Martingale Asset Management L P raised its stake in Arrow Electronics, Inc. (NYSE:ARW - Free Report) by 3,768.6% in the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 83,290 shares of the technology company's stock after acquiring an additional 81,137 shares during the period. Martingale Asset Management L P owned 0.16% of Arrow Electronics worth $11,063,000 as of its most recent SEC filing.

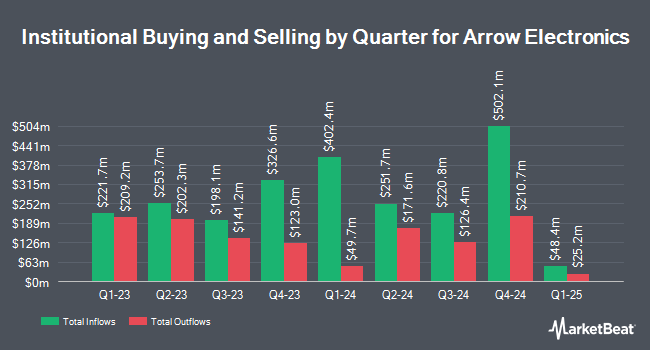

Other institutional investors also recently made changes to their positions in the company. Pacer Advisors Inc. increased its holdings in shares of Arrow Electronics by 71.9% in the 3rd quarter. Pacer Advisors Inc. now owns 2,094,555 shares of the technology company's stock worth $278,220,000 after acquiring an additional 876,396 shares during the period. SG Americas Securities LLC acquired a new stake in shares of Arrow Electronics in the second quarter valued at approximately $938,000. Tidal Investments LLC raised its holdings in shares of Arrow Electronics by 124.1% during the first quarter. Tidal Investments LLC now owns 12,644 shares of the technology company's stock valued at $1,637,000 after buying an additional 7,002 shares during the last quarter. Edgestream Partners L.P. acquired a new position in shares of Arrow Electronics during the second quarter worth approximately $1,267,000. Finally, Texas Permanent School Fund Corp grew its holdings in Arrow Electronics by 33.8% in the 2nd quarter. Texas Permanent School Fund Corp now owns 63,021 shares of the technology company's stock worth $7,610,000 after buying an additional 15,926 shares in the last quarter. 99.34% of the stock is owned by institutional investors.

Arrow Electronics Price Performance

Shares of NYSE ARW traded up $0.77 during midday trading on Friday, reaching $120.16. The company's stock had a trading volume of 134,199 shares, compared to its average volume of 462,048. The company has a current ratio of 1.46, a quick ratio of 1.09 and a debt-to-equity ratio of 0.39. The company has a market cap of $6.32 billion, a price-to-earnings ratio of 13.43 and a beta of 1.27. Arrow Electronics, Inc. has a one year low of $108.51 and a one year high of $137.80. The company has a 50 day moving average price of $126.73 and a 200 day moving average price of $127.12.

Arrow Electronics (NYSE:ARW - Get Free Report) last released its earnings results on Thursday, October 31st. The technology company reported $2.38 earnings per share for the quarter, topping the consensus estimate of $2.23 by $0.15. The business had revenue of $6.82 billion for the quarter, compared to the consensus estimate of $6.73 billion. Arrow Electronics had a net margin of 1.71% and a return on equity of 10.71%. The firm's quarterly revenue was down 14.8% compared to the same quarter last year. During the same period last year, the firm posted $4.14 earnings per share. On average, equities research analysts expect that Arrow Electronics, Inc. will post 10.23 EPS for the current year.

Analysts Set New Price Targets

Several analysts have weighed in on the company. Truist Financial cut their target price on Arrow Electronics from $141.00 to $120.00 and set a "hold" rating on the stock in a research note on Friday, November 1st. Raymond James cut their price objective on shares of Arrow Electronics from $140.00 to $135.00 and set an "outperform" rating on the stock in a research note on Friday, November 1st. Finally, Wells Fargo & Company increased their target price on shares of Arrow Electronics from $100.00 to $110.00 and gave the company an "underweight" rating in a research report on Friday, August 2nd. One equities research analyst has rated the stock with a sell rating, three have issued a hold rating and one has given a buy rating to the company's stock. According to MarketBeat, the stock presently has an average rating of "Hold" and an average price target of $124.25.

Read Our Latest Research Report on ARW

Arrow Electronics Company Profile

(

Free Report)

Arrow Electronics, Inc provides products, services, and solutions to industrial and commercial users of electronic components and enterprise computing solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company operates in two segments, Global Components and Global Enterprise Computing Solutions.

See Also

Before you consider Arrow Electronics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arrow Electronics wasn't on the list.

While Arrow Electronics currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.