Martingale Asset Management L P acquired a new stake in Karat Packaging Inc. (NASDAQ:KRT - Free Report) during the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 11,213 shares of the company's stock, valued at approximately $339,000. Martingale Asset Management L P owned approximately 0.06% of Karat Packaging as of its most recent SEC filing.

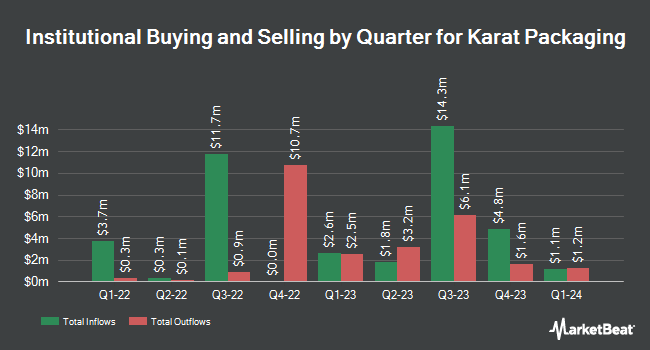

A number of other large investors have also made changes to their positions in the stock. Geode Capital Management LLC boosted its stake in shares of Karat Packaging by 15.5% during the 3rd quarter. Geode Capital Management LLC now owns 178,645 shares of the company's stock worth $4,626,000 after purchasing an additional 24,020 shares during the last quarter. Russell Investments Group Ltd. boosted its position in Karat Packaging by 28.0% during the fourth quarter. Russell Investments Group Ltd. now owns 79,645 shares of the company's stock worth $2,410,000 after acquiring an additional 17,419 shares during the last quarter. Trexquant Investment LP purchased a new stake in Karat Packaging in the 4th quarter worth approximately $352,000. Exchange Traded Concepts LLC purchased a new stake in Karat Packaging in the 4th quarter worth approximately $291,000. Finally, Barclays PLC raised its holdings in Karat Packaging by 12.5% in the 3rd quarter. Barclays PLC now owns 71,153 shares of the company's stock valued at $1,843,000 after acquiring an additional 7,911 shares during the last quarter. Institutional investors and hedge funds own 25.20% of the company's stock.

Karat Packaging Trading Down 0.3 %

Karat Packaging stock traded down $0.07 during trading on Friday, reaching $24.39. The company had a trading volume of 65,178 shares, compared to its average volume of 38,291. Karat Packaging Inc. has a 12-month low of $23.00 and a 12-month high of $33.89. The company has a debt-to-equity ratio of 0.29, a quick ratio of 1.82 and a current ratio of 3.12. The stock's 50 day moving average price is $28.22 and its two-hundred day moving average price is $28.93. The firm has a market capitalization of $488.70 million, a price-to-earnings ratio of 17.42 and a beta of 1.12.

Karat Packaging (NASDAQ:KRT - Get Free Report) last announced its quarterly earnings data on Thursday, March 13th. The company reported $0.29 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.43 by ($0.14). The company had revenue of $101.65 million for the quarter, compared to analysts' expectations of $102.27 million. Karat Packaging had a net margin of 6.78% and a return on equity of 19.84%. As a group, equities analysts expect that Karat Packaging Inc. will post 1.66 earnings per share for the current fiscal year.

Karat Packaging Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, February 28th. Stockholders of record on Monday, February 24th were issued a dividend of $0.45 per share. The ex-dividend date was Monday, February 24th. This represents a $1.80 dividend on an annualized basis and a dividend yield of 7.38%. This is a boost from Karat Packaging's previous quarterly dividend of $0.40. Karat Packaging's payout ratio is presently 120.81%.

Analysts Set New Price Targets

Separately, William Blair cut Karat Packaging from an "outperform" rating to a "market perform" rating in a report on Thursday, January 2nd.

View Our Latest Stock Report on Karat Packaging

Karat Packaging Company Profile

(

Free Report)

Karat Packaging Inc, together with its subsidiaries, engages in the manufacture and distribution of single-use disposable products in plastic, paper, biopolymer-based, and other compostable forms used in various restaurant and foodservice settings. It provides food and take-out containers, bags, tableware, cups, lids, cutlery, straws, specialty beverage ingredients, equipment, gloves, and other products under the Karat Earth brand.

Featured Articles

Before you consider Karat Packaging, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Karat Packaging wasn't on the list.

While Karat Packaging currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.