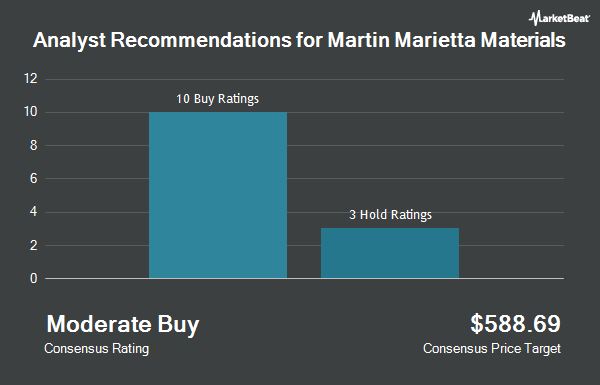

Shares of Martin Marietta Materials, Inc. (NYSE:MLM - Get Free Report) have received an average recommendation of "Moderate Buy" from the fifteen brokerages that are covering the company, MarketBeat reports. Two analysts have rated the stock with a hold rating, twelve have issued a buy rating and one has given a strong buy rating to the company. The average twelve-month target price among brokerages that have covered the stock in the last year is $644.46.

Several equities research analysts have recently commented on MLM shares. Barclays lifted their price target on shares of Martin Marietta Materials from $595.00 to $645.00 and gave the stock an "overweight" rating in a research report on Tuesday, October 29th. StockNews.com raised Martin Marietta Materials from a "sell" rating to a "hold" rating in a research note on Monday, December 2nd. JPMorgan Chase & Co. upgraded Martin Marietta Materials from a "neutral" rating to an "overweight" rating and raised their price target for the stock from $515.00 to $640.00 in a research report on Wednesday, November 27th. Morgan Stanley upped their price objective on Martin Marietta Materials from $610.00 to $657.00 and gave the company an "overweight" rating in a report on Monday, August 26th. Finally, Citigroup decreased their target price on Martin Marietta Materials from $658.00 to $646.00 and set a "buy" rating for the company in a research report on Monday, August 12th.

Check Out Our Latest Analysis on Martin Marietta Materials

Martin Marietta Materials Price Performance

Shares of NYSE:MLM traded down $1.21 during midday trading on Friday, reaching $581.18. The company's stock had a trading volume of 397,427 shares, compared to its average volume of 398,543. The business's fifty day simple moving average is $575.82 and its 200-day simple moving average is $556.03. The company has a debt-to-equity ratio of 0.43, a current ratio of 2.34 and a quick ratio of 1.24. Martin Marietta Materials has a fifty-two week low of $458.58 and a fifty-two week high of $633.23. The company has a market capitalization of $35.52 billion, a P/E ratio of 18.11, a P/E/G ratio of 3.95 and a beta of 0.89.

Martin Marietta Materials (NYSE:MLM - Get Free Report) last announced its earnings results on Wednesday, October 30th. The construction company reported $5.91 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $6.41 by ($0.50). Martin Marietta Materials had a return on equity of 12.53% and a net margin of 30.47%. The company had revenue of $1.89 billion for the quarter, compared to analyst estimates of $1.94 billion. During the same quarter in the previous year, the company posted $6.94 earnings per share. Martin Marietta Materials's revenue for the quarter was down 5.3% on a year-over-year basis. As a group, equities research analysts expect that Martin Marietta Materials will post 17.58 EPS for the current fiscal year.

Martin Marietta Materials Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Tuesday, December 31st. Stockholders of record on Monday, December 2nd will be issued a $0.79 dividend. The ex-dividend date of this dividend is Monday, December 2nd. This represents a $3.16 dividend on an annualized basis and a dividend yield of 0.54%. Martin Marietta Materials's dividend payout ratio (DPR) is 9.85%.

Hedge Funds Weigh In On Martin Marietta Materials

A number of large investors have recently bought and sold shares of the company. Ameritas Advisory Services LLC grew its holdings in shares of Martin Marietta Materials by 2.8% in the 2nd quarter. Ameritas Advisory Services LLC now owns 664 shares of the construction company's stock valued at $360,000 after acquiring an additional 18 shares in the last quarter. Inspire Investing LLC grew its stake in shares of Martin Marietta Materials by 0.9% in the third quarter. Inspire Investing LLC now owns 2,126 shares of the construction company's stock valued at $1,144,000 after buying an additional 19 shares in the last quarter. Integrated Wealth Concepts LLC increased its holdings in Martin Marietta Materials by 2.5% during the third quarter. Integrated Wealth Concepts LLC now owns 782 shares of the construction company's stock worth $421,000 after buying an additional 19 shares during the last quarter. TFG Advisers LLC lifted its stake in Martin Marietta Materials by 3.7% in the second quarter. TFG Advisers LLC now owns 555 shares of the construction company's stock valued at $300,000 after acquiring an additional 20 shares during the last quarter. Finally, Meiji Yasuda Life Insurance Co increased its stake in shares of Martin Marietta Materials by 3.0% during the 2nd quarter. Meiji Yasuda Life Insurance Co now owns 680 shares of the construction company's stock worth $368,000 after purchasing an additional 20 shares during the last quarter. Institutional investors and hedge funds own 95.04% of the company's stock.

Martin Marietta Materials Company Profile

(

Get Free ReportMartin Marietta Materials, Inc, a natural resource-based building materials company, supplies aggregates and heavy-side building materials to the construction industry in the United States and internationally. It offers crushed stone, sand, and gravel products; ready mixed concrete and asphalt; paving products and services; and Portland and specialty cement for use in the infrastructure projects, and nonresidential and residential construction markets, as well as in the railroad, agricultural, utility, and environmental industries.

Recommended Stories

Before you consider Martin Marietta Materials, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Martin Marietta Materials wasn't on the list.

While Martin Marietta Materials currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.