Martingale Asset Management L P trimmed its position in CNA Financial Co. (NYSE:CNA - Free Report) by 13.5% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 147,642 shares of the insurance provider's stock after selling 23,082 shares during the period. Martingale Asset Management L P owned approximately 0.05% of CNA Financial worth $7,226,000 at the end of the most recent quarter.

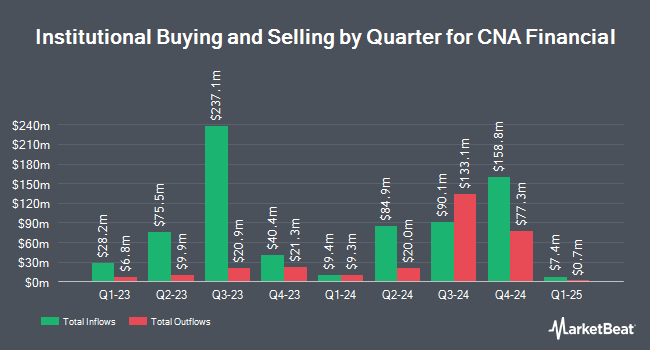

Other institutional investors have also recently bought and sold shares of the company. New York State Common Retirement Fund lifted its holdings in shares of CNA Financial by 366.7% during the 3rd quarter. New York State Common Retirement Fund now owns 1,401,539 shares of the insurance provider's stock valued at $68,591,000 after purchasing an additional 1,101,217 shares in the last quarter. AQR Capital Management LLC lifted its stake in CNA Financial by 97.9% in the second quarter. AQR Capital Management LLC now owns 1,152,528 shares of the insurance provider's stock valued at $51,760,000 after buying an additional 570,172 shares in the last quarter. Rhumbline Advisers boosted its holdings in shares of CNA Financial by 570.6% in the second quarter. Rhumbline Advisers now owns 529,862 shares of the insurance provider's stock valued at $24,411,000 after buying an additional 450,843 shares during the period. Bank of New York Mellon Corp increased its position in shares of CNA Financial by 45.5% during the second quarter. Bank of New York Mellon Corp now owns 1,068,956 shares of the insurance provider's stock worth $49,247,000 after acquiring an additional 334,463 shares in the last quarter. Finally, American Century Companies Inc. raised its holdings in shares of CNA Financial by 786.5% during the second quarter. American Century Companies Inc. now owns 153,669 shares of the insurance provider's stock worth $7,080,000 after acquiring an additional 136,334 shares during the period. Institutional investors and hedge funds own 98.45% of the company's stock.

CNA Financial Stock Up 0.3 %

CNA stock traded up $0.17 during midday trading on Friday, hitting $50.44. The company's stock had a trading volume of 258,763 shares, compared to its average volume of 274,376. The company's fifty day moving average price is $48.93 and its 200 day moving average price is $47.90. The company has a debt-to-equity ratio of 0.28, a current ratio of 0.26 and a quick ratio of 0.26. CNA Financial Co. has a twelve month low of $40.92 and a twelve month high of $52.36. The stock has a market capitalization of $13.66 billion, a P/E ratio of 10.51, a PEG ratio of 6.44 and a beta of 0.65.

CNA Financial (NYSE:CNA - Get Free Report) last released its earnings results on Monday, November 4th. The insurance provider reported $1.08 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.07 by $0.01. The business had revenue of $3.62 billion for the quarter, compared to the consensus estimate of $3.15 billion. CNA Financial had a return on equity of 13.30% and a net margin of 9.26%. During the same quarter in the previous year, the business earned $1.06 earnings per share. As a group, equities research analysts predict that CNA Financial Co. will post 4.68 EPS for the current year.

CNA Financial Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Thursday, December 5th. Investors of record on Monday, November 18th will be paid a $0.44 dividend. The ex-dividend date is Monday, November 18th. This represents a $1.76 annualized dividend and a dividend yield of 3.49%. CNA Financial's dividend payout ratio is presently 36.67%.

Insider Buying and Selling

In other news, EVP Douglas Worman sold 22,973 shares of CNA Financial stock in a transaction dated Thursday, November 7th. The shares were sold at an average price of $48.75, for a total value of $1,119,933.75. Following the completion of the transaction, the executive vice president now owns 133,777 shares of the company's stock, valued at $6,521,628.75. This trade represents a 14.66 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, EVP Mark Steven James sold 18,547 shares of the company's stock in a transaction dated Monday, September 16th. The shares were sold at an average price of $50.58, for a total transaction of $938,107.26. Following the completion of the sale, the executive vice president now directly owns 22,917 shares in the company, valued at approximately $1,159,141.86. The trade was a 44.73 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.30% of the stock is owned by corporate insiders.

Analyst Ratings Changes

A number of equities analysts recently weighed in on the stock. Keefe, Bruyette & Woods upped their target price on shares of CNA Financial from $54.00 to $55.00 and gave the stock a "market perform" rating in a research note on Friday, November 8th. Bank of America upped their price objective on CNA Financial from $45.00 to $48.00 and gave the stock an "underperform" rating in a research report on Thursday, October 10th. Finally, StockNews.com upgraded CNA Financial from a "hold" rating to a "buy" rating in a research note on Wednesday, November 13th.

View Our Latest Research Report on CNA Financial

CNA Financial Profile

(

Free Report)

CNA Financial Corporation provides commercial property and casualty insurance products in the United States and internationally. It operates through Specialty, Commercial, International, Life & Group, and Corporate & Other segments. The company offers professional liability coverages and risk management services to various professional firms, including architects, real estate agents, and accounting and law firms; directors and officers, employment practices, fiduciary, and fidelity and cyber coverages to small and mid-size firms, public and privately held firms, and not-for-profit organizations; professional and general liability, as well as associated casualty coverages for healthcare industry; surety and fidelity bonds; and warranty and alternative risks products.

See Also

Before you consider CNA Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CNA Financial wasn't on the list.

While CNA Financial currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report