter. World Investment Advisors LLC increased its holdings in Geron by 10,151.4% during the 3rd quarter. World Investment Advisors LLC now owns 1,029,553 shares of the biopharmaceutical company's stock worth $4,674,000 after acquiring an additional 1,019,510 shares during the period. Finally, Sei Investments Co. lifted its stake in Geron by 6.8% in the 4th quarter. Sei Investments Co. now owns 189,614 shares of the biopharmaceutical company's stock worth $671,000 after purchasing an additional 12,027 shares in the last quarter. 73.71% of the stock is owned by institutional investors.

Geron Price Performance

Shares of Geron stock opened at $1.41 on Wednesday. The stock has a market capitalization of $898.05 million, a price-to-earnings ratio of -4.41 and a beta of 0.66. The company has a fifty day moving average of $1.71 and a 200-day moving average of $2.98. Geron Co. has a 52-week low of $1.17 and a 52-week high of $5.34. The company has a debt-to-equity ratio of 0.04, a quick ratio of 2.74 and a current ratio of 2.89.

Geron (NASDAQ:GERN - Get Free Report) last announced its quarterly earnings data on Wednesday, February 26th. The biopharmaceutical company reported ($0.04) earnings per share (EPS) for the quarter, meeting analysts' consensus estimates of ($0.04). Geron had a negative return on equity of 67.53% and a negative net margin of 682.48%. The firm had revenue of $47.54 million for the quarter, compared to analysts' expectations of $45.29 million. Equities research analysts expect that Geron Co. will post -0.25 EPS for the current year.

Analyst Upgrades and Downgrades

GERN has been the topic of several research analyst reports. B. Riley cut shares of Geron from a "buy" rating to a "neutral" rating and decreased their price target for the stock from $3.50 to $2.00 in a report on Thursday, February 27th. Needham & Company LLC restated a "buy" rating and issued a $5.00 target price on shares of Geron in a research note on Wednesday, March 12th. Barclays reaffirmed an "overweight" rating and issued a $4.00 price target (down previously from $9.00) on shares of Geron in a report on Thursday, February 27th. HC Wainwright reissued a "neutral" rating on shares of Geron in a report on Wednesday, March 12th. Finally, Scotiabank lowered their target price on shares of Geron from $6.00 to $4.00 and set a "sector outperform" rating on the stock in a research note on Thursday, February 27th. One equities research analyst has rated the stock with a sell rating, three have given a hold rating, seven have given a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, the stock has an average rating of "Moderate Buy" and an average target price of $5.75.

View Our Latest Stock Report on GERN

Geron Company Profile

(

Free Report)

Geron Corporation, a late-stage clinical biopharmaceutical company, focuses on the development and commercialization of therapeutics for myeloid hematologic malignancies. It develops imetelstat, a telomerase inhibitor that is in Phase 3 clinical trials, which inhibits the uncontrolled proliferation of malignant stem and progenitor cells in myeloid hematologic malignancies for the treatment of low or intermediate-1 risk myelodysplastic syndromes and intermediate-2 or high-risk myelofibrosis.

Featured Articles

Want to see what other hedge funds are holding GERN? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Geron Co. (NASDAQ:GERN - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Geron, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Geron wasn't on the list.

While Geron currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.