Masco (NYSE:MAS - Get Free Report)'s stock had its "equal weight" rating reissued by equities research analysts at Wells Fargo & Company in a research report issued on Tuesday, Marketbeat reports. They presently have a $85.00 price objective on the construction company's stock, down from their prior price objective of $92.00. Wells Fargo & Company's price objective suggests a potential upside of 11.01% from the stock's current price.

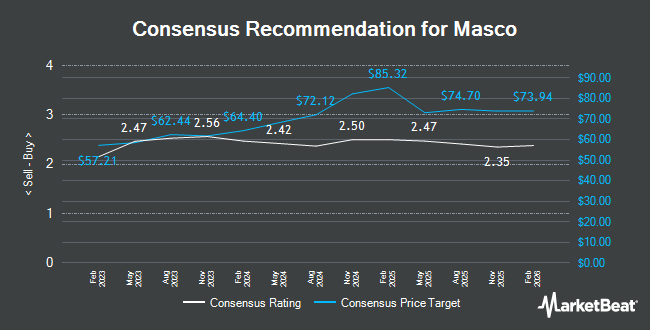

MAS has been the topic of several other reports. Loop Capital lifted their target price on Masco from $76.00 to $87.00 and gave the stock a "hold" rating in a report on Wednesday, October 30th. Royal Bank of Canada cut Masco from an "outperform" rating to a "sector perform" rating and upped their target price for the company from $79.00 to $80.00 in a report on Wednesday, October 30th. UBS Group raised their price target on shares of Masco from $89.00 to $94.00 and gave the stock a "buy" rating in a report on Wednesday, October 30th. Truist Financial increased their price objective on shares of Masco from $84.00 to $92.00 and gave the stock a "buy" rating in a research report on Wednesday, October 30th. Finally, JPMorgan Chase & Co. boosted their target price on shares of Masco from $80.00 to $83.50 and gave the company a "neutral" rating in a report on Tuesday, November 5th. Ten investment analysts have rated the stock with a hold rating and four have given a buy rating to the stock. According to data from MarketBeat, Masco has an average rating of "Hold" and an average price target of $85.88.

View Our Latest Research Report on MAS

Masco Price Performance

NYSE:MAS traded down $1.21 during mid-day trading on Tuesday, reaching $76.57. The stock had a trading volume of 1,403,141 shares, compared to its average volume of 1,763,824. The stock has a 50-day simple moving average of $80.82 and a two-hundred day simple moving average of $76.71. The company has a debt-to-equity ratio of 20.74, a current ratio of 1.83 and a quick ratio of 1.21. Masco has a 12 month low of $63.60 and a 12 month high of $86.70. The stock has a market capitalization of $16.52 billion, a PE ratio of 20.36, a P/E/G ratio of 2.57 and a beta of 1.23.

Masco (NYSE:MAS - Get Free Report) last announced its quarterly earnings data on Tuesday, October 29th. The construction company reported $1.08 earnings per share for the quarter, hitting the consensus estimate of $1.08. Masco had a return on equity of 615.54% and a net margin of 10.54%. The business had revenue of $1.98 billion during the quarter, compared to the consensus estimate of $2 billion. During the same period in the prior year, the company earned $1.00 EPS. Masco's revenue for the quarter was up .2% on a year-over-year basis. On average, equities analysts anticipate that Masco will post 4.09 earnings per share for the current year.

Hedge Funds Weigh In On Masco

Hedge funds have recently bought and sold shares of the company. Blue Trust Inc. boosted its position in Masco by 38.5% in the second quarter. Blue Trust Inc. now owns 738 shares of the construction company's stock worth $49,000 after purchasing an additional 205 shares during the last quarter. Raymond James & Associates increased its holdings in Masco by 8.8% during the second quarter. Raymond James & Associates now owns 415,813 shares of the construction company's stock worth $27,722,000 after buying an additional 33,673 shares during the last quarter. Vicus Capital raised its position in Masco by 3.7% in the second quarter. Vicus Capital now owns 7,175 shares of the construction company's stock worth $478,000 after acquiring an additional 254 shares during the period. Secure Asset Management LLC bought a new position in Masco during the second quarter valued at $360,000. Finally, Horizon Bancorp Inc. IN increased its position in Masco by 15.9% in the second quarter. Horizon Bancorp Inc. IN now owns 2,428 shares of the construction company's stock worth $162,000 after buying an additional 333 shares during the last quarter. 93.91% of the stock is owned by hedge funds and other institutional investors.

Masco Company Profile

(

Get Free Report)

Masco Corporation designs, manufactures, and distributes home improvement and building products in North America, Europe, and internationally. The company's Plumbing Products segment offers faucets, showerheads, handheld showers, valves, bath hardware and accessories, bathing units, shower bases and enclosures, sinks, toilets, acrylic tubs, shower trays, spas, exercise pools, and fitness systems; brass, copper, and composite plumbing system components; connected water products; thermoplastic solutions, extruded plastic profiles, specialized fabrications, and PEX tubing products; and other non-decorative plumbing products.

Featured Stories

Before you consider Masco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Masco wasn't on the list.

While Masco currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.