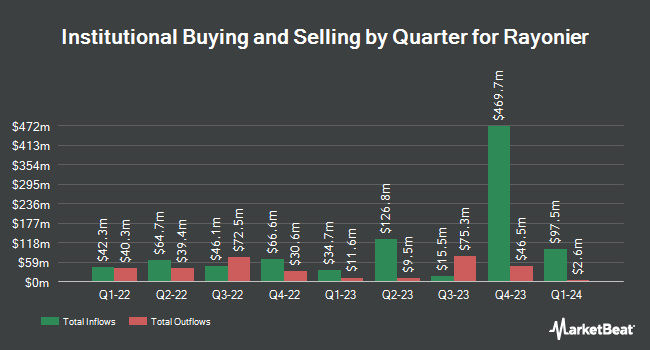

Massachusetts Financial Services Co. MA grew its position in Rayonier Inc. (NYSE:RYN - Free Report) by 26.2% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 3,352,691 shares of the real estate investment trust's stock after acquiring an additional 695,810 shares during the quarter. Massachusetts Financial Services Co. MA owned about 2.25% of Rayonier worth $107,890,000 at the end of the most recent reporting period.

Several other large investors have also modified their holdings of the company. Impax Asset Management Group plc boosted its stake in Rayonier by 17.3% during the 2nd quarter. Impax Asset Management Group plc now owns 6,815,188 shares of the real estate investment trust's stock worth $197,226,000 after purchasing an additional 1,004,357 shares during the period. Teramo Advisors LLC purchased a new stake in shares of Rayonier in the second quarter valued at about $9,309,000. Crossmark Global Holdings Inc. boosted its stake in shares of Rayonier by 2,950.1% during the third quarter. Crossmark Global Holdings Inc. now owns 296,222 shares of the real estate investment trust's stock worth $9,532,000 after buying an additional 286,510 shares during the period. Millennium Management LLC boosted its stake in shares of Rayonier by 56.7% during the second quarter. Millennium Management LLC now owns 752,847 shares of the real estate investment trust's stock worth $21,900,000 after buying an additional 272,349 shares during the period. Finally, Price T Rowe Associates Inc. MD grew its holdings in shares of Rayonier by 1.2% during the first quarter. Price T Rowe Associates Inc. MD now owns 16,294,936 shares of the real estate investment trust's stock worth $541,645,000 after buying an additional 196,571 shares during the last quarter. 89.12% of the stock is owned by institutional investors and hedge funds.

Rayonier Stock Performance

Shares of NYSE:RYN traded up $0.77 during midday trading on Friday, hitting $31.05. The stock had a trading volume of 605,091 shares, compared to its average volume of 727,326. The company has a market capitalization of $4.63 billion, a PE ratio of 29.29 and a beta of 1.05. Rayonier Inc. has a 1 year low of $27.40 and a 1 year high of $35.29. The stock has a 50 day moving average price of $31.38 and a two-hundred day moving average price of $30.34. The company has a current ratio of 1.99, a quick ratio of 1.85 and a debt-to-equity ratio of 0.71.

Rayonier (NYSE:RYN - Get Free Report) last announced its quarterly earnings data on Wednesday, November 6th. The real estate investment trust reported $0.12 earnings per share for the quarter, missing analysts' consensus estimates of $0.13 by ($0.01). The business had revenue of $195.00 million during the quarter, compared to analysts' expectations of $211.21 million. Rayonier had a net margin of 15.84% and a return on equity of 2.95%. Rayonier's revenue for the quarter was down 3.3% compared to the same quarter last year. During the same period in the prior year, the firm posted $0.13 EPS. As a group, equities analysts predict that Rayonier Inc. will post 0.38 earnings per share for the current fiscal year.

Rayonier Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 31st. Shareholders of record on Tuesday, December 17th will be given a $0.285 dividend. This represents a $1.14 annualized dividend and a yield of 3.67%. The ex-dividend date of this dividend is Tuesday, December 17th. Rayonier's payout ratio is 107.55%.

Analyst Ratings Changes

Several analysts have commented on RYN shares. StockNews.com raised Rayonier from a "sell" rating to a "hold" rating in a research note on Saturday, November 16th. Truist Financial upped their price target on Rayonier from $31.00 to $32.00 and gave the stock a "hold" rating in a research note on Tuesday, October 15th.

Read Our Latest Research Report on RYN

Insider Buying and Selling at Rayonier

In other news, Director V. Larkin Martin sold 10,011 shares of the business's stock in a transaction that occurred on Wednesday, September 11th. The stock was sold at an average price of $30.57, for a total transaction of $306,036.27. Following the sale, the director now owns 40,168 shares of the company's stock, valued at $1,227,935.76. The trade was a 19.95 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. 0.83% of the stock is owned by corporate insiders.

Rayonier Profile

(

Free Report)

Rayonier is a leading timberland real estate investment trust with assets located in some of the most productive softwood timber growing regions in the United States and New Zealand. As of December 31, 2023, Rayonier owned or leased under long-term agreements approximately 2.7 million acres of timberlands located in the U.S.

Further Reading

Before you consider Rayonier, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rayonier wasn't on the list.

While Rayonier currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.