Marshfield Associates increased its holdings in shares of Strategic Education, Inc. (NASDAQ:STRA - Free Report) by 0.5% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 1,829,622 shares of the health services provider's stock after purchasing an additional 9,001 shares during the quarter. Strategic Education accounts for approximately 3.6% of Marshfield Associates' portfolio, making the stock its 14th biggest position. Marshfield Associates owned about 7.45% of Strategic Education worth $169,332,000 as of its most recent SEC filing.

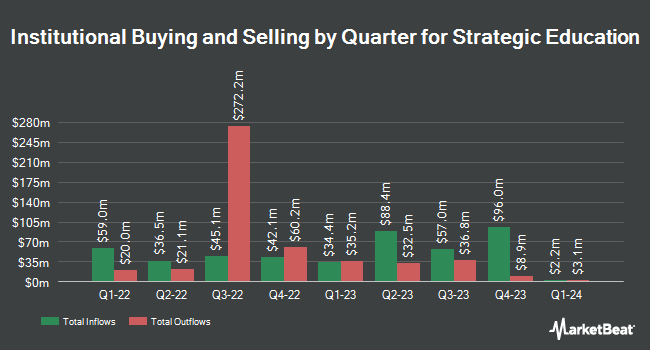

Other hedge funds and other institutional investors have also recently modified their holdings of the company. Dimensional Fund Advisors LP boosted its holdings in Strategic Education by 3.5% during the 2nd quarter. Dimensional Fund Advisors LP now owns 1,447,810 shares of the health services provider's stock valued at $160,212,000 after acquiring an additional 48,462 shares during the period. Burgundy Asset Management Ltd. boosted its holdings in Strategic Education by 2.1% during the 2nd quarter. Burgundy Asset Management Ltd. now owns 1,209,100 shares of the health services provider's stock valued at $133,799,000 after acquiring an additional 25,269 shares during the period. State Street Corp boosted its holdings in Strategic Education by 6.1% during the 3rd quarter. State Street Corp now owns 890,133 shares of the health services provider's stock valued at $82,382,000 after acquiring an additional 50,980 shares during the period. Disciplined Growth Investors Inc. MN boosted its holdings in Strategic Education by 0.6% during the 2nd quarter. Disciplined Growth Investors Inc. MN now owns 450,928 shares of the health services provider's stock valued at $49,900,000 after acquiring an additional 2,749 shares during the period. Finally, Envestnet Asset Management Inc. boosted its holdings in Strategic Education by 7.4% during the 2nd quarter. Envestnet Asset Management Inc. now owns 369,728 shares of the health services provider's stock valued at $40,914,000 after acquiring an additional 25,455 shares during the period. 93.27% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Several equities analysts have recently issued reports on STRA shares. Barrington Research reiterated an "outperform" rating and issued a $135.00 price objective on shares of Strategic Education in a research note on Thursday, November 7th. StockNews.com cut Strategic Education from a "buy" rating to a "hold" rating in a research note on Saturday, October 5th. Finally, Truist Financial decreased their price objective on Strategic Education from $145.00 to $120.00 and set a "buy" rating for the company in a research note on Wednesday, October 16th. One research analyst has rated the stock with a hold rating and four have assigned a buy rating to the company's stock. Based on data from MarketBeat, Strategic Education currently has an average rating of "Moderate Buy" and an average price target of $126.00.

View Our Latest Stock Report on Strategic Education

Strategic Education Trading Up 1.2 %

STRA stock traded up $1.22 during trading on Tuesday, hitting $99.82. 111,939 shares of the company's stock were exchanged, compared to its average volume of 131,295. The business has a 50-day moving average price of $92.86 and a two-hundred day moving average price of $99.93. The stock has a market capitalization of $2.45 billion, a price-to-earnings ratio of 19.01, a PEG ratio of 1.37 and a beta of 0.59. Strategic Education, Inc. has a 52-week low of $85.11 and a 52-week high of $123.62.

Strategic Education (NASDAQ:STRA - Get Free Report) last posted its earnings results on Thursday, November 7th. The health services provider reported $1.16 earnings per share for the quarter, topping the consensus estimate of $0.81 by $0.35. The firm had revenue of $305.96 million during the quarter, compared to analysts' expectations of $301.62 million. Strategic Education had a return on equity of 7.61% and a net margin of 10.44%. The firm's revenue was up 7.0% compared to the same quarter last year. During the same quarter in the previous year, the business earned $0.97 earnings per share. On average, equities research analysts anticipate that Strategic Education, Inc. will post 4.79 earnings per share for the current fiscal year.

Strategic Education Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Monday, December 9th. Investors of record on Monday, December 2nd were paid a dividend of $0.60 per share. This represents a $2.40 annualized dividend and a yield of 2.40%. The ex-dividend date was Monday, December 2nd. Strategic Education's payout ratio is 45.71%.

Strategic Education Company Profile

(

Free Report)

Strategic Education, Inc, through its subsidiaries, provides education services through campus-based and online post-secondary education, and programs to develop job-ready skills. The company operates through U.S. Higher Education, Australia/New Zealand, and Education Technology Services segments. It operates Strayer University that offers undergraduate and graduate degree programs in business, criminal justice, education, health services, information technology, and public administration at physical campuses located in the eastern United States, as well as through online; non-degree web and mobile application development courses through Hackbright Academy and Devmountain; and MBA online through its Jack Welch Management Institute.

Featured Articles

Before you consider Strategic Education, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Strategic Education wasn't on the list.

While Strategic Education currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.