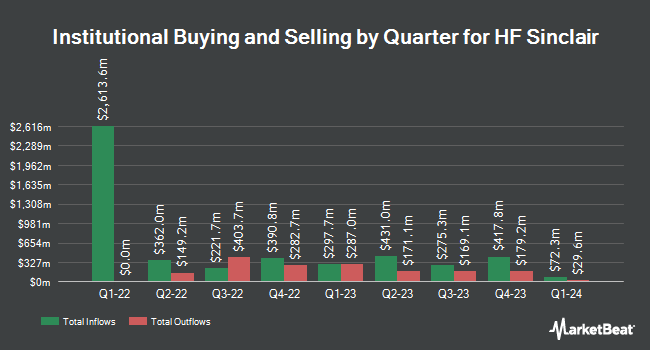

Martingale Asset Management L P increased its position in shares of HF Sinclair Co. (NYSE:DINO - Free Report) by 23.1% in the 3rd quarter, according to its most recent disclosure with the SEC. The institutional investor owned 187,115 shares of the company's stock after purchasing an additional 35,058 shares during the quarter. Martingale Asset Management L P owned approximately 0.10% of HF Sinclair worth $8,340,000 as of its most recent filing with the SEC.

Several other hedge funds have also recently added to or reduced their stakes in the company. Matrix Trust Co lifted its stake in HF Sinclair by 122.4% in the 3rd quarter. Matrix Trust Co now owns 576 shares of the company's stock worth $26,000 after purchasing an additional 317 shares in the last quarter. Capital Performance Advisors LLP purchased a new position in HF Sinclair during the third quarter worth approximately $27,000. Innealta Capital LLC purchased a new position in HF Sinclair during the second quarter worth approximately $34,000. Massmutual Trust Co. FSB ADV boosted its stake in HF Sinclair by 82.2% during the third quarter. Massmutual Trust Co. FSB ADV now owns 820 shares of the company's stock worth $37,000 after buying an additional 370 shares during the last quarter. Finally, Coastline Trust Co purchased a new stake in HF Sinclair in the 3rd quarter valued at $55,000. 88.29% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

Several research analysts have recently commented on DINO shares. Wells Fargo & Company reduced their price target on HF Sinclair from $54.00 to $53.00 and set an "overweight" rating on the stock in a report on Wednesday, October 9th. Mizuho decreased their target price on shares of HF Sinclair from $53.00 to $50.00 and set a "neutral" rating on the stock in a report on Thursday, October 10th. Piper Sandler cut their price target on shares of HF Sinclair from $58.00 to $49.00 and set an "overweight" rating for the company in a report on Friday, September 20th. BMO Capital Markets decreased their price objective on HF Sinclair from $57.00 to $53.00 and set an "outperform" rating on the stock in a report on Friday, October 4th. Finally, Barclays reduced their target price on HF Sinclair from $44.00 to $42.00 and set an "equal weight" rating on the stock in a research report on Monday, November 11th. Six investment analysts have rated the stock with a hold rating and seven have given a buy rating to the company's stock. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus target price of $54.27.

Get Our Latest Research Report on DINO

Insider Activity

In other HF Sinclair news, Director Franklin Myers acquired 5,000 shares of the company's stock in a transaction dated Friday, November 1st. The shares were acquired at an average price of $38.76 per share, for a total transaction of $193,800.00. Following the acquisition, the director now owns 145,293 shares in the company, valued at $5,631,556.68. The trade was a 3.56 % increase in their position. The purchase was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Company insiders own 0.28% of the company's stock.

HF Sinclair Stock Down 0.1 %

Shares of NYSE DINO traded down $0.05 during midday trading on Friday, hitting $40.93. The company's stock had a trading volume of 940,767 shares, compared to its average volume of 2,011,513. The company has a debt-to-equity ratio of 0.24, a current ratio of 1.81 and a quick ratio of 0.90. The firm has a market capitalization of $7.70 billion, a price-to-earnings ratio of 25.29 and a beta of 1.18. The business's fifty day simple moving average is $43.14 and its two-hundred day simple moving average is $47.86. HF Sinclair Co. has a 1 year low of $38.25 and a 1 year high of $64.16.

HF Sinclair (NYSE:DINO - Get Free Report) last announced its quarterly earnings data on Thursday, October 31st. The company reported $0.51 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.32 by $0.19. HF Sinclair had a return on equity of 5.51% and a net margin of 1.10%. The business had revenue of $7.21 billion for the quarter, compared to analysts' expectations of $7.11 billion. During the same period last year, the firm earned $4.06 earnings per share. The company's revenue for the quarter was down 19.1% compared to the same quarter last year. On average, equities analysts predict that HF Sinclair Co. will post 2.35 EPS for the current year.

HF Sinclair Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Wednesday, December 4th. Stockholders of record on Thursday, November 21st will be issued a $0.50 dividend. The ex-dividend date of this dividend is Thursday, November 21st. This represents a $2.00 dividend on an annualized basis and a dividend yield of 4.89%. HF Sinclair's payout ratio is 123.46%.

HF Sinclair Company Profile

(

Free Report)

HF Sinclair Corporation operates as an independent energy company. The company produces and markets gasoline, diesel fuel, jet fuel, renewable diesel, specialty lubricant products, specialty chemicals, specialty and modified asphalt, and others. It owns and operates refineries located in Kansas, Oklahoma, New Mexico, Utah, Washington, and Wyoming; and markets its refined products principally in the Southwest United States and Rocky Mountains, Pacific Northwest, and in other neighboring Plains states.

See Also

Before you consider HF Sinclair, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HF Sinclair wasn't on the list.

While HF Sinclair currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.