Martinrea International (TSE:MRE - Get Free Report) was downgraded by analysts at BMO Capital Markets from an "outperform" rating to a "market perform" rating in a research report issued to clients and investors on Monday,BayStreet.CA reports. They currently have a C$11.00 price target on the stock, down from their prior price target of C$13.00. BMO Capital Markets' target price indicates a potential upside of 19.57% from the stock's current price.

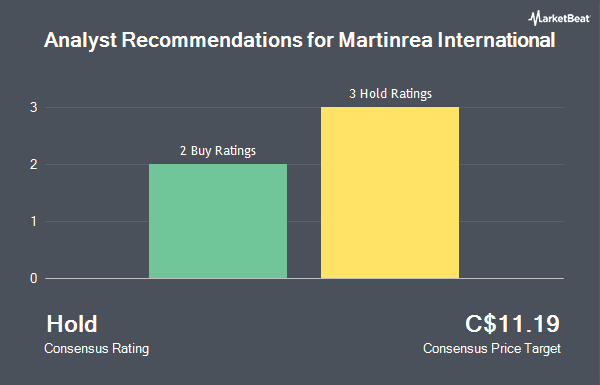

Several other equities research analysts have also recently issued reports on MRE. CIBC cut their target price on Martinrea International from C$17.00 to C$14.50 in a research note on Thursday, November 14th. TD Securities cut their price objective on Martinrea International from C$18.00 to C$13.00 in a research report on Wednesday, November 13th. Two analysts have rated the stock with a hold rating and three have assigned a buy rating to the stock. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average price target of C$14.20.

Get Our Latest Analysis on Martinrea International

Martinrea International Trading Down 5.3 %

Shares of Martinrea International stock traded down C$0.52 during mid-day trading on Monday, hitting C$9.20. The stock had a trading volume of 346,916 shares, compared to its average volume of 163,331. The firm has a market cap of C$688.25 million, a P/E ratio of 5.08, a price-to-earnings-growth ratio of 0.82 and a beta of 2.08. The company has a quick ratio of 0.68, a current ratio of 1.25 and a debt-to-equity ratio of 83.13. The firm has a 50-day moving average of C$10.60 and a two-hundred day moving average of C$11.13. Martinrea International has a 12-month low of C$9.19 and a 12-month high of C$14.59.

Insider Transactions at Martinrea International

In other Martinrea International news, Director Robert Peter Edward Wildeboer acquired 7,000 shares of the stock in a transaction dated Friday, November 22nd. The stock was acquired at an average price of C$10.02 per share, with a total value of C$70,140.00. Company insiders own 11.31% of the company's stock.

Martinrea International Company Profile

(

Get Free Report)

Martinrea International Inc is a Canadian producer of steel and aluminium parts and fluid management systems. Its products are used primarily in the automotive sector by the majority of vehicle manufacturers. Martinrea manufactures aluminum engine blocks, specialized products, suspensions, chassis modules and components, and fluid management systems for fuel, power steering and brake fluids.

Recommended Stories

Before you consider Martinrea International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Martinrea International wasn't on the list.

While Martinrea International currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.