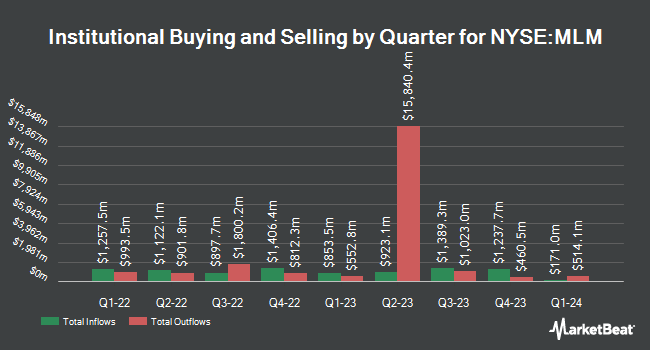

Cerity Partners LLC increased its holdings in Martin Marietta Materials, Inc. (NYSE:MLM - Free Report) by 28.9% in the third quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 26,302 shares of the construction company's stock after purchasing an additional 5,899 shares during the period. Cerity Partners LLC's holdings in Martin Marietta Materials were worth $14,157,000 as of its most recent SEC filing.

Other large investors also recently added to or reduced their stakes in the company. Newbridge Financial Services Group Inc. lifted its stake in shares of Martin Marietta Materials by 411.1% in the 2nd quarter. Newbridge Financial Services Group Inc. now owns 46 shares of the construction company's stock valued at $25,000 after acquiring an additional 37 shares during the last quarter. Asset Dedication LLC increased its position in shares of Martin Marietta Materials by 1,300.0% in the third quarter. Asset Dedication LLC now owns 56 shares of the construction company's stock valued at $30,000 after acquiring an additional 52 shares during the period. First Personal Financial Services bought a new stake in shares of Martin Marietta Materials in the third quarter worth about $33,000. Fortitude Family Office LLC raised its position in Martin Marietta Materials by 186.4% during the 2nd quarter. Fortitude Family Office LLC now owns 63 shares of the construction company's stock valued at $34,000 after purchasing an additional 41 shares during the last quarter. Finally, Pathway Financial Advisers LLC purchased a new stake in Martin Marietta Materials in the 1st quarter worth approximately $41,000. Hedge funds and other institutional investors own 95.04% of the company's stock.

Wall Street Analysts Forecast Growth

MLM has been the subject of a number of recent analyst reports. Barclays upped their target price on Martin Marietta Materials from $595.00 to $645.00 and gave the company an "overweight" rating in a report on Tuesday, October 29th. StockNews.com upgraded shares of Martin Marietta Materials from a "sell" rating to a "hold" rating in a report on Thursday, November 21st. UBS Group began coverage on Martin Marietta Materials in a research note on Thursday, November 7th. They set a "buy" rating and a $730.00 target price on the stock. Morgan Stanley boosted their price target on Martin Marietta Materials from $610.00 to $657.00 and gave the stock an "overweight" rating in a research note on Monday, August 26th. Finally, Truist Financial dropped their price objective on Martin Marietta Materials from $700.00 to $670.00 and set a "buy" rating on the stock in a research report on Friday, August 9th. Four analysts have rated the stock with a hold rating, eleven have assigned a buy rating and one has given a strong buy rating to the company. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $634.85.

Check Out Our Latest Stock Analysis on Martin Marietta Materials

Martin Marietta Materials Trading Down 0.9 %

MLM stock traded down $5.37 during mid-day trading on Tuesday, reaching $598.63. The company had a trading volume of 209,714 shares, compared to its average volume of 446,546. The company has a debt-to-equity ratio of 0.43, a current ratio of 2.34 and a quick ratio of 1.24. The company has a market capitalization of $36.59 billion, a PE ratio of 18.82, a price-to-earnings-growth ratio of 4.05 and a beta of 0.90. The firm has a 50 day moving average of $566.69 and a 200 day moving average of $556.18. Martin Marietta Materials, Inc. has a 12 month low of $456.83 and a 12 month high of $633.23.

Martin Marietta Materials (NYSE:MLM - Get Free Report) last issued its earnings results on Wednesday, October 30th. The construction company reported $5.91 EPS for the quarter, missing analysts' consensus estimates of $6.41 by ($0.50). The company had revenue of $1.89 billion during the quarter, compared to the consensus estimate of $1.94 billion. Martin Marietta Materials had a return on equity of 12.53% and a net margin of 30.47%. Martin Marietta Materials's revenue was down 5.3% on a year-over-year basis. During the same quarter in the prior year, the company earned $6.94 earnings per share. On average, equities analysts predict that Martin Marietta Materials, Inc. will post 17.58 earnings per share for the current fiscal year.

Martin Marietta Materials Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, December 31st. Stockholders of record on Monday, December 2nd will be given a $0.79 dividend. The ex-dividend date is Monday, December 2nd. This represents a $3.16 annualized dividend and a dividend yield of 0.53%. Martin Marietta Materials's payout ratio is presently 9.85%.

Martin Marietta Materials Profile

(

Free Report)

Martin Marietta Materials, Inc, a natural resource-based building materials company, supplies aggregates and heavy-side building materials to the construction industry in the United States and internationally. It offers crushed stone, sand, and gravel products; ready mixed concrete and asphalt; paving products and services; and Portland and specialty cement for use in the infrastructure projects, and nonresidential and residential construction markets, as well as in the railroad, agricultural, utility, and environmental industries.

Read More

Before you consider Martin Marietta Materials, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Martin Marietta Materials wasn't on the list.

While Martin Marietta Materials currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.