Massachusetts Financial Services Co. MA lessened its stake in shares of Funko, Inc. (NASDAQ:FNKO - Free Report) by 18.5% during the 3rd quarter, according to its most recent disclosure with the SEC. The institutional investor owned 2,889,572 shares of the company's stock after selling 656,464 shares during the period. Massachusetts Financial Services Co. MA owned about 5.36% of Funko worth $35,311,000 as of its most recent filing with the SEC.

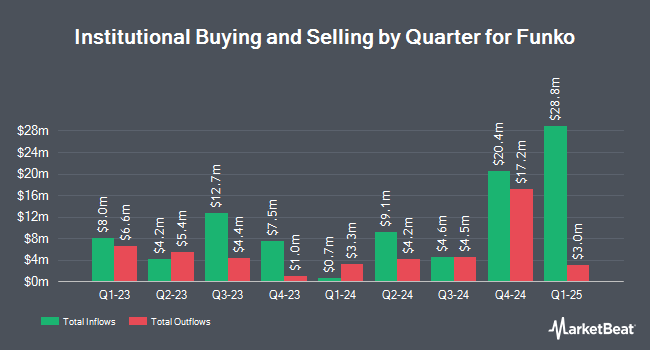

Other hedge funds have also recently bought and sold shares of the company. California State Teachers Retirement System boosted its holdings in shares of Funko by 4.5% during the first quarter. California State Teachers Retirement System now owns 33,179 shares of the company's stock worth $207,000 after acquiring an additional 1,414 shares during the period. Quest Partners LLC bought a new position in Funko in the 2nd quarter valued at about $25,000. Price T Rowe Associates Inc. MD lifted its holdings in shares of Funko by 7.3% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 39,335 shares of the company's stock worth $246,000 after acquiring an additional 2,689 shares during the period. Rhumbline Advisers raised its position in Funko by 9.0% during the second quarter. Rhumbline Advisers now owns 54,180 shares of the company's stock valued at $529,000 after purchasing an additional 4,475 shares in the last quarter. Finally, Olympiad Research LP boosted its holdings in shares of Funko by 40.3% in the 3rd quarter. Olympiad Research LP now owns 23,532 shares of the company's stock valued at $288,000 after purchasing an additional 6,756 shares in the last quarter. 99.15% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

Several analysts recently weighed in on FNKO shares. B. Riley raised their price objective on Funko from $13.00 to $15.00 and gave the company a "buy" rating in a research note on Thursday, September 12th. DA Davidson reiterated a "buy" rating and issued a $16.00 price target on shares of Funko in a research note on Thursday, November 14th. Finally, Stifel Nicolaus upped their target price on Funko from $9.00 to $10.50 and gave the stock a "hold" rating in a report on Tuesday, October 22nd.

View Our Latest Report on FNKO

Insider Activity

In other Funko news, insider Andrew David Oddie sold 10,800 shares of Funko stock in a transaction on Monday, September 23rd. The shares were sold at an average price of $12.03, for a total value of $129,924.00. Following the completion of the sale, the insider now directly owns 40,372 shares of the company's stock, valued at approximately $485,675.16. The trade was a 21.11 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, Director Michael C. Lunsford sold 97,000 shares of the stock in a transaction dated Friday, November 15th. The stock was sold at an average price of $10.40, for a total transaction of $1,008,800.00. Following the transaction, the director now directly owns 11,613 shares in the company, valued at $120,775.20. This trade represents a 89.31 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 126,805 shares of company stock valued at $1,366,661. 4.81% of the stock is currently owned by insiders.

Funko Trading Up 7.5 %

Shares of FNKO stock traded up $0.80 on Monday, hitting $11.41. The company had a trading volume of 305,960 shares, compared to its average volume of 524,547. The stock's 50-day moving average is $11.61 and its two-hundred day moving average is $10.23. The company has a debt-to-equity ratio of 0.44, a quick ratio of 0.64 and a current ratio of 0.96. The firm has a market cap of $617.97 million, a P/E ratio of -22.10 and a beta of 1.21. Funko, Inc. has a twelve month low of $5.36 and a twelve month high of $12.61.

Funko Company Profile

(

Free Report)

Funko, Inc, a pop culture consumer products company, designs, sources, and distributes licensed pop culture products in the United States, Europe, and internationally. The company provides media and entertainment content, including movies, television (TV) shows, video games, music, and sports; figures, handbags, backpacks, wallets, apparel, accessories, plush products, homewares, and digital non-fungible tokens; and art prints and vinyl records, posters, soundtracks, toys, books, games, and other collectibles.

See Also

Before you consider Funko, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Funko wasn't on the list.

While Funko currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.