Martingale Asset Management L P decreased its holdings in shares of Perdoceo Education Co. (NASDAQ:PRDO - Free Report) by 20.0% in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 111,405 shares of the company's stock after selling 27,910 shares during the period. Martingale Asset Management L P owned approximately 0.17% of Perdoceo Education worth $2,478,000 as of its most recent filing with the Securities and Exchange Commission.

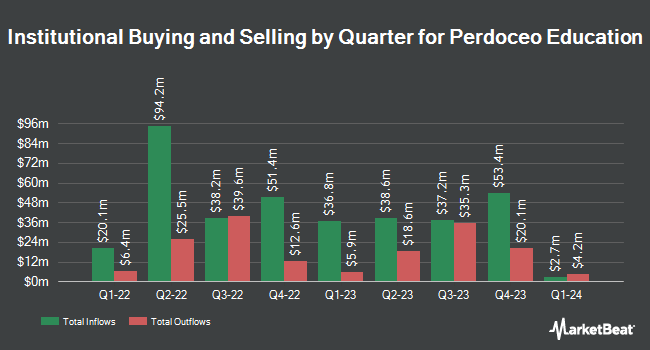

Several other hedge funds also recently made changes to their positions in PRDO. Vanguard Group Inc. raised its holdings in Perdoceo Education by 0.8% during the 1st quarter. Vanguard Group Inc. now owns 5,896,257 shares of the company's stock worth $103,538,000 after buying an additional 45,259 shares during the period. Dimensional Fund Advisors LP raised its holdings in shares of Perdoceo Education by 0.6% during the second quarter. Dimensional Fund Advisors LP now owns 5,069,173 shares of the company's stock valued at $108,580,000 after acquiring an additional 28,909 shares during the period. Renaissance Technologies LLC lifted its position in shares of Perdoceo Education by 2.5% in the 2nd quarter. Renaissance Technologies LLC now owns 4,505,687 shares of the company's stock valued at $96,512,000 after acquiring an additional 107,918 shares in the last quarter. Pacer Advisors Inc. boosted its stake in Perdoceo Education by 24.3% in the 2nd quarter. Pacer Advisors Inc. now owns 2,650,123 shares of the company's stock worth $56,766,000 after purchasing an additional 518,048 shares during the period. Finally, LSV Asset Management grew its position in Perdoceo Education by 3.9% during the 2nd quarter. LSV Asset Management now owns 2,010,254 shares of the company's stock worth $43,060,000 after purchasing an additional 75,293 shares in the last quarter. Institutional investors and hedge funds own 93.46% of the company's stock.

Insider Activity

In related news, SVP John Robert Kline sold 30,574 shares of the business's stock in a transaction on Friday, November 15th. The shares were sold at an average price of $26.47, for a total transaction of $809,293.78. Following the transaction, the senior vice president now owns 130,405 shares of the company's stock, valued at approximately $3,451,820.35. The trade was a 18.99 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, Director Patrick W. Gross sold 3,400 shares of the stock in a transaction on Monday, November 18th. The shares were sold at an average price of $26.74, for a total transaction of $90,916.00. Following the completion of the sale, the director now directly owns 69,635 shares of the company's stock, valued at approximately $1,862,039.90. This trade represents a 4.66 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 40,450 shares of company stock valued at $1,036,206 over the last 90 days. 1.81% of the stock is currently owned by company insiders.

Perdoceo Education Stock Down 0.7 %

PRDO stock traded down $0.18 during trading hours on Friday, hitting $27.45. The company's stock had a trading volume of 188,116 shares, compared to its average volume of 452,972. The company has a market capitalization of $1.80 billion, a PE ratio of 13.79, a price-to-earnings-growth ratio of 0.81 and a beta of 1.04. The stock has a 50 day moving average price of $23.34 and a two-hundred day moving average price of $22.70. Perdoceo Education Co. has a 12 month low of $16.12 and a 12 month high of $29.47.

Perdoceo Education (NASDAQ:PRDO - Get Free Report) last posted its earnings results on Tuesday, November 12th. The company reported $0.59 EPS for the quarter, topping the consensus estimate of $0.53 by $0.06. Perdoceo Education had a net margin of 20.42% and a return on equity of 15.58%. The firm had revenue of $169.83 million for the quarter, compared to the consensus estimate of $164.60 million. During the same period in the prior year, the business posted $0.64 earnings per share. The business's quarterly revenue was down 5.6% on a year-over-year basis. Sell-side analysts expect that Perdoceo Education Co. will post 2.27 earnings per share for the current year.

Perdoceo Education Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, December 13th. Shareholders of record on Monday, December 2nd will be issued a dividend of $0.13 per share. The ex-dividend date is Monday, December 2nd. This represents a $0.52 annualized dividend and a yield of 1.89%. Perdoceo Education's dividend payout ratio (DPR) is presently 26.13%.

Wall Street Analyst Weigh In

A number of analysts have recently issued reports on PRDO shares. StockNews.com lowered Perdoceo Education from a "strong-buy" rating to a "buy" rating in a report on Saturday. Barrington Research increased their price objective on Perdoceo Education from $30.00 to $32.00 and gave the stock an "outperform" rating in a research note on Wednesday, November 13th.

Read Our Latest Analysis on Perdoceo Education

Perdoceo Education Profile

(

Free Report)

Perdoceo Education Corporation provides postsecondary education through online, campus-based, and blended learning programs in the United States. It operates in two segments, Colorado Technical University and The American InterContinental University System. The Colorado Technical University segment offers academic programs, such as business and management, nursing, healthcare management, computer science, engineering, information systems and technology, project management, cybersecurity, and criminal justice.

Read More

Before you consider Perdoceo Education, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Perdoceo Education wasn't on the list.

While Perdoceo Education currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.