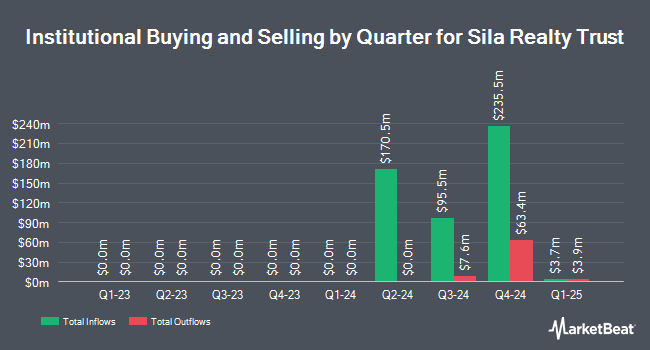

Marshall Wace LLP acquired a new position in shares of Sila Realty Trust, Inc. (NYSE:SILA - Free Report) in the 4th quarter, according to the company in its most recent filing with the SEC. The fund acquired 308,955 shares of the company's stock, valued at approximately $7,514,000. Marshall Wace LLP owned approximately 0.56% of Sila Realty Trust as of its most recent SEC filing.

Other hedge funds and other institutional investors also recently bought and sold shares of the company. Carolina Wealth Advisors LLC purchased a new stake in shares of Sila Realty Trust during the fourth quarter worth about $26,000. Pineridge Advisors LLC grew its position in Sila Realty Trust by 244.0% during the 4th quarter. Pineridge Advisors LLC now owns 3,244 shares of the company's stock worth $79,000 after purchasing an additional 2,301 shares during the last quarter. EverSource Wealth Advisors LLC grew its position in Sila Realty Trust by 507.9% during the 4th quarter. EverSource Wealth Advisors LLC now owns 3,465 shares of the company's stock worth $84,000 after purchasing an additional 2,895 shares during the last quarter. Sound Income Strategies LLC increased its stake in Sila Realty Trust by 16.8% during the 4th quarter. Sound Income Strategies LLC now owns 5,690 shares of the company's stock valued at $138,000 after purchasing an additional 817 shares in the last quarter. Finally, Blue Trust Inc. raised its holdings in shares of Sila Realty Trust by 5.6% in the fourth quarter. Blue Trust Inc. now owns 9,138 shares of the company's stock worth $222,000 after buying an additional 481 shares during the last quarter.

Analyst Ratings Changes

Separately, Truist Financial upped their target price on Sila Realty Trust from $27.00 to $28.00 and gave the company a "buy" rating in a research report on Monday, March 17th.

View Our Latest Analysis on Sila Realty Trust

Sila Realty Trust Trading Up 1.2 %

Shares of NYSE SILA opened at $25.95 on Wednesday. Sila Realty Trust, Inc. has a 52 week low of $20.20 and a 52 week high of $27.50. The business's 50 day moving average price is $25.64 and its 200 day moving average price is $25.15. The company has a current ratio of 0.78, a quick ratio of 0.78 and a debt-to-equity ratio of 0.37.

Sila Realty Trust Dividend Announcement

The company also recently announced a dividend, which was paid on Wednesday, March 26th. Investors of record on Wednesday, March 12th were paid a $0.40 dividend. The ex-dividend date of this dividend was Wednesday, March 12th.

Sila Realty Trust Company Profile

(

Free Report)

Sila Realty Trust, Inc, headquartered in Tampa, Florida, is a net lease real estate investment trust with a strategic focus on investing in the large, growing, and resilient healthcare sector. The Company invests in high quality healthcare facilities along the continuum of care, which, we believe, generate predictable, durable, and growing income streams.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Sila Realty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sila Realty Trust wasn't on the list.

While Sila Realty Trust currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.