Martin Midstream Partners (NASDAQ:MMLP - Get Free Report) is expected to post its quarterly earnings results after the market closes on Wednesday, April 16th. Analysts expect Martin Midstream Partners to post earnings of $0.02 per share for the quarter.

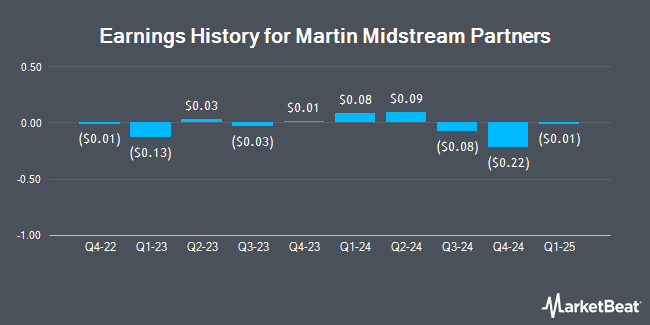

Martin Midstream Partners (NASDAQ:MMLP - Get Free Report) last issued its quarterly earnings results on Wednesday, February 12th. The pipeline company reported ($0.22) EPS for the quarter, missing analysts' consensus estimates of $0.03 by ($0.25). Martin Midstream Partners had a negative net margin of 0.73% and a negative return on equity of 6.93%. On average, analysts expect Martin Midstream Partners to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

Martin Midstream Partners Stock Up 0.4 %

MMLP traded up $0.01 during trading hours on Friday, hitting $2.79. The stock had a trading volume of 81,747 shares, compared to its average volume of 101,257. Martin Midstream Partners has a 1 year low of $2.36 and a 1 year high of $4.13. The company's fifty day simple moving average is $3.51 and its 200 day simple moving average is $3.72. The stock has a market cap of $108.96 million, a PE ratio of -21.46 and a beta of 1.75.

Martin Midstream Partners Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Friday, February 14th. Shareholders of record on Friday, February 7th were issued a dividend of $0.005 per share. The ex-dividend date of this dividend was Friday, February 7th. This represents a $0.02 dividend on an annualized basis and a yield of 0.72%. Martin Midstream Partners's payout ratio is -15.38%.

Analysts Set New Price Targets

Separately, StockNews.com initiated coverage on shares of Martin Midstream Partners in a report on Wednesday. They issued a "buy" rating on the stock.

View Our Latest Report on Martin Midstream Partners

About Martin Midstream Partners

(

Get Free Report)

Martin Midstream Partners L.P., together with its subsidiaries, provides terminalling, processing, storage, and packaging services for petroleum products and by-products primarily in the United States. The company operates in four segments: Terminalling and Storage, Transportation, Sulfur Services, and Specialty Products.

Further Reading

Before you consider Martin Midstream Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Martin Midstream Partners wasn't on the list.

While Martin Midstream Partners currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.