Martingale Asset Management L P cut its holdings in shares of Grand Canyon Education, Inc. (NASDAQ:LOPE - Free Report) by 14.4% during the third quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 94,013 shares of the company's stock after selling 15,825 shares during the period. Martingale Asset Management L P owned approximately 0.32% of Grand Canyon Education worth $13,336,000 as of its most recent SEC filing.

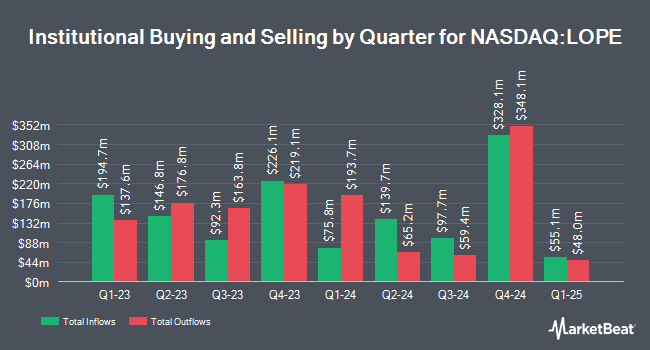

Other institutional investors and hedge funds have also recently modified their holdings of the company. Reston Wealth Management LLC purchased a new position in Grand Canyon Education during the third quarter valued at $28,000. Versant Capital Management Inc lifted its stake in Grand Canyon Education by 14,150.0% in the 2nd quarter. Versant Capital Management Inc now owns 285 shares of the company's stock valued at $40,000 after buying an additional 283 shares in the last quarter. Capital Performance Advisors LLP purchased a new position in Grand Canyon Education in the 3rd quarter valued at about $60,000. Blue Trust Inc. boosted its holdings in Grand Canyon Education by 710.7% in the 2nd quarter. Blue Trust Inc. now owns 608 shares of the company's stock worth $83,000 after buying an additional 533 shares during the last quarter. Finally, GAMMA Investing LLC increased its stake in Grand Canyon Education by 46.1% during the 2nd quarter. GAMMA Investing LLC now owns 640 shares of the company's stock worth $90,000 after buying an additional 202 shares in the last quarter. Hedge funds and other institutional investors own 94.17% of the company's stock.

Insiders Place Their Bets

In related news, CTO Dilek Marsh sold 1,500 shares of Grand Canyon Education stock in a transaction that occurred on Wednesday, September 18th. The shares were sold at an average price of $141.23, for a total value of $211,845.00. Following the completion of the sale, the chief technology officer now owns 22,674 shares in the company, valued at approximately $3,202,249.02. This trade represents a 6.21 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. 2.00% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

A number of analysts have recently issued reports on the company. Barrington Research lifted their price target on Grand Canyon Education from $165.00 to $180.00 and gave the stock an "outperform" rating in a research note on Thursday, November 7th. Robert W. Baird lifted their target price on shares of Grand Canyon Education from $170.00 to $186.00 and gave the stock an "outperform" rating in a research note on Thursday, November 7th. StockNews.com lowered shares of Grand Canyon Education from a "buy" rating to a "hold" rating in a report on Friday, November 15th. Finally, BMO Capital Markets raised their price target on shares of Grand Canyon Education from $152.00 to $173.00 and gave the stock an "outperform" rating in a research note on Thursday, November 7th.

Get Our Latest Report on LOPE

Grand Canyon Education Stock Performance

Shares of LOPE stock traded down $0.20 on Friday, hitting $164.59. 94,531 shares of the stock traded hands, compared to its average volume of 183,505. Grand Canyon Education, Inc. has a twelve month low of $118.48 and a twelve month high of $173.37. The stock has a market capitalization of $4.80 billion, a PE ratio of 21.63, a PEG ratio of 1.37 and a beta of 0.70. The firm's 50-day moving average price is $147.04 and its two-hundred day moving average price is $144.59.

Grand Canyon Education (NASDAQ:LOPE - Get Free Report) last posted its earnings results on Wednesday, November 6th. The company reported $1.48 earnings per share for the quarter, beating the consensus estimate of $1.47 by $0.01. The company had revenue of $238.30 million for the quarter, compared to analyst estimates of $239.69 million. Grand Canyon Education had a net margin of 22.09% and a return on equity of 31.01%. Grand Canyon Education's revenue was up 7.4% on a year-over-year basis. During the same period in the previous year, the business posted $1.26 EPS. On average, equities research analysts anticipate that Grand Canyon Education, Inc. will post 8.03 EPS for the current fiscal year.

Grand Canyon Education Profile

(

Free Report)

Grand Canyon Education, Inc provides education services to colleges and universities in the United States. It offers technology services, including learning management system, internal administration, infrastructure, and support services; academic services, such as program and curriculum, faculty and related training and development, class scheduling, and skills and simulation lab sites; and counseling services and support services comprising admission, financial aid, and field experience and other counseling services.

Featured Stories

Before you consider Grand Canyon Education, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Grand Canyon Education wasn't on the list.

While Grand Canyon Education currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for January 2025. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.